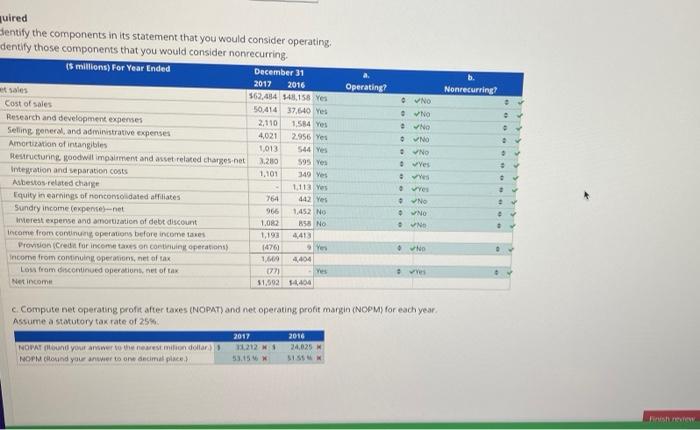

Question: problem C uired dentify the components in its statement that you would consider operating, dentify those components that you would consider nonrecurring. (5 millions) For

uired dentify the components in its statement that you would consider operating, dentify those components that you would consider nonrecurring. (5 millions) For Year Ended et sales Cost of sales Research and development expenses Selling general, and administrative expenses Amortization of intangibles Restructuring, goodwill impairment and asset related charges-net Integration and separation costs Asbestos related charge Equity in earnings of nonconsolidated affiliates Sundry income (expense)-net Interest expense and amortization of debt discount Income from continuing operations before income taxes Provision (Credit for income taxes on continuing operations) Income from continuing operations, net of tax Loss from discontinued operations, net of tax Net income December 31 2017 2016 $62,484 148,158 Yes NOPAT (ound your answer to the nearest milion dollar) NOPM (Round your answer to one decimal place.) 50,414 37,640 Yes 2,110 1,584 Yes 2.956 Yes 544 Yes 4,021 1,013 3,280 1,101 764 966 1,082 1,193 (476) 1,609 (77) $1.502 2017 31.212 53.15% 595 Yes 349 Yes 1,113 Yes 442 Yes 1,452 No 858 No 4413 9 Yes 4,404 14404 Yes Operating? 2016 24,025 M 51.55 M NO NO 0 NO NO No Yes Yes res No . 0 No NO c. Compute net operating profit after taxes (NOPAT) and net operating profit margin (NOPM) for each year. Assume a statutory tax rate of 25% No vies Nonrecurring? e V V Finish review

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts