Question: Problem C-2A Consider present value (LOC-2, C-3) Bruce is considering the purchase of a restaurant named Hard Rock Hollywood. The restaurant is listed for

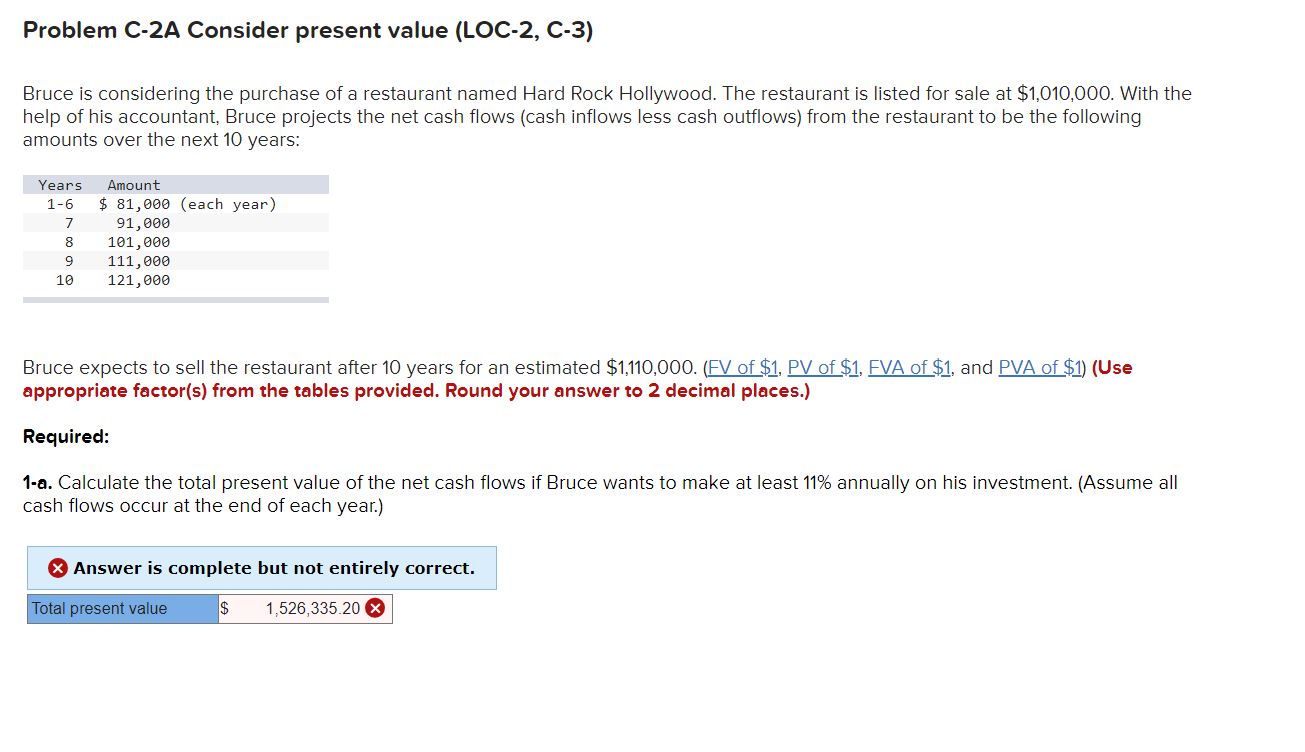

Problem C-2A Consider present value (LOC-2, C-3) Bruce is considering the purchase of a restaurant named Hard Rock Hollywood. The restaurant is listed for sale at $1,010,000. With the help of his accountant, Bruce projects the net cash flows (cash inflows less cash outflows) from the restaurant to be the following amounts over the next 10 years: Amount $ 81,000 (each year) 91,000 Years 1-6 7 8 101,000 9 10 111,000 121,000 Bruce expects to sell the restaurant after 10 years for an estimated $1,110,000. (EV of $1. PV of $1. EVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Round your answer to 2 decimal places.) Required: 1-a. Calculate the total present value of the net cash flows if Bruce wants to make at least 11% annually on his investment. (Assume all cash flows occur at the end of each year.) Answer is complete but not entirely correct. Total present value $ 1,526,335.20 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts