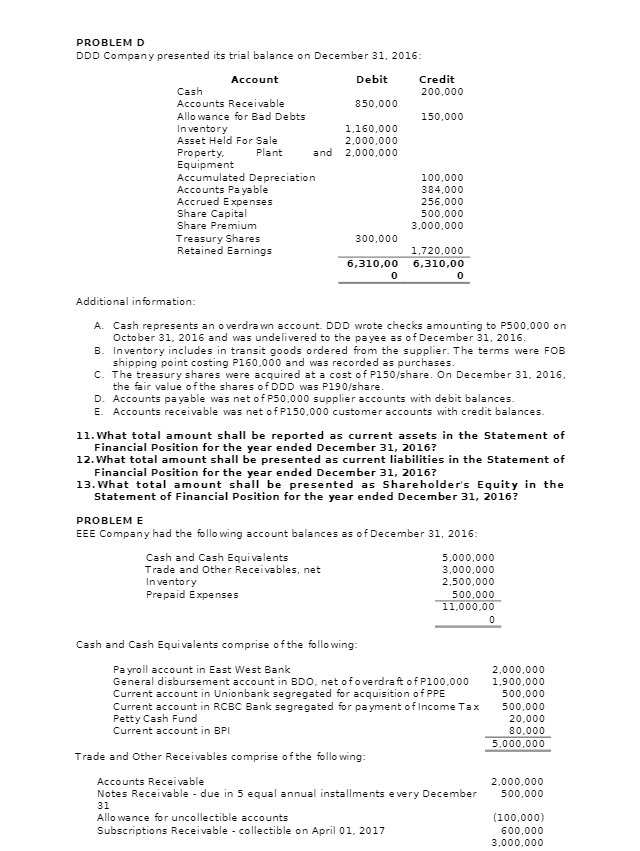

PROBLEM D DDD Company presented its trial balance on December 31, 2016: Account Debit Credit Cash 200,000 Accounts Receivable 850,000 Allowance for Bad Debts 150,000 Inventory 1,160,000 Asset Held For Sale 2.000,000 Property. Plant and 2.000,000 Equipment Accumulated Depreciation 100,000 Accounts Payable 384,000 Accrued Expenses 256,000 Share Capital 500,000 Share Premium 3,000,000 Treasury Shares 300,000 Retained Earnings 1,720,000 6,310,00 6,310,00 0 Additional information: A. Cash represents an overdrawn account. DDD wrote checks amounting to P500,000 on October 31, 2016 and was undelivered to the payee as of December 31, 2016. B. Inventory includes in transit goods ordered from the supplier. The terms were FOB shipping point costing P160.000 and was recorded as purchases. C. The treasury shares were acquired at a cost of P150/share. On December 31, 2016, the fair value of the shares of DDD was P190/share. D. Accounts payable was net of P50,000 supplier accounts with debit balances. E. Accounts receivable was net of P150,000 customer accounts with credit balances. 11. What total amount shall be reported as current assets in the Statement of Financial Position for the year ended December 31, 2016? 12. What total amount shall be presented as current liabilities in the Statement of Financial Position for the year ended December 31, 2016? 13. What total amount shall be presented as Shareholder's Equity in the Statement of Financial Position for the year ended December 31, 2016? PROBLEM E EEE Company had the following account balances as of December 31, 2016: Cash and Cash Equivalents 5,000,000 Trade and Other Receivables, net 3,000,000 Inventory 2.500,000 Prepaid Expenses 500,000 11,000,00 0 Cash and Cash Equivalents comprise of the following: Payroll account in East West Bank 2.000,000 General disbursement account in BDO. net of overdraft of P100,000 1,900,000 Current account in Unionbank segregated for acquisition of PPE 500,000 Current account in RCBC Bank segregated for payment of Income Tax 500,000 Petty Cash Fund 20.000 Current account in BPI 80,000 5,000,000 Trade and Other Receivables comprise of the following: Accounts Receivable 10.000 Notes Receivable - due in 5 equal annual installments every December 500,000 31 Allowance for uncollectible accounts (100,000) Subscriptions Receivable - collectible on April 01, 2017 600,000 3,000.000