Question: PROBLEM D: You are considering opening a new bar on Court Street. The initial necessary investment is $650,000. This investment has a projected salvage (or

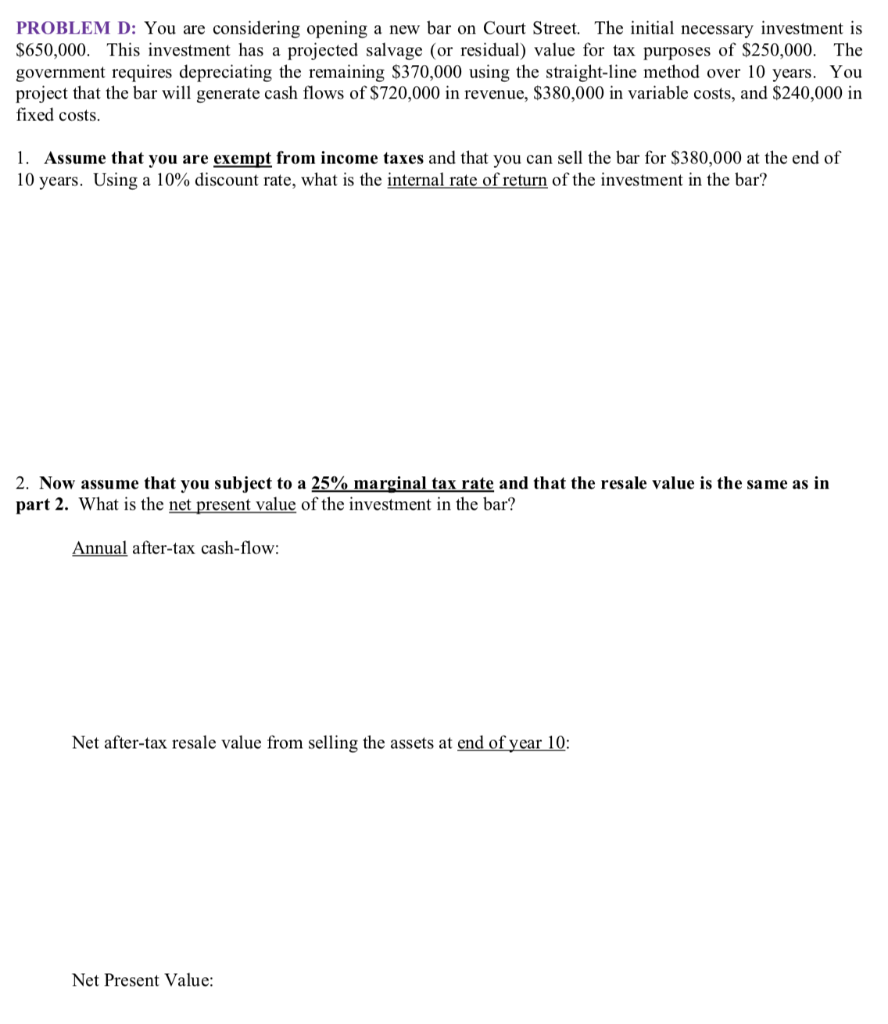

PROBLEM D: You are considering opening a new bar on Court Street. The initial necessary investment is $650,000. This investment has a projected salvage (or residual) value for tax purposes of $250,000. The government requires depreciating the remaining $370,000 using the straight-line method over 10 years. You project that the bar will generate cash flows of $720,000 in revenue, $380,000 in variable costs, and $240,000 in fixed costs. 1. Assume that you are exempt from income taxes and that you can sell the bar for $380,000 at the end of 10 years. Using a 10% discount rate, what is the internal rate of return of the investment in the bar? 2. Now assume that you subject to a 25% marginal tax rate and that the resale value is the same as in part 2. What is the net present value of the investment in the bar? Annual after-tax cash-flow: Net after-tax resale value from selling the assets at end of year 10: Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts