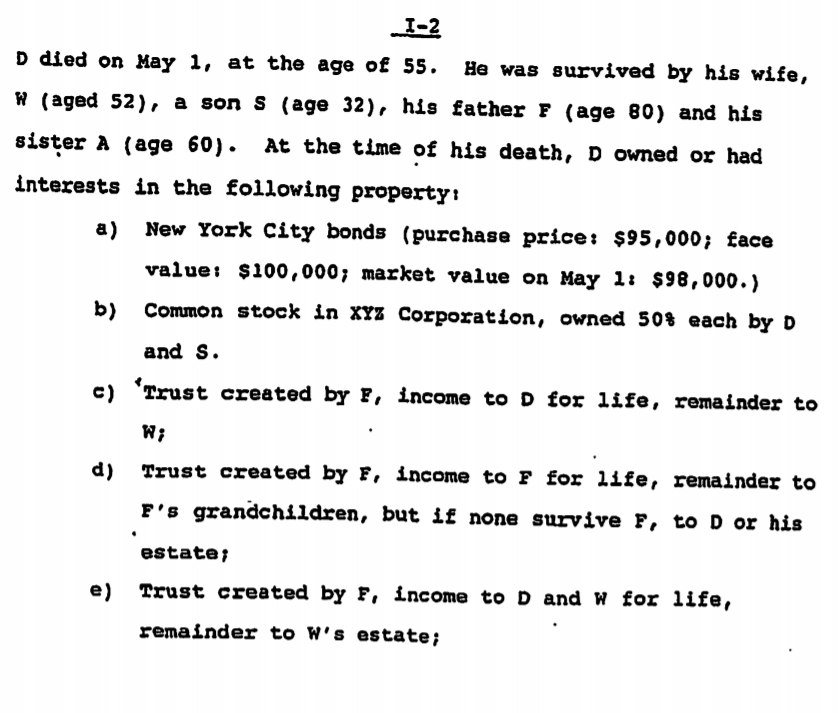

Question: problem deals with Internal Revenue Code Section 2033 I-2 D died on May 1, at the age of 55. He was survived by his wife,

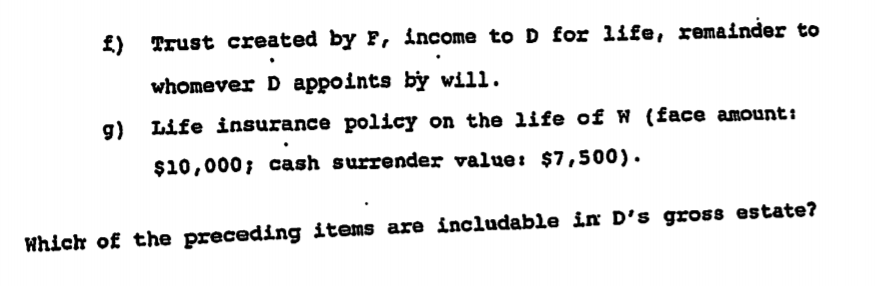

problem deals with Internal Revenue Code Section 2033 I-2 D died on May 1, at the age of 55. He was survived by his wife, W (aged 52), a son s (age 32), his father F (age 80) and his sister A (age 60). At the time of his death, D owned or had interests in the following property: a) New York City bonds (purchase price: $95,000; face value: $100,000; market value on May 1: $98,000.) b) Common stock in XYZ Corporation, owned 50% each by D and s. c) 'Trust created by F, income to D for life, remainder to W; d) Trust created by F, income to F for life, remainder to F's grandchildren, but if none survive F, to D or his estate; e) Trust created by F, Income to D and w for life, remainder to W's estate; ) D Trust created by F, income to D for life, remainder to whomever D appoints by will. g) Life insurance policy on the life of W (face amount: $10,000; cash surrender value: $7,500). Which of the preceding items are includable in D's gross estate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts