Question: PROBLEM DESCRIPTION: In addition to being a full - service financial institution, the Foggyview Credit Union operates a call center where most customer services are

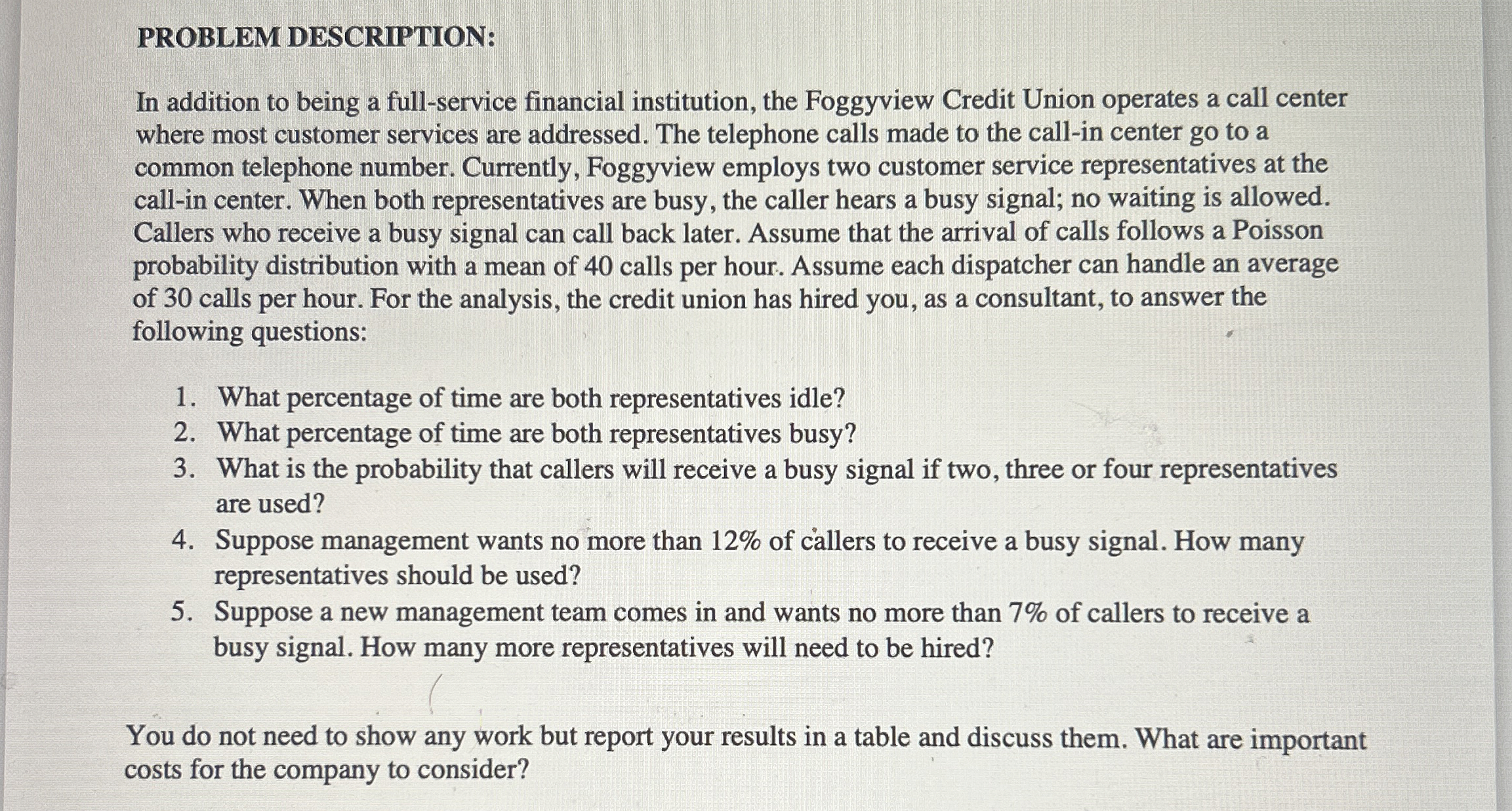

PROBLEM DESCRIPTION:

In addition to being a fullservice financial institution, the Foggyview Credit Union operates a call center where most customer services are addressed. The telephone calls made to the callin center go to a common telephone number. Currently, Foggyview employs two customer service representatives at the callin center. When both representatives are busy, the caller hears a busy signal; no waiting is allowed. Callers who receive a busy signal can call back later. Assume that the arrival of calls follows a Poisson probability distribution with a mean of calls per hour. Assume each dispatcher can handle an average of calls per hour. For the analysis, the credit union has hired you, as a consultant, to answer the following questions:

What percentage of time are both representatives idle?

What percentage of time are both representatives busy?

What is the probability that callers will receive a busy signal if two, three or four representatives are used?

Suppose management wants no more than of callers to receive a busy signal. How many representatives should be used?

Suppose a new management team comes in and wants no more than of callers to receive a busy signal. How many more representatives will need to be hired?

You do not need to show any work but report your results in a table and discuss them. What are important costs for the company to consider?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock