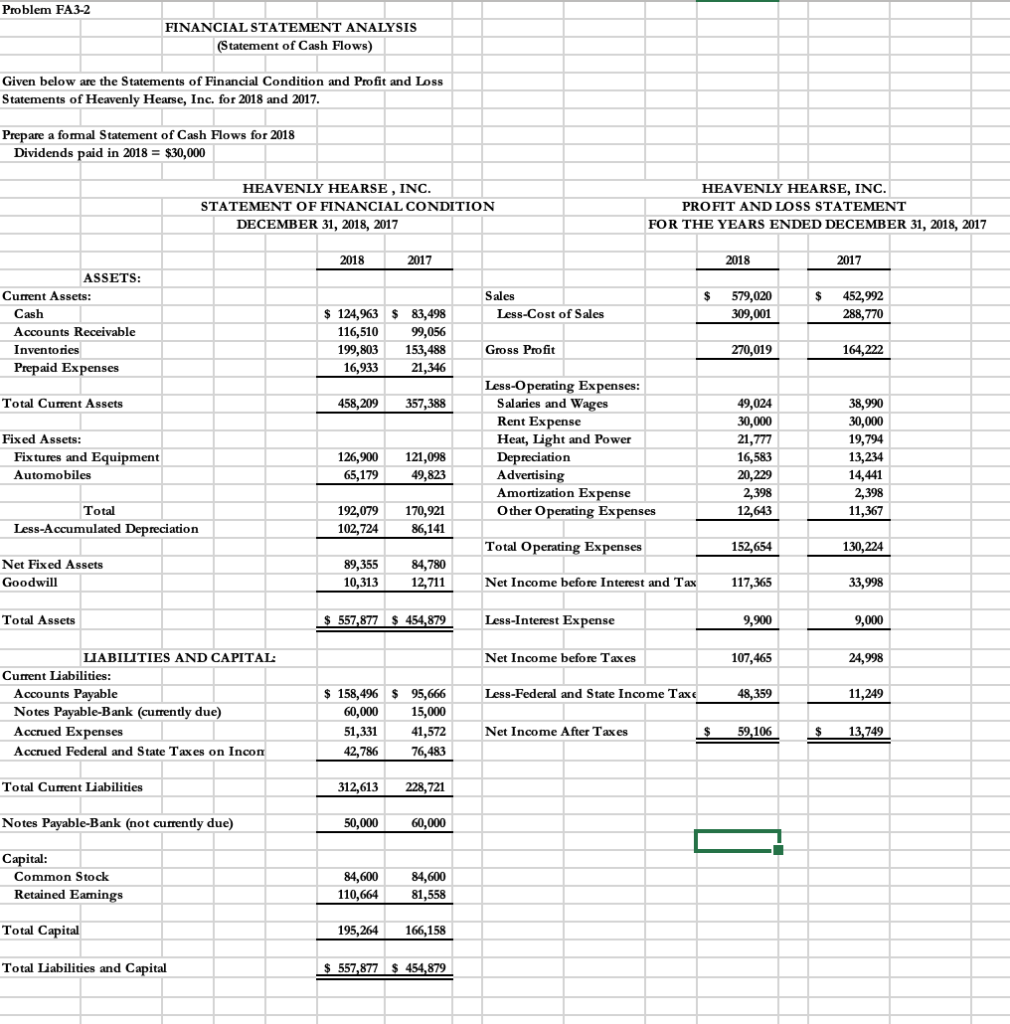

Question: Problem FA3-2 FINANCIAL STATEMENT ANALYSIS (Statement of Cash Flows) Given below are the Statements of Financial Condition and Profit and Loss Statements of Heavenly Hearse,

Problem FA3-2 FINANCIAL STATEMENT ANALYSIS (Statement of Cash Flows) Given below are the Statements of Financial Condition and Profit and Loss Statements of Heavenly Hearse, Inc. for 2018 and 2017. Prepare a fomal Statement of Cash Flows for 2018 Dividends paid in 2018 = $30,000 HEAVENLY HEARSE, INC. HEAVENLY HEARSE, INC. STATEMENT OF FINANCIAL CONDITION PROFIT AND LOSS STATEMENT FOR THE YEARS ENDED DECEMBER 31, 2018, 2017 DECEMBER 31, 2018, 2017 2017 2018 2018 2017 ASSETS: Current Assets: Sales 579,020 452,992 124,963 $ 83,498 309,001 288,770 Cash Less-Cost of Sales Accounts Receivable 116,510 99,056 Gross Profit Inventories 199,803 153,488 270,019 164.222 Prepaid Expenses 16,933 21,346 Less-Operating Expenses: Salaries and Wages Rent Expense Heat, Light and Power Depreciation Advertising Amortization Expense Other Operating Expenses Total Curent Assets 458,209 357,388 49,024 38,990 30,000 30,000 Fixed Assets: 21,777 19,794 Fixtures and Equipment 126,900 121,098 16,583 13,234 Automobiles 65,179 49,823 20,229 14,441 2,398 2,398 Total 192,079 170,921 12,643 11,367 102,724 86,141 Less-Accumulated Depreciation Total Operating Expenses 152,654 130,224 Net Fixed Assets 89,355 84,780 Goodwill 10,313 12,711 Net Income before Interest and Tax 117,365 33,998 557,877 454,879 Less-Interest Expense Total Assets 9,900 9,000 LIABILITIES AND CAPITAL: Net Income before Taxes 107,465 24,998 Current Liabilities: $158,496 95,666 60,000 Accounts Payable Notes Payable-Bank (currently due) Accrued Expenses Less-Federal and State Income Taxe 48,359 11,249 15,000 51,331 41,572 Net Income After Taxes S 59,106 13,749 Accrued Federal and State Taxes on Incom 42,786 76,483 Total Current Liabilities 312,613 228,721 Notes Payable-Bank (not currently due) 50,000 60,000 Capital: Common Stock 84,600 84,600 Retained Earings 110,664 81,558 Total Capital 195,264 166,158 Total Liabilities and Capital 557,877 $ 454,879

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts