Question: Problem FORW-39H LR2023-10 It is given that S(0)=$100. This is the share price today (time 0) of XYZ stock. =5% p.a. This is the growth

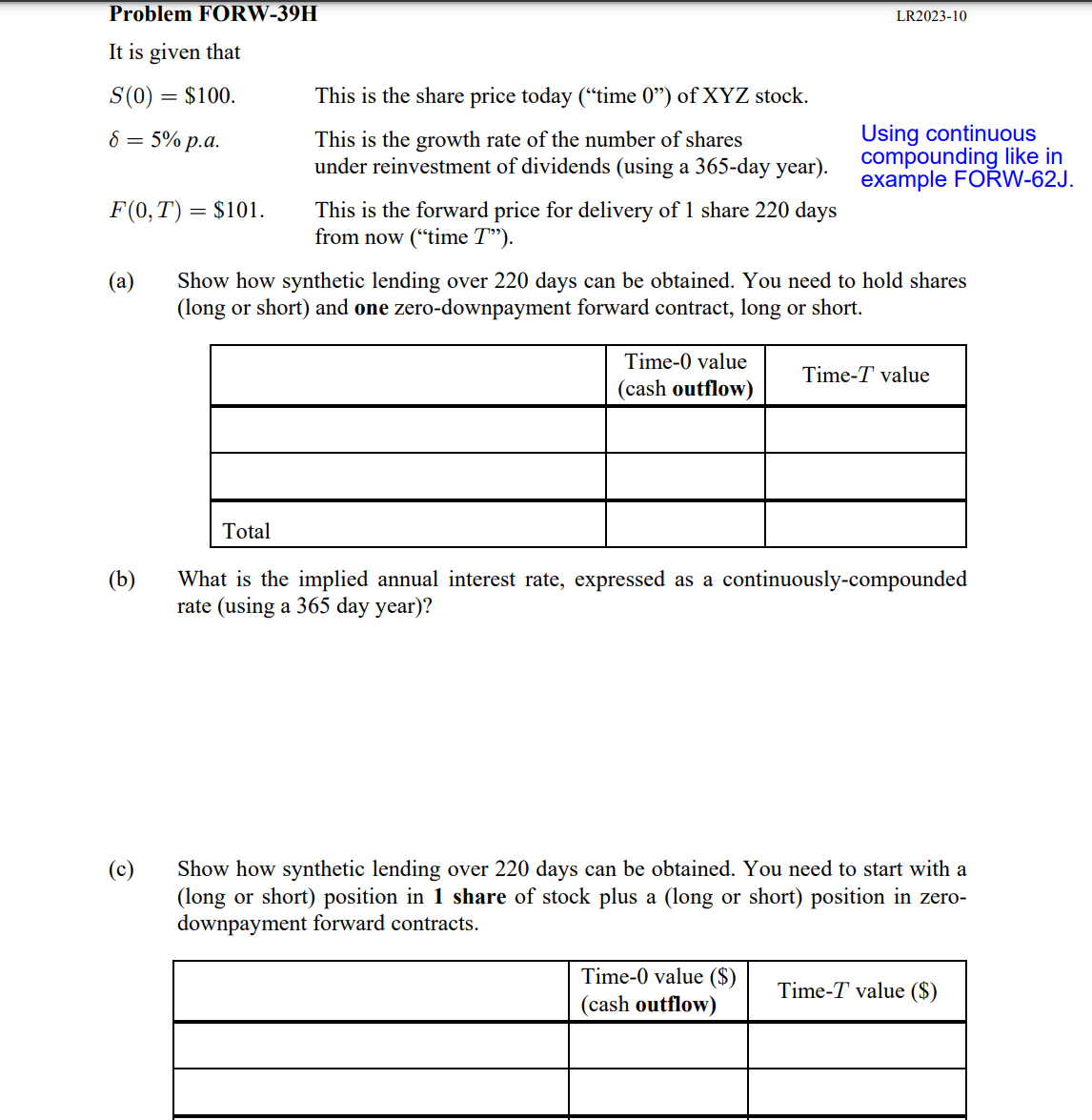

Problem FORW-39H LR2023-10 It is given that S(0)=$100. This is the share price today ("time 0") of XYZ stock. =5% p.a. This is the growth rate of the number of shares Using continuous under reinvestment of dividends (using a 365-day year). compounding like example FORW-6: F(0,T)=$101. This is the forward price for delivery of 1 share 220 days from now ("time T "). (a) Show how synthetic lending over 220 days can be obtained. You need to hold shares (long or short) and one zero-downpayment forward contract, long or short. (b) What is the implied annual interest rate, expressed as a continuously-compounded rate (using a 365 day year)? (c) Show how synthetic lending over 220 days can be obtained. You need to start with a (long or short) position in 1 share of stock plus a (long or short) position in zerodownpayment forward contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts