Question: Problem Four Use the following data to answer Questions 11 through 16: An analyst has gathered the following data about two projects, each with a

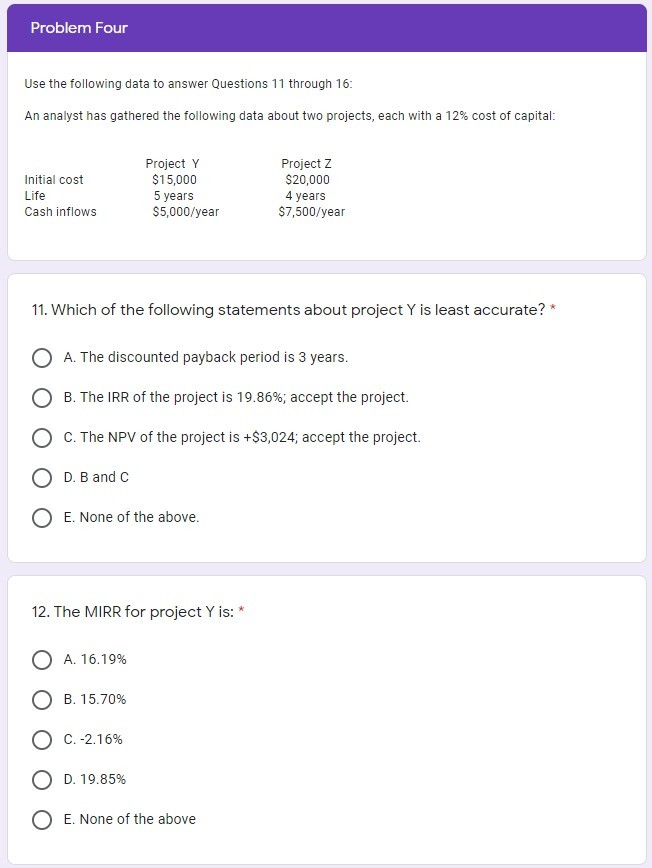

Problem Four Use the following data to answer Questions 11 through 16: An analyst has gathered the following data about two projects, each with a 12% cost of capital: Initial cost Life Cash inflows Project Y $15,000 5 years $5,000/year Project 2 $20,000 4 years $7,500/year 11. Which of the following statements about project Y is least accurate?* A. The discounted payback period is 3 years. B. The IRR of the project is 19.86%; accept the project. O C. The NPV of the project is +$3,0 accept the project. D. B and C E. None of the above. 12. The MIRR for project Y is: * O A. 16.19% OB. 15.70% O C.-2.16% O D. 19.85% O E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts