Question: PROBLEM Goodfellow & Perkins LLP is a successful mid-tier accounting firm with a large range of clients across Texas. During 2025, Goodfellow & Perkins gained

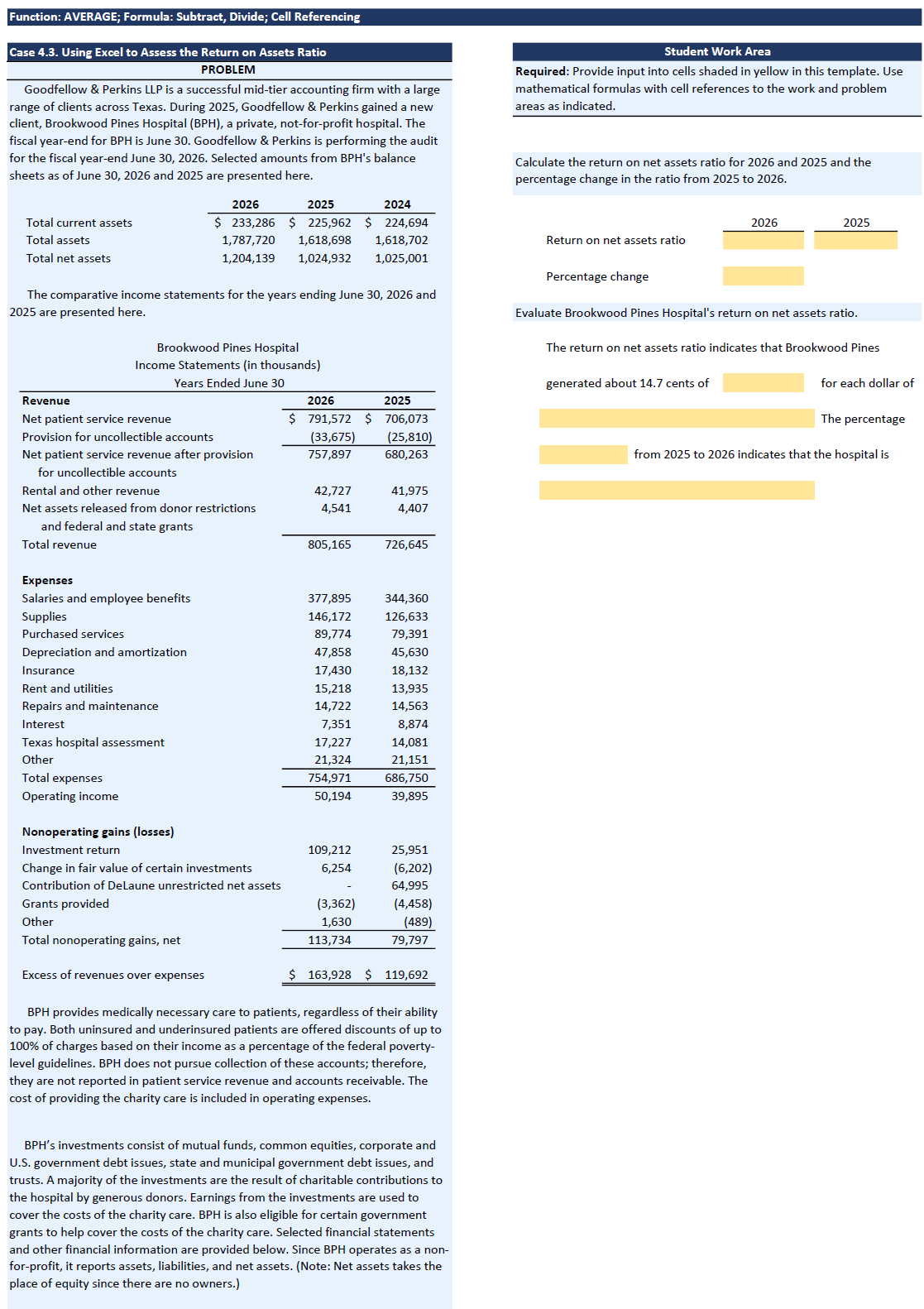

PROBLEM Goodfellow \& Perkins LLP is a successful mid-tier accounting firm with a large range of clients across Texas. During 2025, Goodfellow \& Perkins gained a new client, Brookwood Pines Hospital (BPH), a private, not-for-profit hospital. The fiscal year-end for BPH is June 30 . Goodfellow \& Perkins is performing the audit for the fiscal year-end June 30, 2026. Selected amounts from BPH's balance sheets as of June 30, 2026 and 2025 are presented here. The comparative income statements for the years ending June 30, 2026 and 2025 are presented here. BPH provides medically necessary care to patients, regardless of their ability to pay. Both uninsured and underinsured patients are offered discounts of up to 100% of charges based on their income as a percentage of the federal povertylevel guidelines. BPH does not pursue collection of these accounts; therefore, they are not reported in patient service revenue and accounts receivable. The cost of providing the charity care is included in operating expenses. BPH s investments consist of mutual funds, common equities, corporate and U.S. government debt issues, state and municipal government debt issues, and trusts. A majority of the investments are the result of charitable contributions to the hospital by generous donors. Earnings from the investments are used to cover the costs of the charity care. BPH is also eligible for certain government grants to help cover the costs of the charity care. Selected financial statements and other financial information are provided below. Since BPH operates as a nonfor-profit, it reports assets, liabilities, and net assets. (Note: Net assets takes the place of equity since there are no owners.) Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to the work and problem areas as indicated. Calculate the return on net assets ratio for 2026 and 2025 and the percentage change in the ratio from 2025 to 2026. Evaluate Brookwood Pines Hospital's return on net assets ratio. The return on net assets ratio indicates that Brookwood Pines generated about 14.7 cents of for each dollar of The percentage from 2025 to 2026 indicates that the hospital is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts