Question: Problem I: (10 points) The following list shows the various types of transactions a construction company might have. Assume the company's construction projects are ongoing

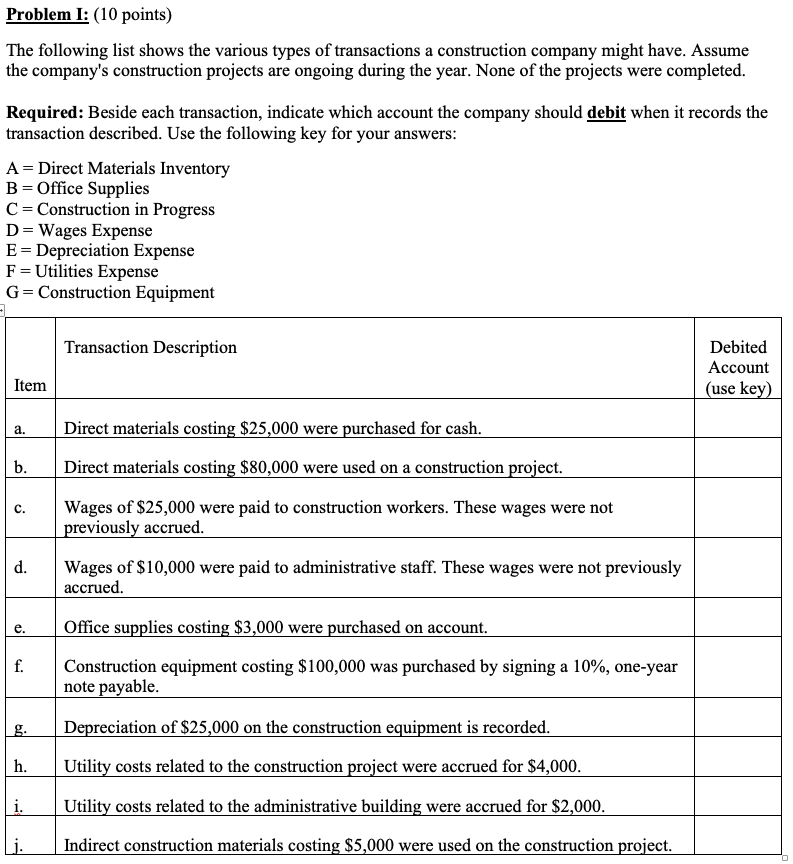

Problem I: (10 points) The following list shows the various types of transactions a construction company might have. Assume the company's construction projects are ongoing during the year. None of the projects were completed. Required: Beside each transaction, indicate which account the company should debit when it records the transaction described. Use the following key for your answers: A = Direct Materials Inventory B=Office Supplies C=Construction in Progress D=Wages Expense E=Depreciation Expense F=Utilities Expense G=Construction Equipment Transaction Description Debited Account (use key) Item a. Direct materials costing $25,000 were purchased for cash. b. Direct materials costing $80,000 were used on a construction project. Wages of $25,000 were paid to construction workers. These wages were not previously accrued. c. d. Wages of $10,000 were paid to administrative staff. These wages were not previously accrued. e. f. Office supplies costing $3,000 were purchased on account. Construction equipment costing $100,000 was purchased by signing a 10%, one-year note payable. g. h. Depreciation of $25,000 on the construction equipment is recorded. Utility costs related to the construction project were accrued for $4,000. Utility costs related to the administrative building were accrued for $2,000. i. Indirect construction materials costing $5,000 were used on the construction project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts