Question: Problem I: (18 points) Nowell Inc.'s post-closing trial balance at 12/31/20 shows the following select account balances: Debit Common Stock - no par (26,000 shares

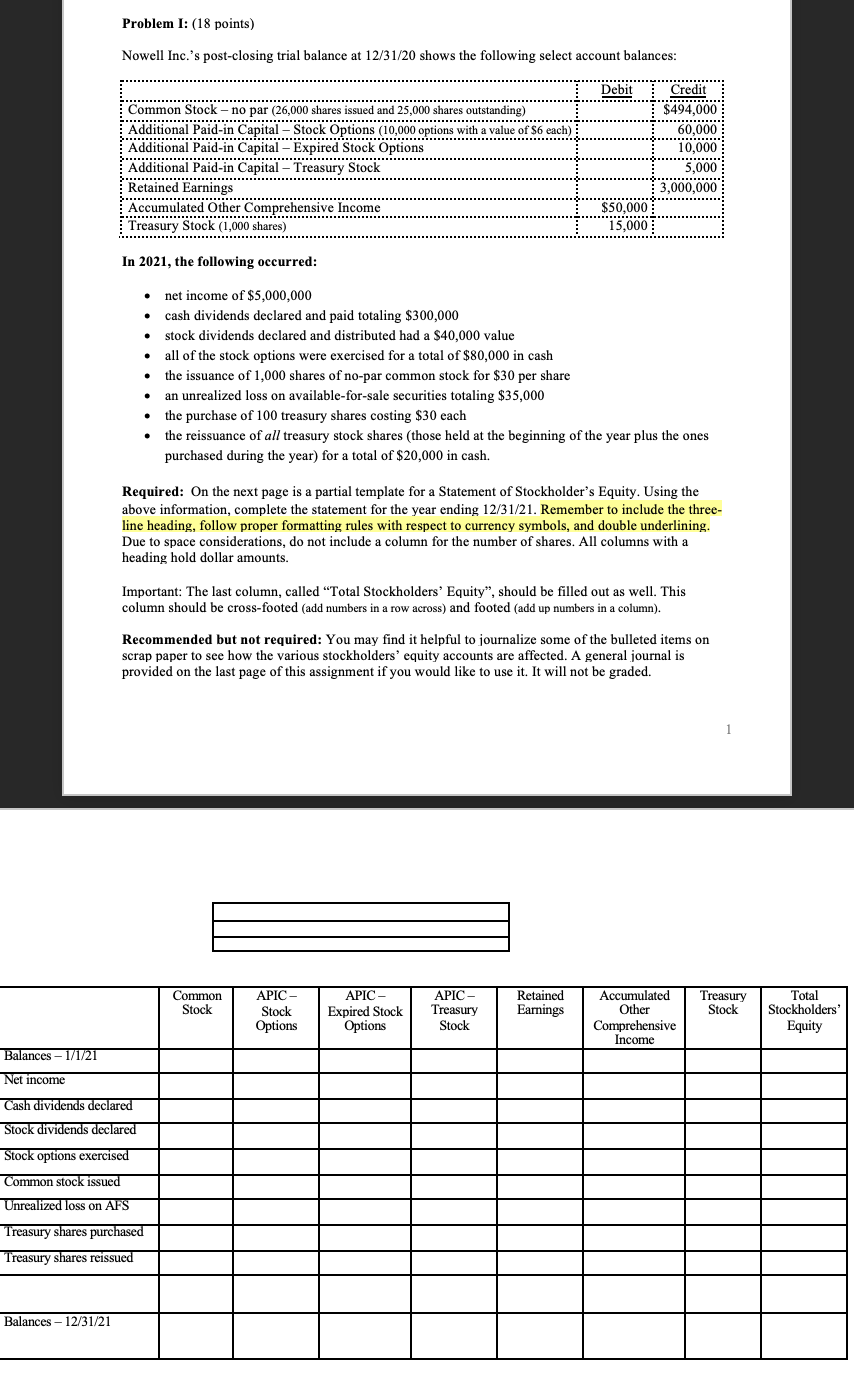

Problem I: (18 points) Nowell Inc.'s post-closing trial balance at 12/31/20 shows the following select account balances: Debit Common Stock - no par (26,000 shares issued and 25,000 shares outstanding) Additional Paid-in Capital - Stock Options (10,000 options with a value of $6 each) ............................ ................................................................................ Additional Paid-in Capital - Expired Stock Options .................................................................. Additional Paid-in Capital Treasury Stock Retained Earnings .............................. Accumulated Other Comprehensive Income Treasury Stock (1,000 shares) Credit $494,000 ............ 60,000 ...!!!! 10,000 5,000 3,000,000 $50.000 15,000 In 2021, the following occurred: . . net income of $5,000,000 cash dividends declared and paid totaling $300,000 stock dividends declared and distributed had a $40,000 value all of the stock options were exercised for a total of $80,000 in cash the issuance of 1,000 shares of no-par common stock for $30 per share an unrealized loss on available-for-sale securities totaling $35,000 the purchase of 100 treasury shares costing $30 each the reissuance of all treasury stock shares (those held at the beginning of the year plus the ones purchased during the year) for a total of $20,000 in cash. . Required: On the next page is a partial template for a Statement of Stockholder's Equity. Using the above information, complete the statement for the year ending 12/31/21. Remember to include the three- line heading, follow proper formatting rules with respect to currency symbols, and double underlining. Due to space considerations, do not include a column for the number of shares. All columns with a heading hold dollar amounts. Important: The last column, called "Total Stockholders' Equity", should be filled out as well. This column should be cross-footed (add numbers in a row across) and footed (add up numbers in a column). Recommended but not required: You may find it helpful to journalize some of the bulleted items on scrap paper to see how the various stockholders' equity accounts are affected. A general journal is provided on the last page of this assignment if you would like to use it. It will not be graded. 1 Common Stock APIC - Stock Options APIC- Expired Stock Options APIC- Treasury Stock Retained Earnings Treasury Stock Accumulated Other Comprehensive Income Total Stockholders' Equity Balances - 1/1/21 Net income Cash dividends declared Stock dividends declared Stock options exercised Common stock issued Unrealized loss on AFS Treasury shares purchased Treasury shares reissued Balances - 12/31/21 Problem I: (18 points) Nowell Inc.'s post-closing trial balance at 12/31/20 shows the following select account balances: Debit Common Stock - no par (26,000 shares issued and 25,000 shares outstanding) Additional Paid-in Capital - Stock Options (10,000 options with a value of $6 each) ............................ ................................................................................ Additional Paid-in Capital - Expired Stock Options .................................................................. Additional Paid-in Capital Treasury Stock Retained Earnings .............................. Accumulated Other Comprehensive Income Treasury Stock (1,000 shares) Credit $494,000 ............ 60,000 ...!!!! 10,000 5,000 3,000,000 $50.000 15,000 In 2021, the following occurred: . . net income of $5,000,000 cash dividends declared and paid totaling $300,000 stock dividends declared and distributed had a $40,000 value all of the stock options were exercised for a total of $80,000 in cash the issuance of 1,000 shares of no-par common stock for $30 per share an unrealized loss on available-for-sale securities totaling $35,000 the purchase of 100 treasury shares costing $30 each the reissuance of all treasury stock shares (those held at the beginning of the year plus the ones purchased during the year) for a total of $20,000 in cash. . Required: On the next page is a partial template for a Statement of Stockholder's Equity. Using the above information, complete the statement for the year ending 12/31/21. Remember to include the three- line heading, follow proper formatting rules with respect to currency symbols, and double underlining. Due to space considerations, do not include a column for the number of shares. All columns with a heading hold dollar amounts. Important: The last column, called "Total Stockholders' Equity", should be filled out as well. This column should be cross-footed (add numbers in a row across) and footed (add up numbers in a column). Recommended but not required: You may find it helpful to journalize some of the bulleted items on scrap paper to see how the various stockholders' equity accounts are affected. A general journal is provided on the last page of this assignment if you would like to use it. It will not be graded. 1 Common Stock APIC - Stock Options APIC- Expired Stock Options APIC- Treasury Stock Retained Earnings Treasury Stock Accumulated Other Comprehensive Income Total Stockholders' Equity Balances - 1/1/21 Net income Cash dividends declared Stock dividends declared Stock options exercised Common stock issued Unrealized loss on AFS Treasury shares purchased Treasury shares reissued Balances - 12/31/21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts