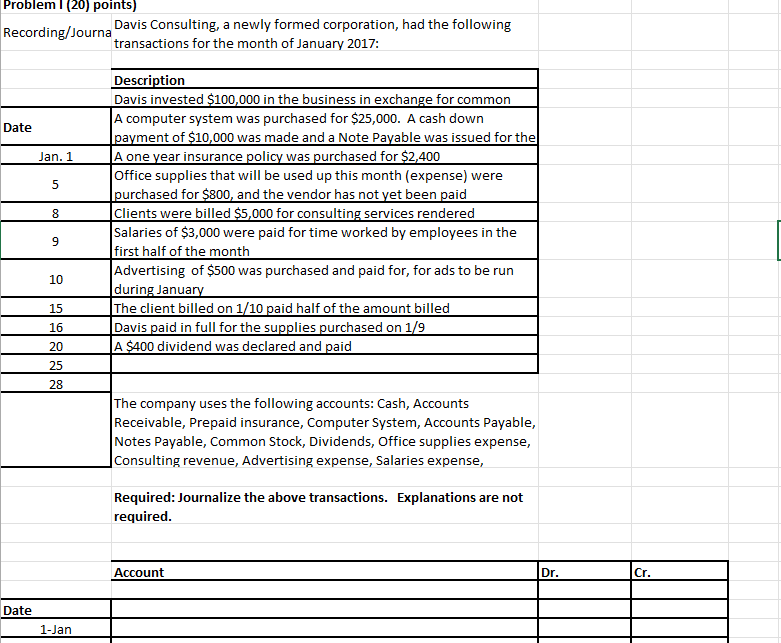

Question: Problem I (20) points) Recording/Journa Date Jan. 1 5 8 9 10 15 16 20 Davis Consulting, a newly formed corporation, had the following

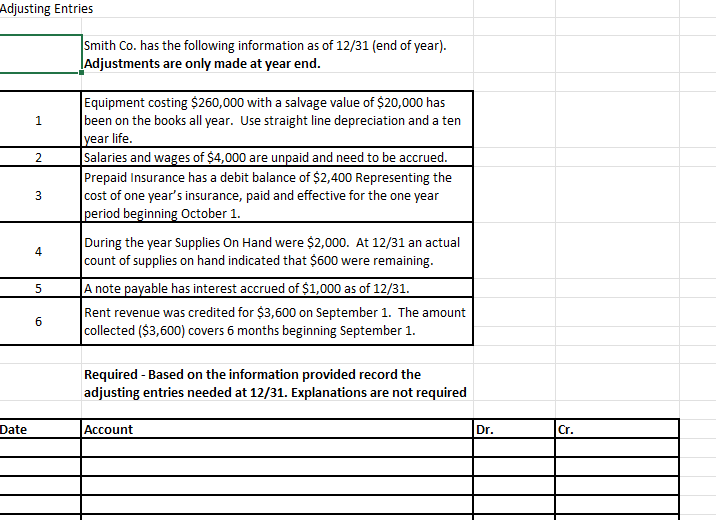

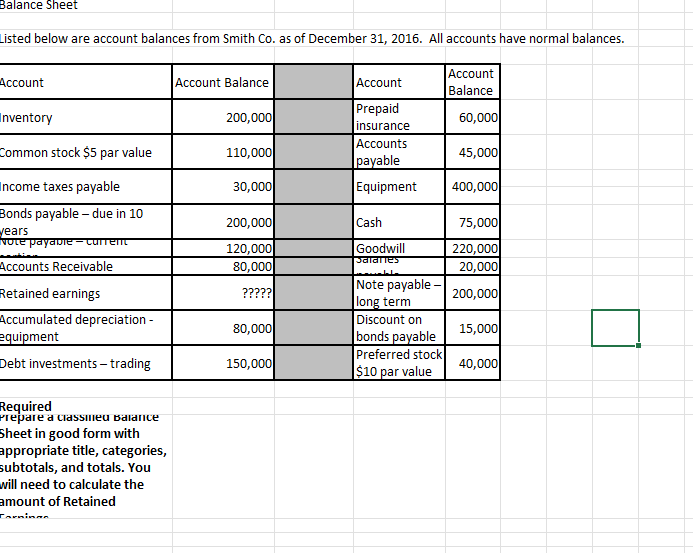

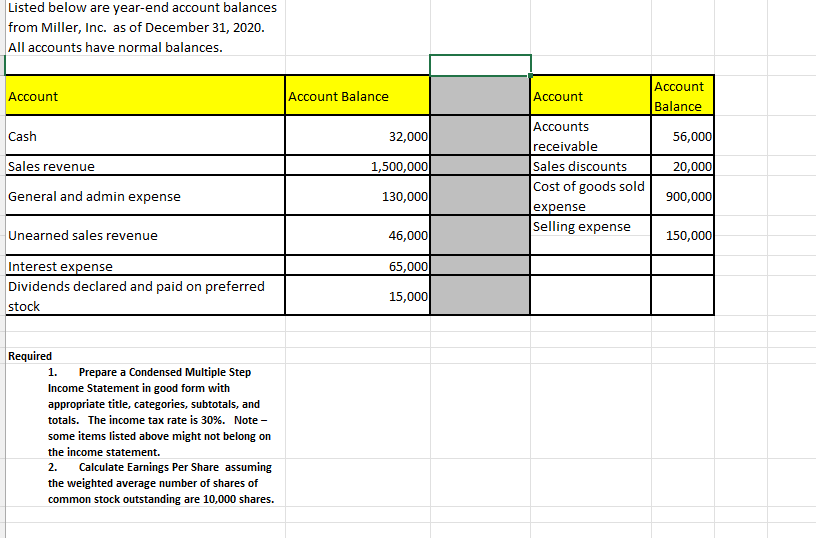

Problem I (20) points) Recording/Journa Date Jan. 1 5 8 9 10 15 16 20 Davis Consulting, a newly formed corporation, had the following transactions for the month of January 2017: Description Davis invested $100,000 in the business in exchange for common A computer system was purchased for $25,000. A cash down payment of $10,000 was made and a Note Payable was issued for the A one year insurance policy was purchased for $2,400 Office supplies that will be used up this month (expense) were purchased for $800, and the vendor has not yet been paid Clients were billed $5,000 for consulting services rendered Salaries of $3,000 were paid for time worked by employees in the first half of the month Advertising of $500 was purchased and paid for, for ads to be run during January The client billed on 1/10 paid half of the amount billed Davis paid in full for the supplies purchased on 1/9 A $400 dividend was declared and paid 25 28 The company uses the following accounts: Cash, Accounts Receivable, Prepaid insurance, Computer System, Accounts Payable, Notes Payable, Common Stock, Dividends, Office supplies expense, Consulting revenue, Advertising expense, Salaries expense, Required: Journalize the above transactions. Explanations are not required. Date 1-Jan Account Dr. Cr. Adjusting Entries 1 2 3 4 Smith Co. has the following information as of 12/31 (end of year). Adjustments are only made at year end. Equipment costing $260,000 with a salvage value of $20,000 has been on the books all year. Use straight line depreciation and a ten year life. Salaries and wages of $4,000 are unpaid and need to be accrued. Prepaid Insurance has a debit balance of $2,400 Representing the cost of one year's insurance, paid and effective for the one year period beginning October 1. During the year Supplies On Hand were $2,000. At 12/31 an actual count of supplies on hand indicated that $600 were remaining. 5 A note payable has interest accrued of $1,000 as of 12/31. 6 Rent revenue was credited for $3,600 on September 1. The amount collected ($3,600) covers 6 months beginning September 1. Required - Based on the information provided record the adjusting entries needed at 12/31. Explanations are not required Date Account Dr. Cr. Balance Sheet Listed below are account balances from Smith Co. as of December 31, 2016. All accounts have normal balances. Account Account Account Balance Account Balance Prepaid Inventory 200,000 60,000 insurance Accounts Common stock $5 par value 110,000 45,000 payable Income taxes payable 30,000 Equipment 400,000 Bonds payable - due in 10 200,000 Cash 75,000 years vote payable current 120,000 Goodwill 220,000 Salaries Accounts Receivable 80,000 20,000 Retained earnings ????? Note payable - 200,000 long term Accumulated depreciation- Discount on 80,000 15,000 equipment bonds payable Preferred stock Debt investments - trading 150,000 40,000 $10 par value Required Prepare a Classinen Balance Sheet in good form with appropriate title, categories, subtotals, and totals. You will need to calculate the amount of Retained Carminas Listed below are year-end account balances from Miller, Inc. as of December 31, 2020. All accounts have normal balances. Account Account Cash Sales revenue General and admin expense Unearned sales revenue Account Balance Account Balance Accounts 32,000 56,000 receivable 1,500,000 Sales discounts 20,000 Cost of goods sold 130,000 900,000 expense Selling expense 46,000 150,000 Interest expense 65,000 Dividends declared and paid on preferred 15,000 stock Required 1. Prepare a Condensed Multiple Step Income Statement in good form with appropriate title, categories, subtotals, and totals. The income tax rate is 30%. Note - some items listed above might not belong on the income statement. 2. Calculate Earnings Per Share assuming the weighted average number of shares of common stock outstanding are 10,000 shares.

Step by Step Solution

There are 3 Steps involved in it

Here are the journal entries for the transactions Jan 1 Common Stock 100000 Investment in Common Stock 100000 To record Davis investment in common stock Jan 5 Computer System25000 Note Payable10000 Ca... View full answer

Get step-by-step solutions from verified subject matter experts