Question: Problem I. Financial data ($ thousands) for Wisconsin Wilderness, Inc., are reproduced below: Short-term liabilities . . . . $ 500 Long-term liabilities . .

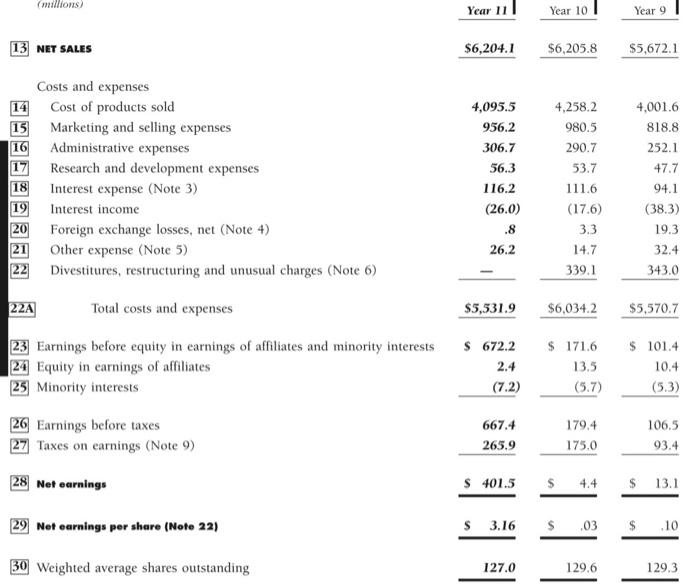

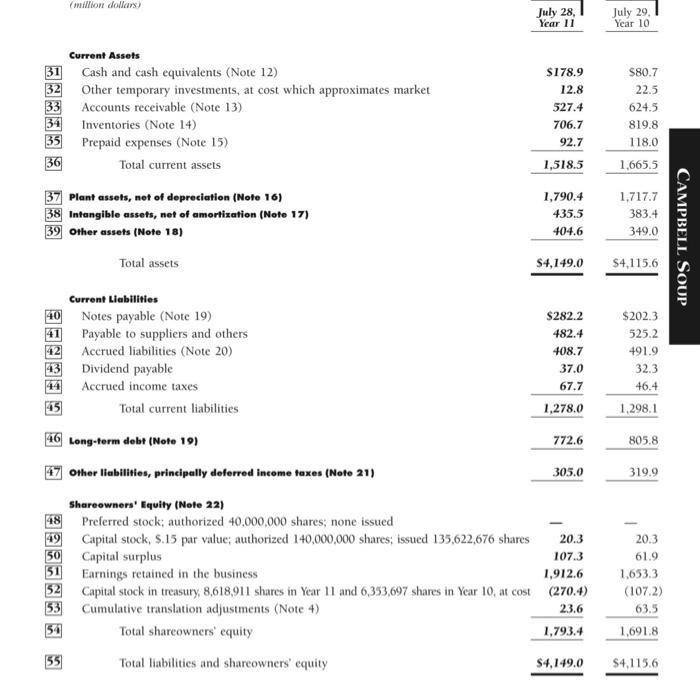

(millions Year 11 Year 10 Year 9 13 NET SALES $6,204.1 $6,205.8 $5,672.1 4,001.6 818.8 252.1 16 Costs and expenses 14 Cost of products sold 15 Marketing and selling expenses Administrative expenses 17 Research and development expenses 18 Interest expense (Note 3) 19 Interest income 20 Foreign exchange losses, net (Note 4) Other expense (Note 5) Divestitures, restructuring and unusual charges (Note 6) 4,095.5 956.2 306.7 56.3 116.2 (26.0) .8 4,258.2 980.5 290.7 53.7 111.6 (17.6) 3.3 47.7 94.1 (38.3) 19.3 32.4 343.0 21 26.2 14.7 22 339.1 22A Total costs and expenses $5,531.9 $6,034.2 $5,570.7 23 Earnings before equity in earnings of affiliates and minority interests 24 Equity in earnings of affiliates 25 Minority interests $ 672.2 2.4 (7.2) $ 171.6 13.5 (5.7) $ 101.4 10.4 (5.3) 26 Earnings before taxes 27 Taxes on earnings (Note 9) 667.4 265.9 179.4 175.0 106.5 93.4 28 Net earnings $ 401.5 4.4 $ 13.1 29 Net earnings per share (Note 22) $ 3.16 $ .03 $ 10 30 Weighted average shares outstanding 127.0 129,6 129.3 (million dollars) July 28, Year 11 July 29, Year 10 31 32 33 Current Assets Cash and cash equivalents (Note 12) Other temporary investments, at cost which approximates market Accounts receivable (Note 13) Inventories (Note 14) Prepaid expenses (Note 15) Total current assets $178.9 12.8 527.4 706.7 92.7 1,518.5 $80.7 22.5 624.5 819.8 118.0 1,665.5 35 36 37 Plant assets, not of depreciation (Note 16) 38 Intangible assets, net of amortization (Note 17) 39 Other assets (Note 18) 1,790.4 435.5 404.6 1,717.7 383.4 349.0 CAMPBELL SOUP Total assets $4,149.0 54.115.6 40 42 Current Liabilities Notes payable (Note 19) Payable to suppliers and others Accrued liabilities (Note 20) Dividend payable Accrued income taxes Total current liabilities $282.2 482.4 408.7 37.0 67.7 1,278.0 $202.3 525.2 491.9 32.3 46.4 1,298.1 16 Long-term debt (Note 19) 772.6 805.8 319.9 48 49 50 51 52 Other liabilities, principally deferred income taxes (Note 21) 305.0 Shareowners' Equity (Note 22) Preferred stock; authorized 40,000,000 shares: none issued Capital stock, S.15 par value; authorized 140,000,000 shares; issued 135,622,676 shares 20.3 Capital surplus 107.3 Earnings retained in the business 1,912.6 Capital stock in treasury, 8,618,911 shares in Year 11 and 6,353,697 shares in Year 10, at cost (270.4) Cumulative translation adjustments (Note 4) Total shareowners' equity 1,793.4 Total liabilities and shareowners' equity $4,149.0 20.3 61.9 1.653.3 (1072) 63.5 1,691.8 23.6 54 55 S4,115.6 (millions Year 11 Year 10 Year 9 13 NET SALES $6,204.1 $6,205.8 $5,672.1 4,001.6 818.8 252.1 16 Costs and expenses 14 Cost of products sold 15 Marketing and selling expenses Administrative expenses 17 Research and development expenses 18 Interest expense (Note 3) 19 Interest income 20 Foreign exchange losses, net (Note 4) Other expense (Note 5) Divestitures, restructuring and unusual charges (Note 6) 4,095.5 956.2 306.7 56.3 116.2 (26.0) .8 4,258.2 980.5 290.7 53.7 111.6 (17.6) 3.3 47.7 94.1 (38.3) 19.3 32.4 343.0 21 26.2 14.7 22 339.1 22A Total costs and expenses $5,531.9 $6,034.2 $5,570.7 23 Earnings before equity in earnings of affiliates and minority interests 24 Equity in earnings of affiliates 25 Minority interests $ 672.2 2.4 (7.2) $ 171.6 13.5 (5.7) $ 101.4 10.4 (5.3) 26 Earnings before taxes 27 Taxes on earnings (Note 9) 667.4 265.9 179.4 175.0 106.5 93.4 28 Net earnings $ 401.5 4.4 $ 13.1 29 Net earnings per share (Note 22) $ 3.16 $ .03 $ 10 30 Weighted average shares outstanding 127.0 129,6 129.3 (million dollars) July 28, Year 11 July 29, Year 10 31 32 33 Current Assets Cash and cash equivalents (Note 12) Other temporary investments, at cost which approximates market Accounts receivable (Note 13) Inventories (Note 14) Prepaid expenses (Note 15) Total current assets $178.9 12.8 527.4 706.7 92.7 1,518.5 $80.7 22.5 624.5 819.8 118.0 1,665.5 35 36 37 Plant assets, not of depreciation (Note 16) 38 Intangible assets, net of amortization (Note 17) 39 Other assets (Note 18) 1,790.4 435.5 404.6 1,717.7 383.4 349.0 CAMPBELL SOUP Total assets $4,149.0 54.115.6 40 42 Current Liabilities Notes payable (Note 19) Payable to suppliers and others Accrued liabilities (Note 20) Dividend payable Accrued income taxes Total current liabilities $282.2 482.4 408.7 37.0 67.7 1,278.0 $202.3 525.2 491.9 32.3 46.4 1,298.1 16 Long-term debt (Note 19) 772.6 805.8 319.9 48 49 50 51 52 Other liabilities, principally deferred income taxes (Note 21) 305.0 Shareowners' Equity (Note 22) Preferred stock; authorized 40,000,000 shares: none issued Capital stock, S.15 par value; authorized 140,000,000 shares; issued 135,622,676 shares 20.3 Capital surplus 107.3 Earnings retained in the business 1,912.6 Capital stock in treasury, 8,618,911 shares in Year 11 and 6,353,697 shares in Year 10, at cost (270.4) Cumulative translation adjustments (Note 4) Total shareowners' equity 1,793.4 Total liabilities and shareowners' equity $4,149.0 20.3 61.9 1.653.3 (1072) 63.5 1,691.8 23.6 54 55 S4,115.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts