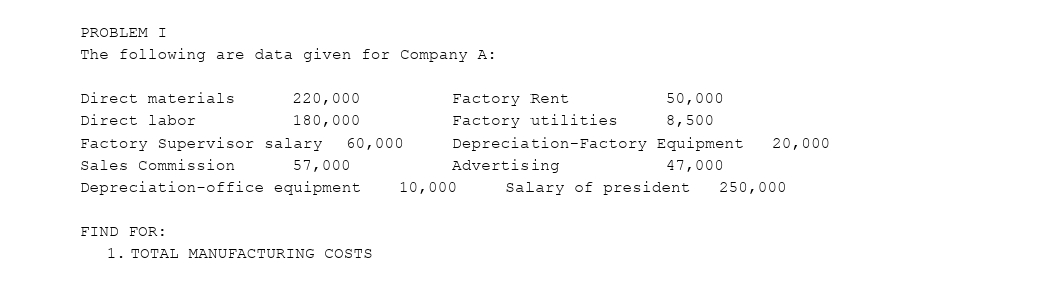

Question: PROBLEM I The following are data given for Company A: Direct materials Direct labor Sales Commission 220,000 180,000 Factory Supervisor salary 60,000 57,000 Depreciation-office

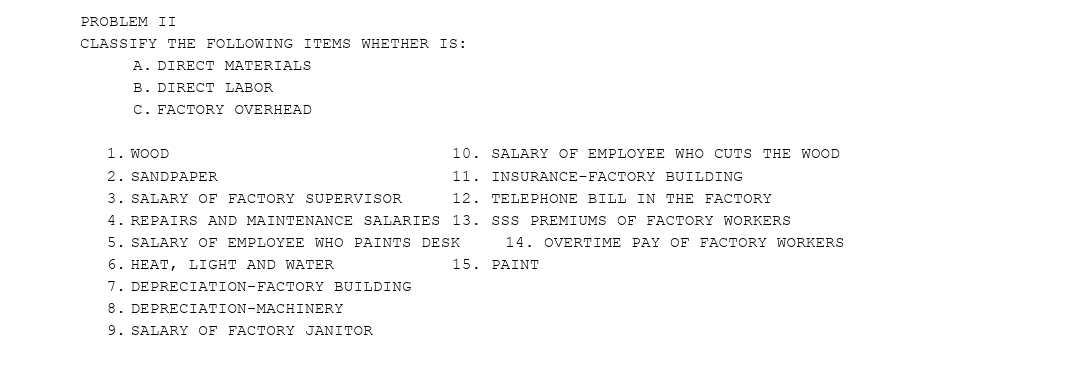

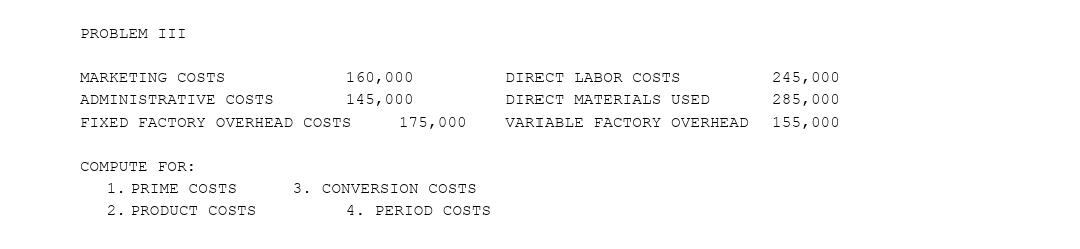

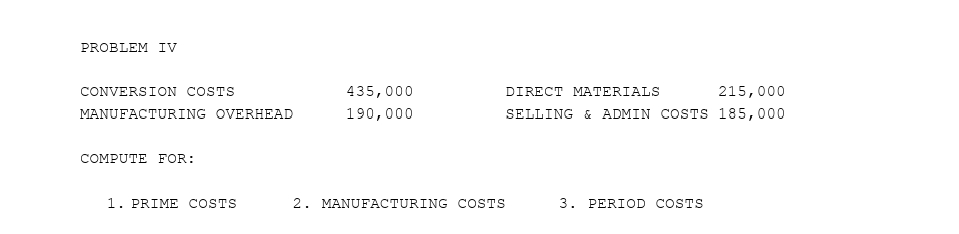

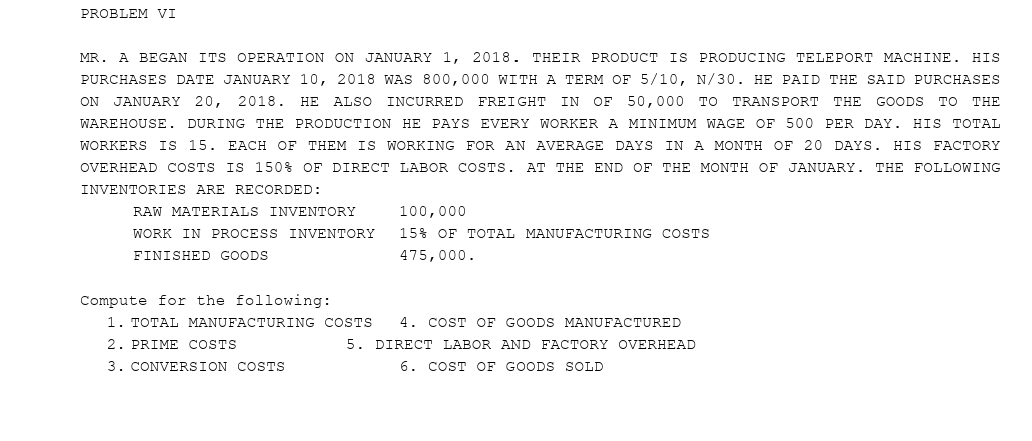

PROBLEM I The following are data given for Company A: Direct materials Direct labor Sales Commission 220,000 180,000 Factory Supervisor salary 60,000 57,000 Depreciation-office equipment FIND FOR: 1. TOTAL MANUFACTURING COSTS Factory Rent Factory utilities 50,000 8,500 Depreciation-Factory Equipment 20,000 Advertising 47,000 10,000 Salary of president 250,000 PROBLEM II CLASSIFY THE FOLLOWING ITEMS WHETHER IS: A. DIRECT MATERIALS B. DIRECT LABOR C. FACTORY OVERHEAD 1. WOOD 2. SANDPAPER 3. SALARY OF FACTORY SUPERVISOR 10. SALARY OF EMPLOYEE WHO CUTS THE WOOD 11. INSURANCE-FACTORY BUILDING 12. TELEPHONE BILL IN THE FACTORY 4. REPAIRS AND MAINTENANCE SALARIES 13. SSS PREMIUMS OF FACTORY WORKERS 5. SALARY OF EMPLOYEE WHO PAINTS DESK 14. OVERTIME PAY OF FACTORY WORKERS 6. HEAT, LIGHT AND WATER 7. DEPRECIATION-FACTORY BUILDING 8. DEPRECIATION-MACHINERY 9. SALARY OF FACTORY JANITOR 15. PAINT PROBLEM III MARKETING COSTS ADMINISTRATIVE COSTS FIXED FACTORY OVERHEAD COSTS COMPUTE FOR: 160,000 145,000 DIRECT LABOR COSTS 245,000 DIRECT MATERIALS USED 285,000 175,000 VARIABLE FACTORY OVERHEAD 155,000 1. PRIME COSTS 3. CONVERSION COSTS 2. PRODUCT COSTS 4. PERIOD COSTS PROBLEM IV CONVERSION COSTS MANUFACTURING OVERHEAD 435,000 190,000 DIRECT MATERIALS 215,000 SELLING & ADMIN COSTS 185,000 COMPUTE FOR: 1. PRIME COSTS 2. MANUFACTURING COSTS 3. PERIOD COSTS PROBLEM VI MR. A BEGAN ITS OPERATION ON JANUARY 1, 2018. THEIR PRODUCT IS PRODUCING TELEPORT MACHINE. HIS PURCHASES DATE JANUARY 10, 2018 WAS 800,000 WITH A TERM OF 5/10, N/30. HE PAID THE SAID PURCHASES ON JANUARY 20, 2018. HE ALSO INCURRED FREIGHT IN OF 50,000 TO TRANSPORT THE GOODS TO THE WAREHOUSE. DURING THE PRODUCTION HE PAYS EVERY WORKER A MINIMUM WAGE OF 500 PER DAY. HIS TOTAL WORKERS IS 15. EACH OF THEM IS WORKING FOR AN AVERAGE DAYS IN A MONTH OF 20 DAYS. HIS FACTORY OVERHEAD COSTS IS 150% OF DIRECT LABOR COSTS. AT THE END OF THE MONTH OF JANUARY. THE FOLLOWING INVENTORIES ARE RECORDED: RAW MATERIALS INVENTORY WORK IN PROCESS INVENTORY FINISHED GOODS 100,000 15% OF TOTAL MANUFACTURING COSTS 475,000. Compute for the following: 1. TOTAL MANUFACTURING COSTS 2. PRIME COSTS 3. CONVERSION COSTS 4. COST OF GOODS MANUFACTURED 5. DIRECT LABOR AND FACTORY OVERHEAD 6. COST OF GOODS SOLD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts