Question: Problem II (30 marks allocated equally) Com.Dot (a cable company) and Time.EXT (a TV and content provider) are considering a merger transaction. Initial financial and

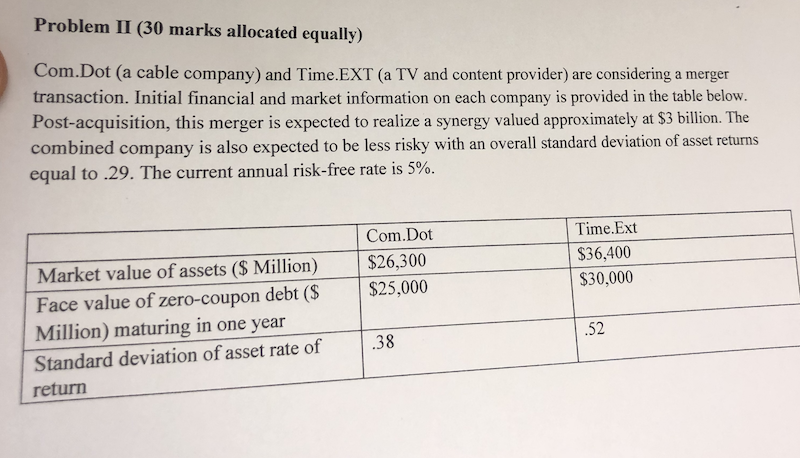

Problem II (30 marks allocated equally) Com.Dot (a cable company) and Time.EXT (a TV and content provider) are considering a merger transaction. Initial financial and market information on each company is provided in the table below Post-acquisition, this merger is expected to realize a synergy valued approximately at $3 billion. The y is also expected to be less risky with an overall standard deviation of asset returns equal to .29. The current annual risk-free rate is 5%. Time.Ext 36,400 $30,000 Com.Dot Market value of assets (S Million) $26,300 Face value of zero-coupon debt (S $25,000 Million) maturing in one year Standard deviation of asset rate of 38 return .52 Problem II (30 marks allocated equally) Com.Dot (a cable company) and Time.EXT (a TV and content provider) are considering a merger transaction. Initial financial and market information on each company is provided in the table below Post-acquisition, this merger is expected to realize a synergy valued approximately at $3 billion. The y is also expected to be less risky with an overall standard deviation of asset returns equal to .29. The current annual risk-free rate is 5%. Time.Ext 36,400 $30,000 Com.Dot Market value of assets (S Million) $26,300 Face value of zero-coupon debt (S $25,000 Million) maturing in one year Standard deviation of asset rate of 38 return .52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts