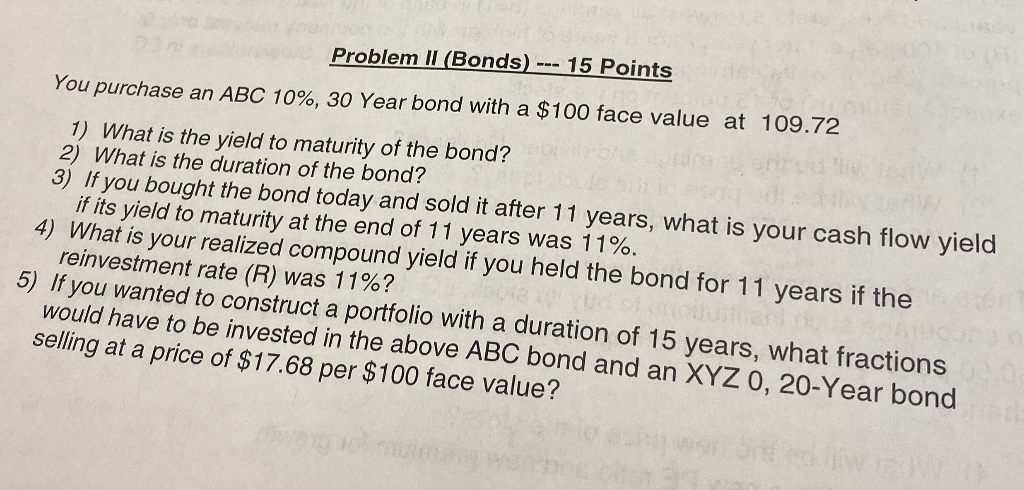

Question: Problem II (Bonds) --- 15 Points You purchase an ABC 10%, 30 Year bond with a $100 face value at 109.72 1) What is the

Problem II (Bonds) --- 15 Points You purchase an ABC 10%, 30 Year bond with a $100 face value at 109.72 1) What is the yield to maturity of the bond? 2) What is the duration of the bond? 3) If you bought the bond today and sold it after 11 years, what is your cash flow yield if its yield to maturity at the end of 11 years was 11%. 4) What is your realized compound yield if you held the bond for 11 years if the reinvestment rate (R) was 11%? 5) If you wanted to construct a portfolio with a duration of 15 years, what fractions would have to be invested in the above ABC bond and an XYZ O, 20-Year bond selling at a price of $17.68 per $100 face value? Problem II (Bonds) --- 15 Points You purchase an ABC 10%, 30 Year bond with a $100 face value at 109.72 1) What is the yield to maturity of the bond? 2) What is the duration of the bond? 3) If you bought the bond today and sold it after 11 years, what is your cash flow yield if its yield to maturity at the end of 11 years was 11%. 4) What is your realized compound yield if you held the bond for 11 years if the reinvestment rate (R) was 11%? 5) If you wanted to construct a portfolio with a duration of 15 years, what fractions would have to be invested in the above ABC bond and an XYZ O, 20-Year bond selling at a price of $17.68 per $100 face value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts