Question: Problem II: Simplified Financial Analysis You want to develop a flex, office-warehouse building with 22,000 square feet (SF) of rentable space and have gathered

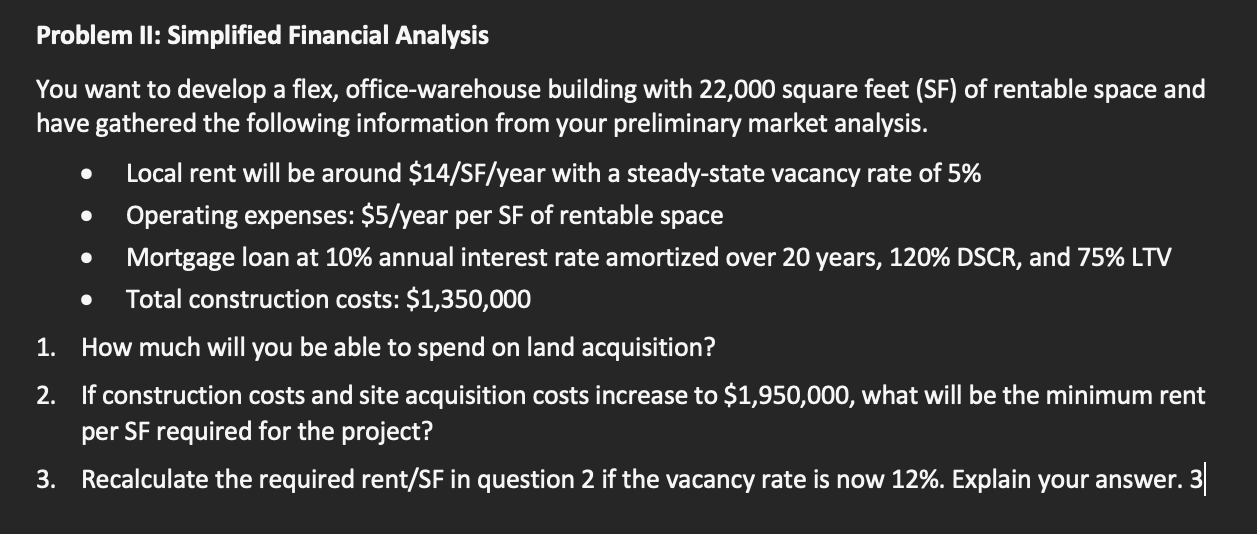

Problem II: Simplified Financial Analysis You want to develop a flex, office-warehouse building with 22,000 square feet (SF) of rentable space and have gathered the following information from your preliminary market analysis. Local rent will be around $14/SF/year with a steady-state vacancy rate of 5% Operating expenses: $5/year per SF of rentable space Mortgage loan at 10% annual interest rate amortized over 20 years, 120% DSCR, and 75% LTV Total construction costs: $1,350,000 1. How much will you be able to spend on land acquisition? 2. If construction costs and site acquisition costs increase to $1,950,000, what will be the minimum rent per SF required for the project? 3. Recalculate the required rent/SF in question 2 if the vacancy rate is now 12%. Explain your answer. 3|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts