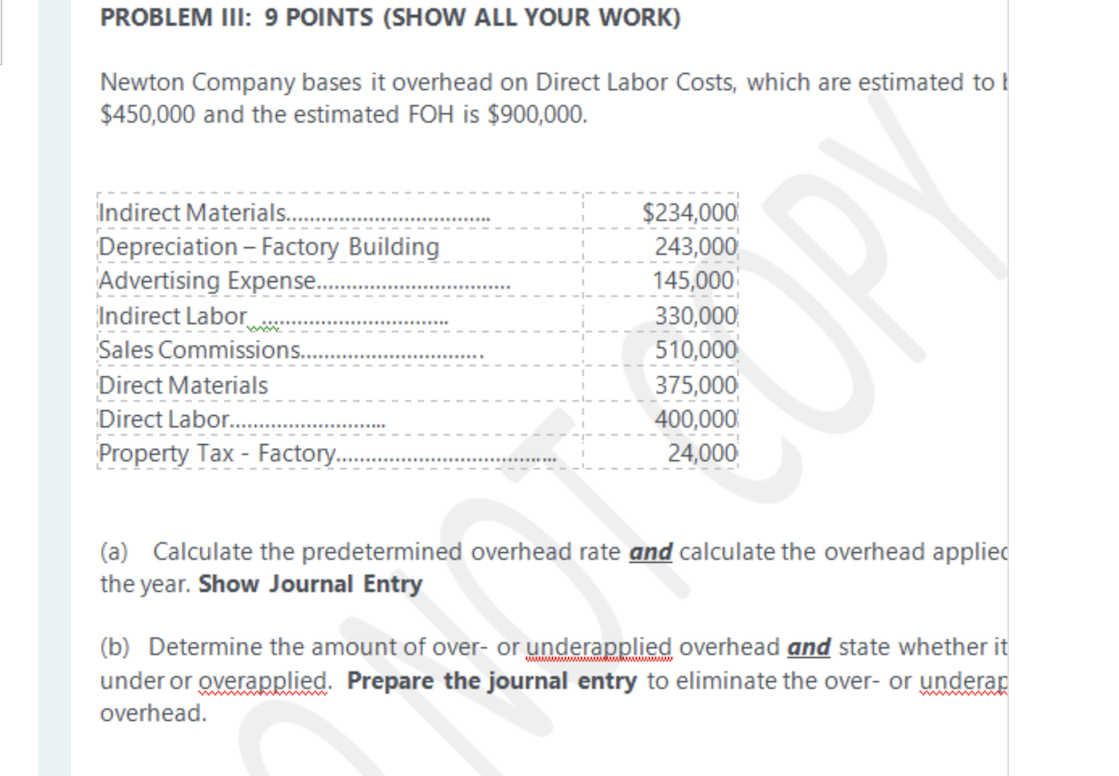

Question: PROBLEM III: 9 POINTS (SHOW ALL YOUR WORK) Newton Company bases it overhead on Direct Labor Costs, which are estimated to ! $450,000 and the

PROBLEM III: 9 POINTS (SHOW ALL YOUR WORK) Newton Company bases it overhead on Direct Labor Costs, which are estimated to ! $450,000 and the estimated FOH is $900,000. Indirect Materials... Depreciation - Factory Building Advertising Expense. Indirect Labor Sales Commissions... Direct Materials Direct Labor.. Property Tax - Factory... $234,000 243,000 145,000 330,000 510,000 375,000 400,000 24,000 UP (a) Calculate the predetermined overhead rate and calculate the overhead applied the year. Show Journal Entry (b) Determine the amount of over- or underapplied overhead and state whether it under or overapplied. Prepare the journal entry to eliminate the over- or underar overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts