Question: Problem II-Recording events in a horizontal statements model ents in a horizontal statements model 30 Points 1. Smith Company was started on company experienced the

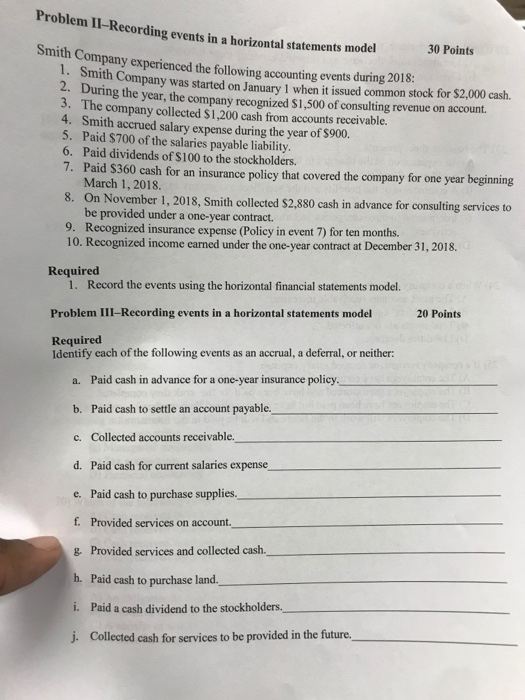

Problem II-Recording events in a horizontal statements model ents in a horizontal statements model 30 Points 1. Smith Company was started on company experienced the following accounting events during 2018: company was started on January 1 when it issued common stock for $2,000 cash. During the year, the company recognized $1,500 of consulting revenue on account. 3. The company collected $1,200 cash from accounts receivable. 4. Smith accrued salary expense during the year of $900. 5. Paid $700 of the salaries payable liability. 6. Paid dividends of $100 to the stockholders. 7. Paid $360 cash for an insurance policy that covered the company for one year beginning March 1, 2018 8. On November 1, 2018, Smith collected $2.880 cash in advance for consulting services to be provided under a one-year contract. 9. Recognized insurance expense (Policy in event 7) for ten months. 10. Recognized income earned under the one-year contract at December 31, 2018. Required 1. Record the events using the horizontal financial statements model Problem III-Recording events in a horizontal statements model 20 Points Required Identify each of the following events as an accrual, a deferral, or neither: a. Paid cash in advance for a one-year insurance policy. b. Paid cash to settle an account payable. c. Collected accounts receivable. d. Paid cash for current salaries expense e. Paid cash to purchase supplies. f. Provided services on account. g. Provided services and collected cash. h. Paid cash to purchase land._ i. Paid a cash dividend to the stockholders. j. Collected cash for services to be provided in the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts