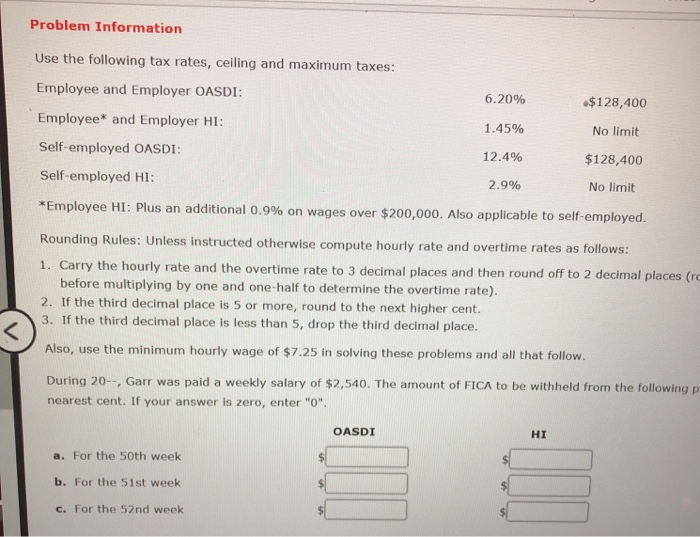

Question: Problem Information Use the following tax rates, ceiling and maximum taxes: Employee and Employer OASDI: 6.20% $128,400 Employee* and Employer HI: 1.45% No limit Self-employed

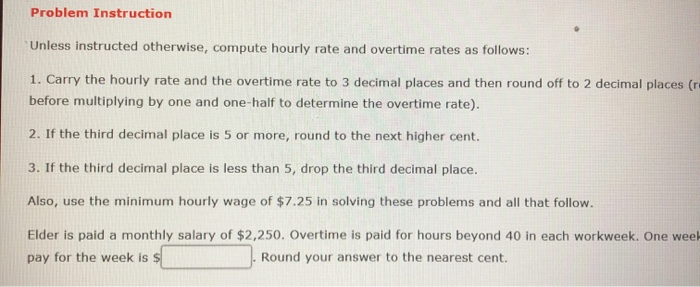

Problem Information Use the following tax rates, ceiling and maximum taxes: Employee and Employer OASDI: 6.20% $128,400 Employee* and Employer HI: 1.45% No limit Self-employed OASDI: 12.4% $128,400 Self-employed HI: 2.9% No limit *Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed. Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows: 1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimal places (rc before multiplying by one and one-half to determine the overtime rate). 2. If the third decimal place is 5 or more, round to the next higher cent. 3. If the third decimal place is less than 5, drop the third decimal place. Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow. During 20--, Garr was paid a weekly salary of $2,540. The amount of FICA to be withheld from the following p nearest cent. If your answ is zero, enter "0". OASDI HI a. For the 50th week b. For the 51st week c. For the 52nd week Problem Instruction Unless instructed otherwise, compute hourly rate and overtime rates as follows: 1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimal places (r before multiplying by one and one-half to determine the overtime rate). 2. If the third decimal place is 5 or more, round to the next higher cent. 3. If the third decimal place is less than 5, drop the third decimal place. the minimum hourly wage of $7.25 in solving these problems and all that follow. Also, use Elder is paid a monthly salary of $2,250. Overtime is paid for hours beyond 40 in each workweek. One week pay for the week is $ Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts