Question: Problem is solved. Just explain and calculate how did you calculate NPV CASH FLOWS NUMBERS WHICH IS GIVEN IN THE LAST TABLE. I hive already

Problem is solved. Just explain and calculate how did you calculate NPV CASH FLOWS NUMBERS WHICH IS GIVEN IN THE LAST TABLE.

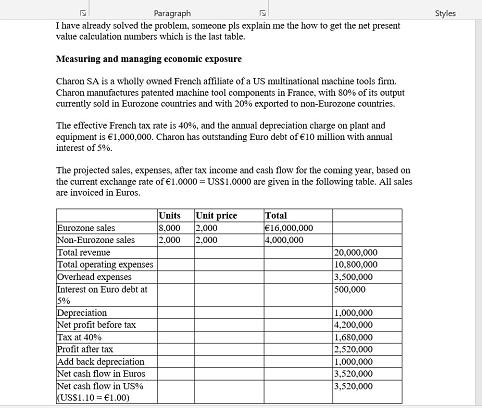

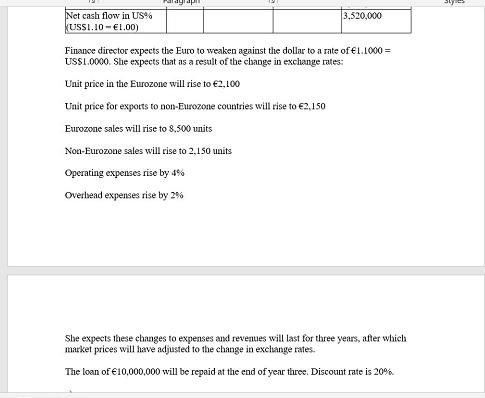

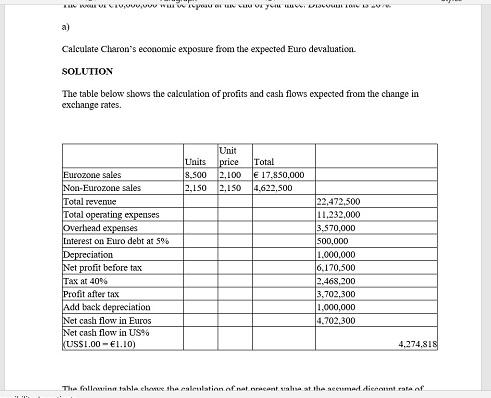

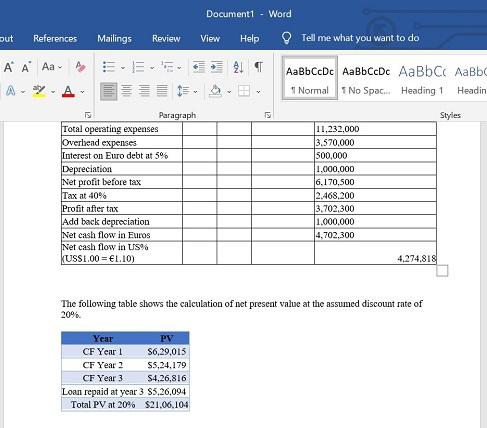

I hive already solved the problem, someone pls explain me the how to get the net present value calculation numbers which is the last table. Measuring and managing cconomic exposure Charou SA is a wholly owned French affiliate of a US multinational machine tools firm. Charon manufactures patented machine tool components in France, with 80% of its output curreatly sold in Eurozone countries and with 202% exported to non-Eusozone countries. The effective French tax rate is 40%, and the annual depreciation charge on plant and equipment is 1,000.000. Charon has outstanding Euro debt of 10 million with annual interest of 50% The projected sales, expenses, after tax income and cash flow fos the coming year, based on the current exclange rate of 1.0000= USS 1,0000 are given in the following table. All sales are invoiced in Euros. Finance director expects the Euro to weaken against the dollar to a rate of 1.1000= USS1,0000. She expects that as a resalt of the clange in exchange rates: Unit price in the Eurozone will rise to e2,100 Uait price for exports to non-Eurozone countries will rise to e2,150 Earozone soles will rise to 8,500 units Non-Eurozone sales will rise to 2,150 units Operating expenses rise by 4% Overlsead expenses rise by 2% She expects these chazges to expenses and revenues will last for three years, after which market poices will have adjusted to the change in exclange rates. The loan of 10,000,000 will be repaid at the end of year three. Discount rate is 20%. ) Calculate Charon's economic exposure from the expected Euro devaluation. SOLUTION The table below shows the calculation of profits and cash flows expected from the change in exchange rates. The following table shows the calculation of net present value at the assumed discount rate of 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts