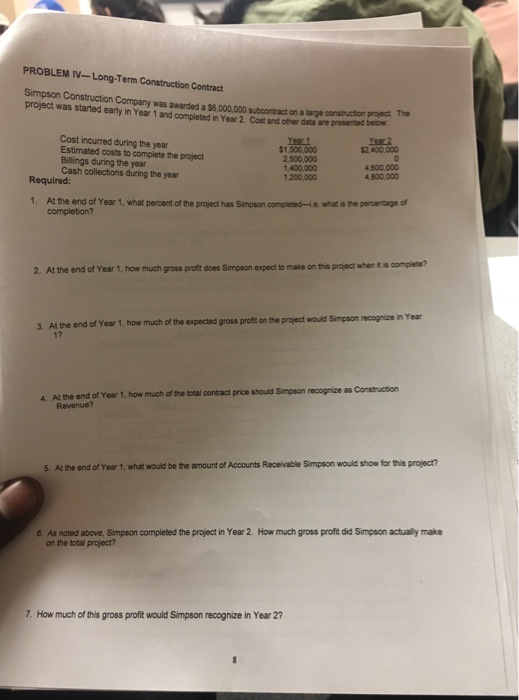

Question: PROBLEM IV-Long-Term Construction Contract Simpson Construction project was started early in Year 1 and completed in Year 2 Cost and other data are presented beo

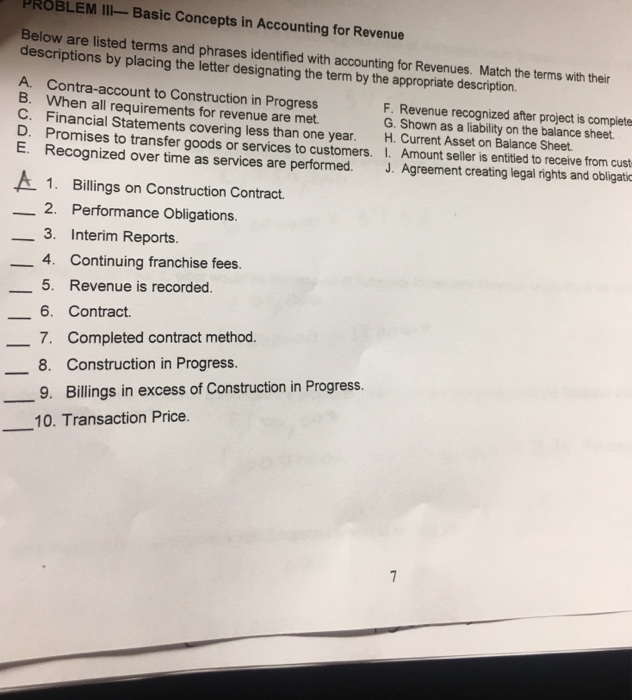

PROBLEM IV-Long-Term Construction Contract Simpson Construction project was started early in Year 1 and completed in Year 2 Cost and other data are presented beo Company was awarded a $6.000,000 subcontract on a large construction project The Cost incurred during the year Estimated costs to complete the project Billings during the year Cash collections during the year Year 1 $1,500,000 2500,000 1,400,000 1.200,000 4.500.000 4 800.000 Required: 1. Atthe end of Year 1.what percent ofthe project has Simpson completed-ewhet the pretage of 2. At the end of Year 1, how much gross proft does Simpson expect to make on this project when t is compiete? 3 Ae end of Year1 how much of the expected gross prot on te project would Simpson mecognice in Year 17 4. At the end of Year 1, how much of the total contract price should Simpson recognize as Construction Revenue? 5. At the end of Year 1, what would be the amount of Accounts Receivable Simpson would show for this project? 6. As noted above, Simpson completed the project in Year 2. How much gross profit did Simpson actualy make on the total project? 7. How much of this gross profit would Simpson recognize in Year 2? PROBLEM IIl-Basic Concepts in Accounting for Revenue are listed terms and phrases identified with accounting for Revenues. Match the terms with their descriptions by placing the letter designating the term by the appropriate description. A. Contra-account to Construction in Progress B. When all requirements for revenue are met. C. Financial Statements F. Revenue recognized after project is complete G. Shown as a liability on the balance sheet H. Current Asset on Balance Sheet covering less than one year. D. Promises to transfer goods or services to customers. Amount seller is entitied to receive from cust E. Recognized over time as services are performed. J. Agreement creating legal rights and obligatio 1, Billings on Construction Contract. 2. Performance Obligations. 3. Interim Reports. 4. Continuing franchise fees. 5. Revenue is recorded. 6. Contract. 7. Completed contract method 8. Construction in Progress. -9. Billings in excess of Construction in Progress. 10. Transaction Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts