Question: Problem l A firm has analyzed three potential projects and listed the estimated cash flows in Table 1 below. Please calculate the NPV and IRR

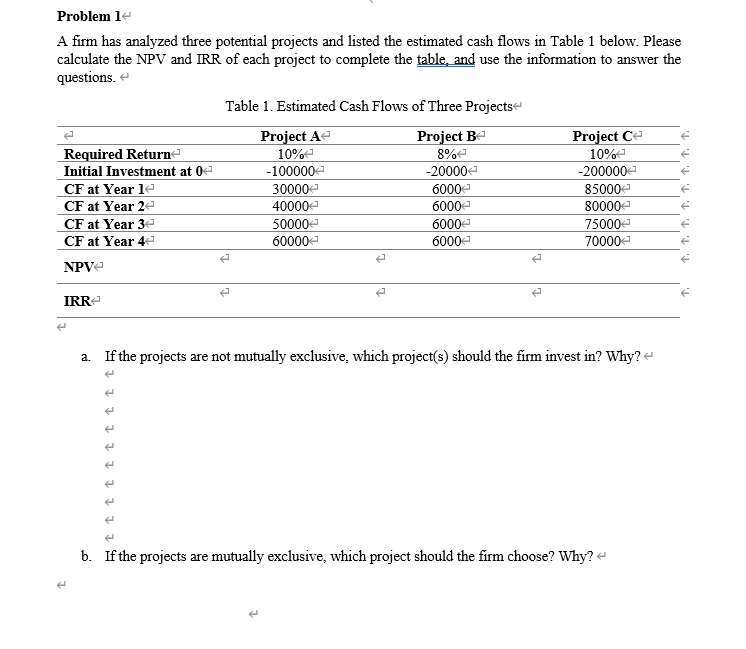

Problem l A firm has analyzed three potential projects and listed the estimated cash flows in Table 1 below. Please calculate the NPV and IRR of each project to complete the table and use the information to answer the questions. Table 1. Estimated Cash Flows of Three Projects Project A Project B Project C Required Return 10% 8% 10% Initial Investment at 04 -100000 -20000 -200000 CF at Year 12 30000 85000 CF at Year 2 40000 6000 80000 CF at Year 34 50000 6000 75000 CF at Year 4 60000 6000 70000 NPV 6000 1. T. 1. 1. T. 1. T. 1. IRR a. If the projects are not mutually exclusive, which project(s) should the firm invest in? Why? tttt b. If the projects are mutually exclusive, which project should the firm choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts