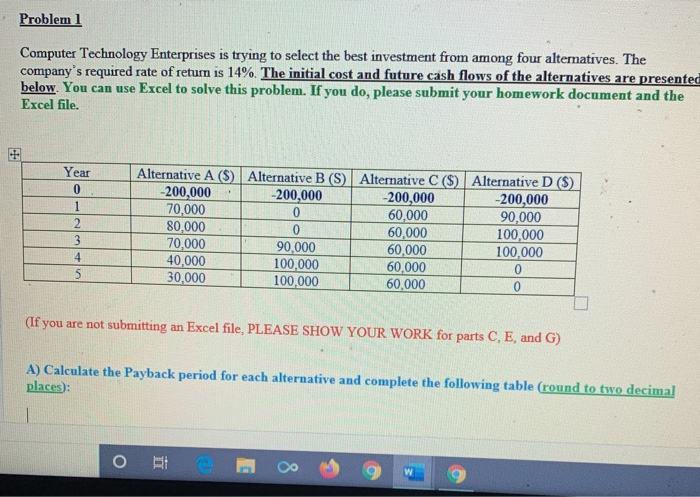

Question: Problem l Computer Technology Enterprises is trying to select the best investment from among four alternatives. The company's required rate of return is 14%. The

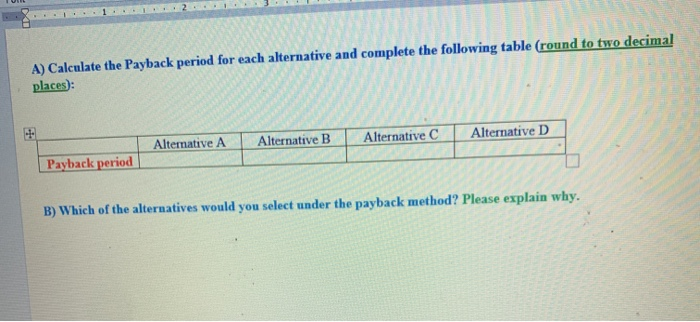

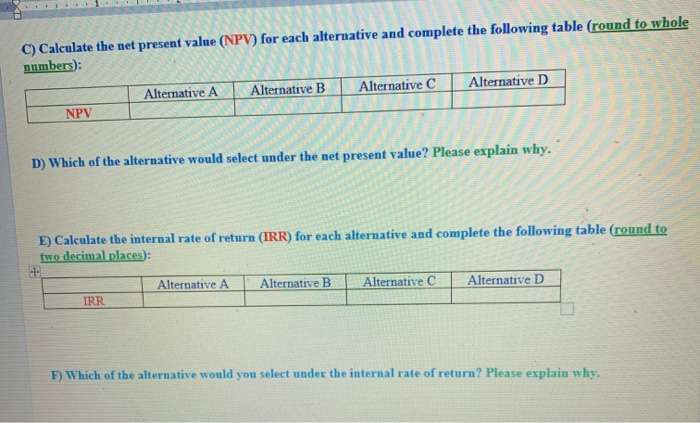

Problem l Computer Technology Enterprises is trying to select the best investment from among four alternatives. The company's required rate of return is 14%. The initial cost and future cash flows of the alternatives are presented below. You can use Excel to solve this problem. If you do, please submit your homework document and the Excel file. Year 0. 1 Alternative A (S) Alternative B (S) -200,000 - 200,000 70,0000 80.000 0 90,000 40.000 100.000 30,000 100,000 Alternative C($) Alternative D ($) -200,000 -200,000 60,000 90,000 60,000 100,000 60,000 100,000 60.000 60.000 (If you are not submitting an Excel file, PLEASE SHOW YOUR WORK for parts C, E, and G) A) Calculate the Payback period for each alternative and complete the following table (round to two decimal places): O OO 9 w A) Calculate the Payback period for each alternative and complete the following table (round to two decimal places): Alternative C Alternative D Alternative A Alternative B Payback period B) Which of the alternatives would you select under the payback method? Please explain why, C) Calculate the net present value (NPV) for each alternative and complete the following table (round to whole numbers): Alternative A Alternative B Alternative Alternative D I NPV D) Which of the alternative would select under the net present value? Please explain why. E) Calculate the internal rate of return (IRR) for each alternative and complete the following table (round to two decimal places): . Alternative A Alternative B Alternative Alternative D IRR F) Which of the alternative would you select under the internal rate of return? Please explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts