Question: Problem M3 (11 points) I am considering purchasing a new golf ball manufacturing machine The total installed cost of this lovely piece of equipment is

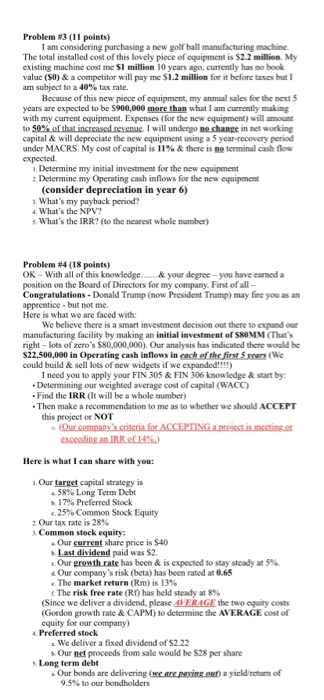

Problem M3 (11 points) I am considering purchasing a new golf ball manufacturing machine The total installed cost of this lovely piece of equipment is $2.2 million. My existing machine cost me Si million 10 years ago, currently has no book value (S0) & a competitor will pay me $1.2 million for it before taxes but I am subject to a 40% tax rate. Because of this new piece of equipment, my annual sales for the next 5 years are expected to be $900.000 more than what I am currently making with my current equipment. Expenses (for the new equipment) will amount to 50% of that increased revenue, I will under ne change in networking capital & will depreciate the new equipment using a 5 year-recovery period under MACRS. My cost of capital is 11% & there is no terminal cash flow expected Determine my initial investment for the new equipment 2. Determine my Operating cash inflows for the new equipment (consider depreciation in year 6) 3. What's my payback period? 4. What's the NPV? What's the IRR? (to the nearest whole number) Problem #4 (18 points) OK-With all of this knowledge.....& your degree - you have earned a position on the Board of Directors for my company. First of all- Congratulations - Donald Trump (now President Trump) may fire you as an apprentice - but not me, Here is what we are faced with: We believe there is a smart investment decision out there to expand our manufacturing facility by making an initial investment of SOMM (That's right-lots of zero's $80.000.000). Our analysis has indicated there would be $22.500.000 in Operating cash inflows in cochef the first 5 years (Wie could build & sell lots of new widgets if we expanded!!!!) I need you to apply your FIN 305 & FIN 306 knowledge & start by Determining our weighted average cost of capital (WACC) . Find the IRR it will be a whole number) . Then make a recommendation to me as to whether we should ACCEPT this project or NOT (Our company's criteria for ACCEPTING a project is meeting er exceeding an IRR of 1490) Here is what I can share with you: 1. Our target capital strategy is 2.58% Long Term Debt 17% Preferred Stock 25% Common Stock Equity 2 Our tax rate is 28% Commen stock equity: Our current share price is $40 Last dividend paid was S2 c. Our growth rate has been & is expected to stay steady at 5% Our company's risk (beta) has been rated at 0.65 The market return (Rm) is 13% 1. The risk free rate (RI) has held steady at 8% (Since we deliver a dividend, please VERGF the two equity costs (Gordon growth rate & CAPM) to determine the AVERAGE cost of equity for our company) 4. Preferred stock . We deliver a fixed dividend of S2.22 Our net proceeds from sale would be $28 per share s Long term debt Our bonds are delivering (we are powing on a yicld return of 9.5% to our bondholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts