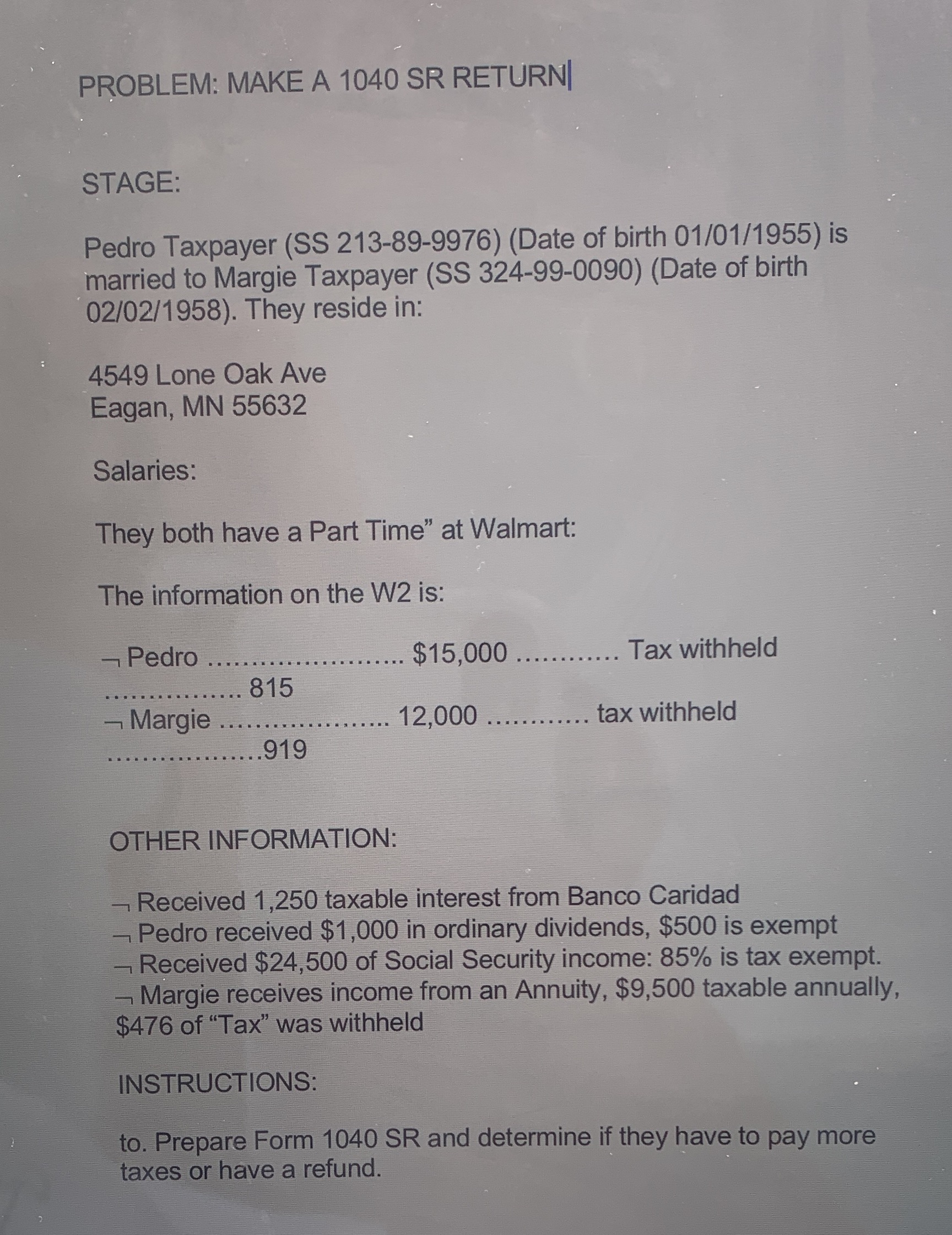

Question: PROBLEM: MAKE A 1040 SR RETURN STAGE: Pedro Taxpayer (SS 213-89-9976) (Date of birth 01/01/1955) is married to Margie Taxpayer (SS 324-99-0090) (Date of birth

PROBLEM: MAKE A 1040 SR RETURN STAGE: Pedro Taxpayer (SS 213-89-9976) (Date of birth 01/01/1955) is married to Margie Taxpayer (SS 324-99-0090) (Date of birth 02/02/1958). They reside in: 4549 Lone Oak Ave Eagan, MN 55632 Salaries: They both have a Part Time" at Walmart: The information on the W2 is: - Pedro . . . . . . $15,000 . . . . . . ... . Tax withheld 815 Margie ...... 12,000 .. . ....... tax withheld 919 OTHER INFORMATION: Received 1,250 taxable interest from Banco Caridad - Pedro received $1,000 in ordinary dividends, $500 is exempt - Received $24,500 of Social Security income: 85% is tax exempt. - Margie receives income from an Annuity, $9,500 taxable annually, $476 of "Tax" was withheld INSTRUCTIONS: to. Prepare Form 1040 SR and determine if they have to pay more taxes or have a refund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts