Question: Problem: Module 1 Textbook Problem 3 Learning Objective: 1-5 Prepare a statement of cash flows All-Star Automotive Company experienced the following accounting events during Year

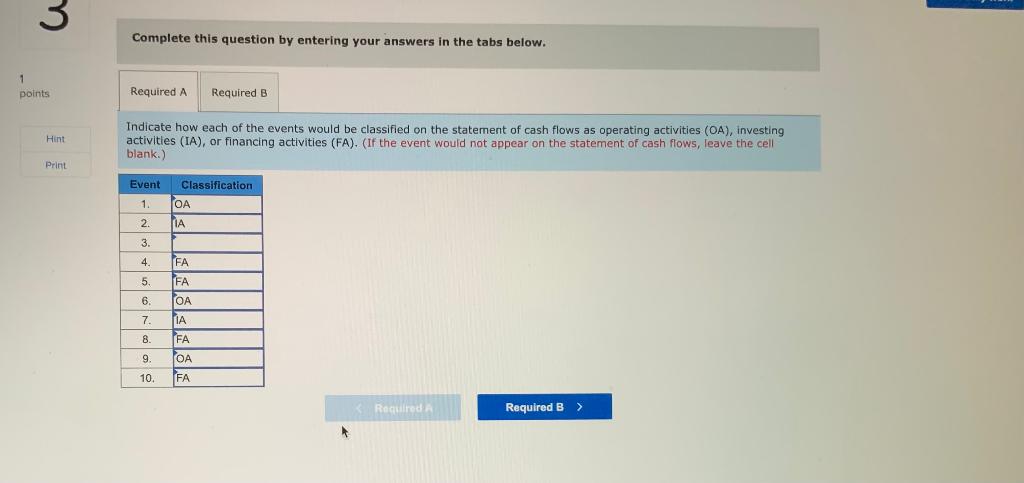

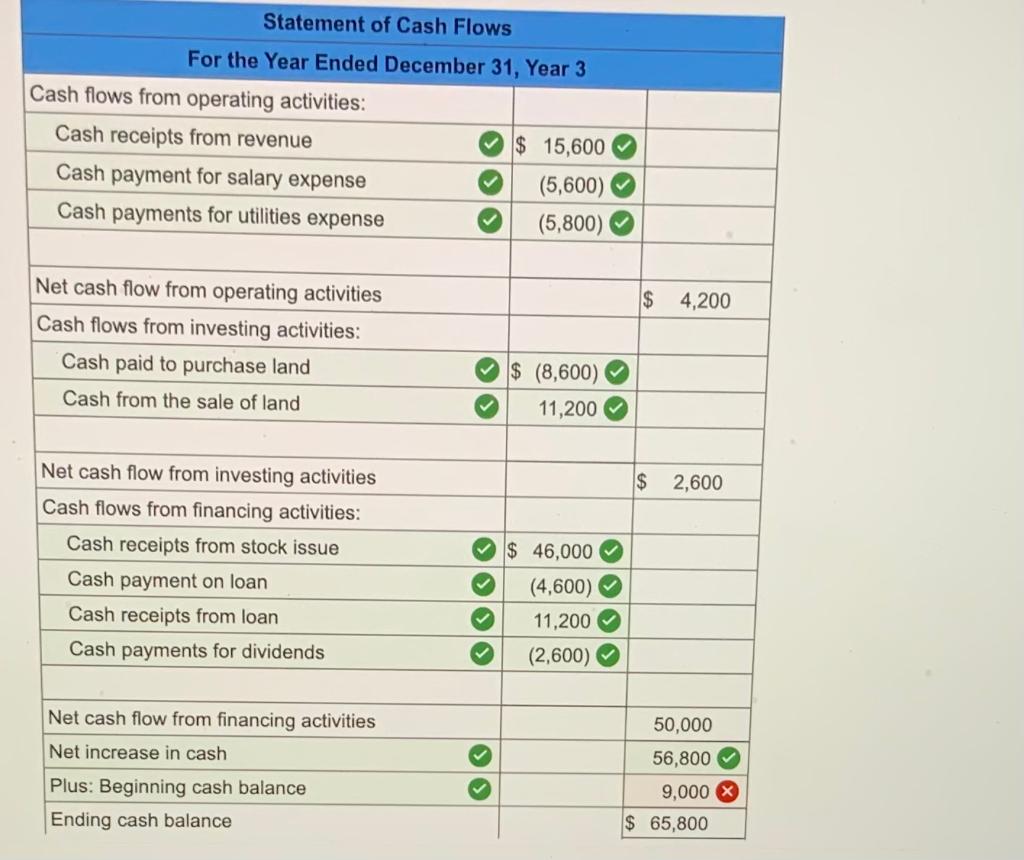

Problem: Module 1 Textbook Problem 3 Learning Objective: 1-5 Prepare a statement of cash flows All-Star Automotive Company experienced the following accounting events during Year 3: 1. Performed services for $15,600 cash. 2. Purchased land for $8,600 cash. 3. Hired an accountant to keep the books. 4. Received $46,000 cash from the issue of common stock. 5. Borrowed $11,200 cash from State Bank. 6. Paid $5,600 cash for salary expense. 7. Sold land for $11,200 cash. 8. Paid $4,600 cash on the loan from State Bank. 9. Paid $5,800 cash for utilities expense. 10. Paid a cash dividend of $2,600 to the stockholders. Required a. Indicate how each of the events would be classified on the statement of cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). b. Prepare a statement of cash flows. Assume All-Star Automotive had a beginning cash balance of $10,600. Complete this question by entering your answers in the tabs below. Required A Required B Indicate how each of the events would be classified on the statement of cash flows as operating activities (OA), investing Complete this question by entering your answers in the tabs below. 1 points Required A Required B Hint Indicate how each of the events would be classified on the statement of cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). (If the event would not appear on the statement of cash flows, leave the cell blank.) Print Event 1. Classification 2. 3. 4 5 FA FA OA 6 7 FA 8. 9 OA 10. FA Required Required B > Statement of Cash Flows For the Year Ended December 31, Year 3 Cash flows from operating activities: Cash receipts from revenue $ 15,600 Cash payment for salary expense (5,600) Cash payments for utilities expense (5,800) $ 4,200 Net cash flow from operating activities Cash flows from investing activities: Cash paid to purchase land Cash from the sale of land $ (8,600) 11,200 $ 2,600 $ 46,000 Net cash flow from investing activities Cash flows from financing activities: Cash receipts from stock issue Cash payment on loan Cash receipts from loan Cash payments for dividends >> OOOO (4,600) 11,200 (2,600) Net cash flow from financing activities Net increase in cash Plus: Beginning cash balance Ending cash balance O 50,000 56,800 9,000 X $ 65,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts