Question: Problem: Module 3 Textbook Problem 13 Learning Objectives: - 3-11 Differentiate between common and preferred stock - 3-12 Show how issuing different classes of stock

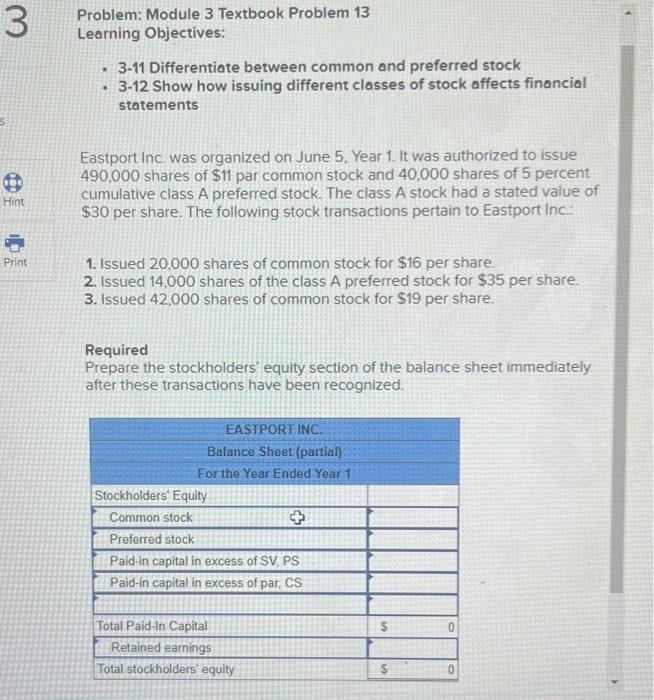

Problem: Module 3 Textbook Problem 13 Learning Objectives: - 3-11 Differentiate between common and preferred stock - 3-12 Show how issuing different classes of stock affects financial statements Eastport Inc. was organized on June 5, Year 1. It was authorized to issue 490,000 shares of $11 par common stock and 40,000 shares of 5 percent cumulative class A preferred stock. The class A stock had a stated value of $30 per share. The following stock transactions pertain to Eastport Inc. 1. Issued 20,000 shares of common stock for $16 per share. 2. Issued 14,000 shares of the class A preferred stock for $35 per share. 3. Issued 42,000 shares of common stock for $19 per share. Required Prepare the stockholders' equity section of the balance sheet immediately after these transactions have been recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts