Question: Problem: Module 3 Textbook Problem 9 Learning Objective: 3-9 Identify the primary characteristics of sole proprietorships, partnerships, and corporations A sole proprietorship was started on

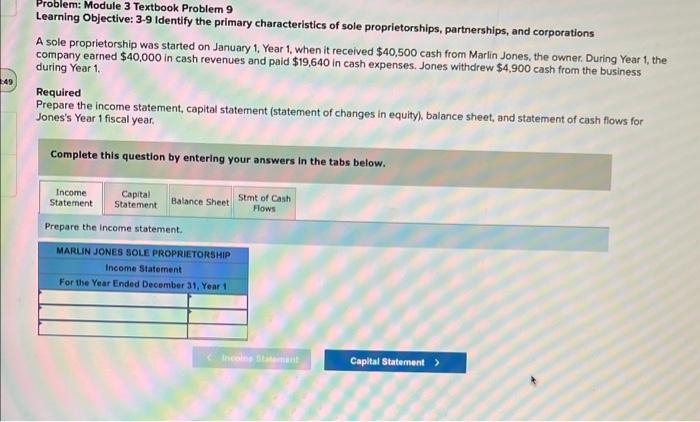

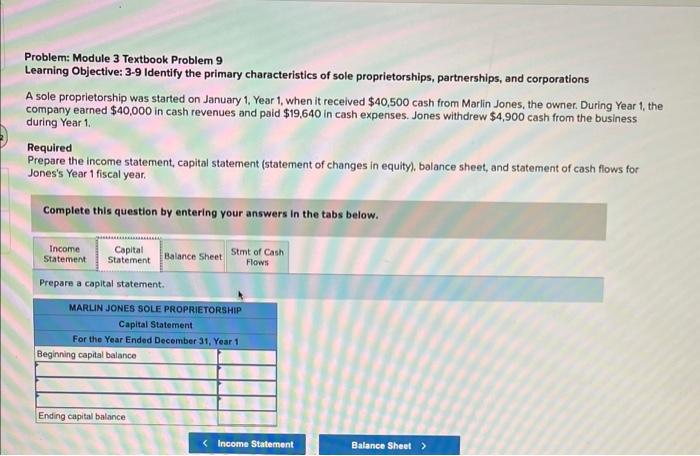

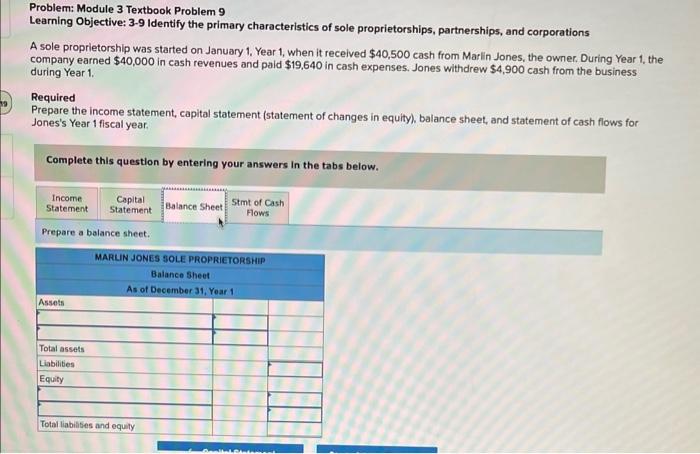

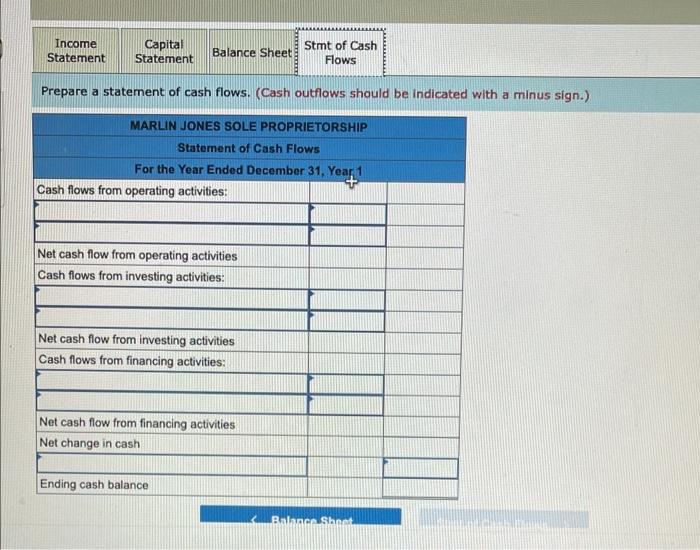

Problem: Module 3 Textbook Problem 9 Learning Objective: 3-9 Identify the primary characteristics of sole proprietorships, partnerships, and corporations A sole proprietorship was started on January 1, Year 1, when it received $40,500 cash from Marlin Jones, the owner. During Year 1, the company earned $40,000 in cash revenues and paid $19,640 in cash expenses. Jones withdrew $4,900 cash from the business during Year 1. Required Prepare the income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones's Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Prepare the income statement. Problem: Module 3 Textbook Problem 9 Learning Objective: 3-9 Identify the primary characteristics of sole proprietorships, partnerships, and corporations A sole proprietorship was started on January 1, Year 1, when it recelved $40,500 cash from Marlin Jones, the owner. During Year 1, the company earned $40,000 in cash revenues and paid $19,640 in cash expenses. Jones withdrew $4,900 cash from the business during Year 1. Required Prepare the income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones's Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Prepare a capital statement. Problem: Module 3 Textbook Problem 9 Learning Objective: 3-9 Identify the primary characteristics of sole proprietorships, partnerships, and corporations A sole proprietorship was started on January 1, Year 1, when it received $40,500 cash from Marlin Jones, the owner. During Year 1, the company earned $40,000 in cash revenues and paid $19,640 in cash expenses. Jones withdrew $4,900 cash from the business during Year 1. Required Prepare the income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones's Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Prepare a balance sheet. Prepare a statement of cash flows. (Cash outflows should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts