Question: Problem: Module 4 Textbook Problem 10 Learning Objectives: . 4-2 Calculate ratios for assessing a company's liquidity 4-3 Calculate ratios for assessing a company's solvency

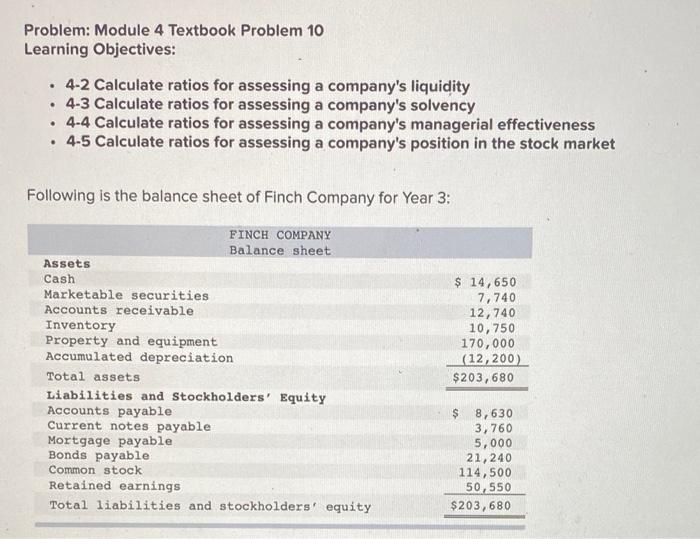

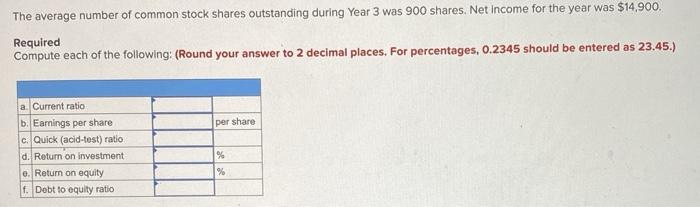

Problem: Module 4 Textbook Problem 10 Learning Objectives: . 4-2 Calculate ratios for assessing a company's liquidity 4-3 Calculate ratios for assessing a company's solvency 4-4 Calculate ratios for assessing a company's managerial effectiveness 4-5 Calculate ratios for assessing a company's position in the stock market . . Following is the balance sheet of Finch Company for Year 3: FINCH COMPANY Balance sheet Assets Cash Marketable securities Accounts receivable Inventory Property and equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Current notes payable Mortgage payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity $ 14,650 7,740 12,740 10,750 170,000 (12,200 $203,680 8,630 3,760 5,000 21,240 114,500 50,550 $203,680 The average number of common stock shares outstanding during Year 3 was 900 shares. Net income for the year was $14,900. Required Compute each of the following: (Round your answer to 2 decimal places. For percentages, 0.2345 should be entered as 23.45.) per share a. Current ratio b. Earnings per share c. Quick (acid-test) ratio d. Return on investment e. Return on equity f. Debt to equity ratio % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts