Question: Problem: Module 4 Textbook Problem 9 Learning Objective: 4.5 Calculate ratios for assessing a company's position in the stock market During Year 3, Benson Corporation

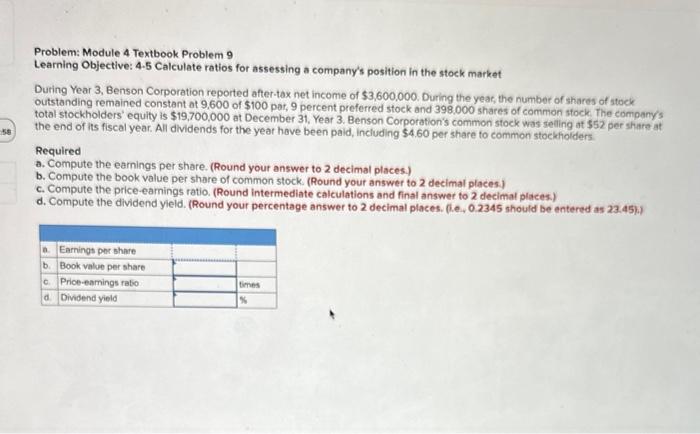

Problem: Module 4 Textbook Problem 9 Learning Objective: 4.5 Calculate ratios for assessing a company's position in the stock market During Year 3, Benson Corporation reported after-tax net income of $3,600,000. During the year, the number of shares of stock outstanding remained constant at 9.600 of $100 pat, 9 percent preferred stock and 398.000 shares of common stock. The company's total stockholders' equity is $19,700,000 at December 31, Year 3. Benson Corporation's common stock was selling at $52 per share at the end of its fiscal year. All dividends for the year hove been paid, including $4.60 per share to commons stockholders. Required a. Compute the earnings per share. (Round your answer to 2 decimal places.) b. Compute the book value per share of common stock. (Round your answer to 2 decimal places) c. Compute the price-eamings ratio. (Round intermediate calculations and final answer to 2 decimal places.) d. Compute the dividend yield. (Round your percentage answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts