Question: Problem: Module 8 Textbook Problem 5 Learning Objectives: 8-3 Prepare a reconciliation of book and taxable income 8-4 Compute the regular tax on corporate taxable

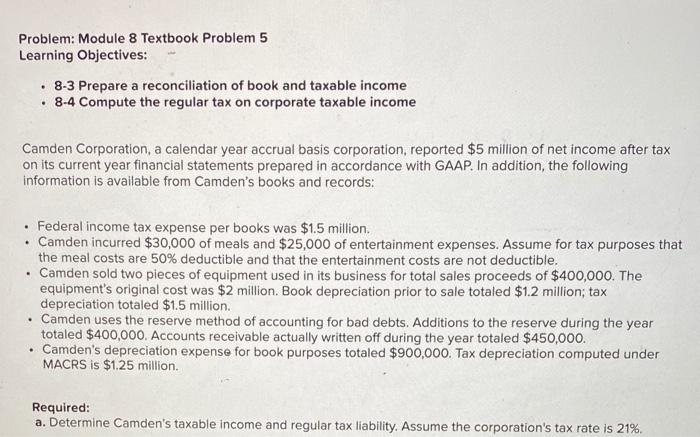

Problem: Module 8 Textbook Problem 5 Learning Objectives: 8-3 Prepare a reconciliation of book and taxable income 8-4 Compute the regular tax on corporate taxable income Camden Corporation, a calendar year accrual basis corporation, reported $5 million of net income after tax on its current year financial statements prepared in accordance with GAAP. In addition, the following information is available from Camden's books and records: . . . Federal income tax expense per books was $1.5 million. Camden incurred $30,000 of meals and $25,000 of entertainment expenses. Assume for tax purposes that the meal costs are 50% deductible and that the entertainment costs are not deductible. Camden sold two pieces of equipment used in its business for total sales proceeds of $400,000. The equipment's original cost was $2 million. Book depreciation prior to sale totaled $1.2 million; tax depreciation totaled $1.5 million. Camden uses the reserve method of accounting for bad debts. Additions to the reserve during the year totaled $400,000. Accounts receivable actually written off during the year totaled $450,000. Camden's depreciation expense for book purposes totaled $900,000. Tax depreciation computed under MACRS is $1.25 million . Required: a. Determine Camden's taxable income and regular tax liability. Assume the corporation's tax rate is 21%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts