Question: Problem: Module 8 Textbook Problem 8 Learning Objective: 8-7 Explain why corporate profits distributed as dividends are double-taxed James, who is in the 35 percent

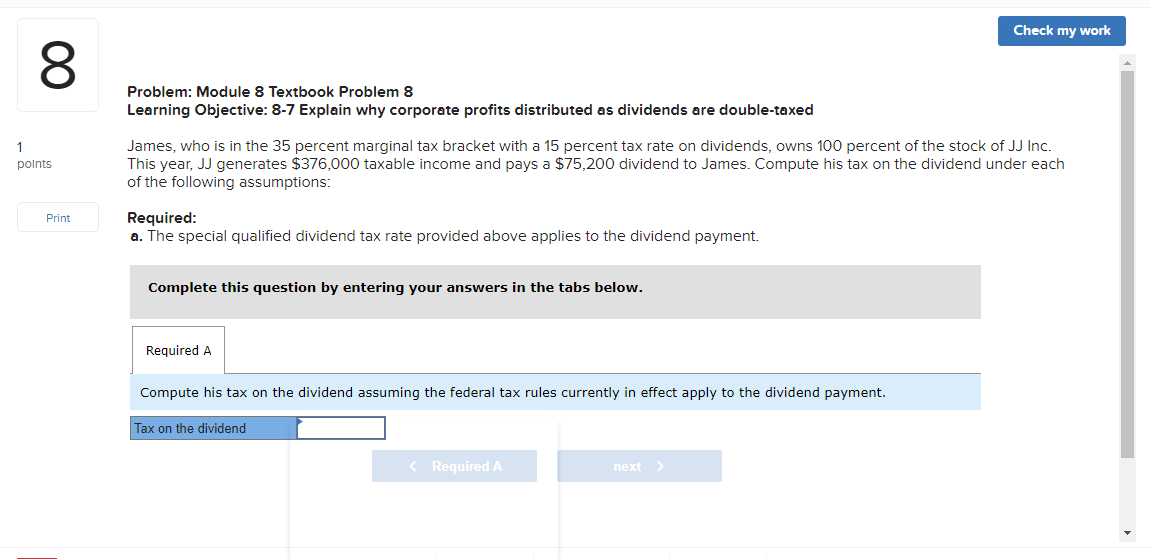

Problem: Module 8 Textbook Problem 8 Learning Objective: 8-7 Explain why corporate profits distributed as dividends are double-taxed James, who is in the 35 percent marginal tax bracket with a 15 percent tax rate on dividends, owns 100 percent of the stock of JJ Inc. This year, JJ generates $376,000 taxable income and pays a $75,200 dividend to James. Compute his tax on the dividend under each of the following assumptions: Required: a. The special qualified dividend tax rate provided above applies to the dividend payment. Complete this question by entering your answers in the tabs below. Compute his tax on the dividend assuming the federal tax rules currently in effect apply to the dividend payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts