Question: Problem: Module 9 Textbook Problem 3 Learning Objective: 9-2 Calculate after-tax cash flow from passthrough entities and taxable corporations Mr. and Mrs. Lund and their

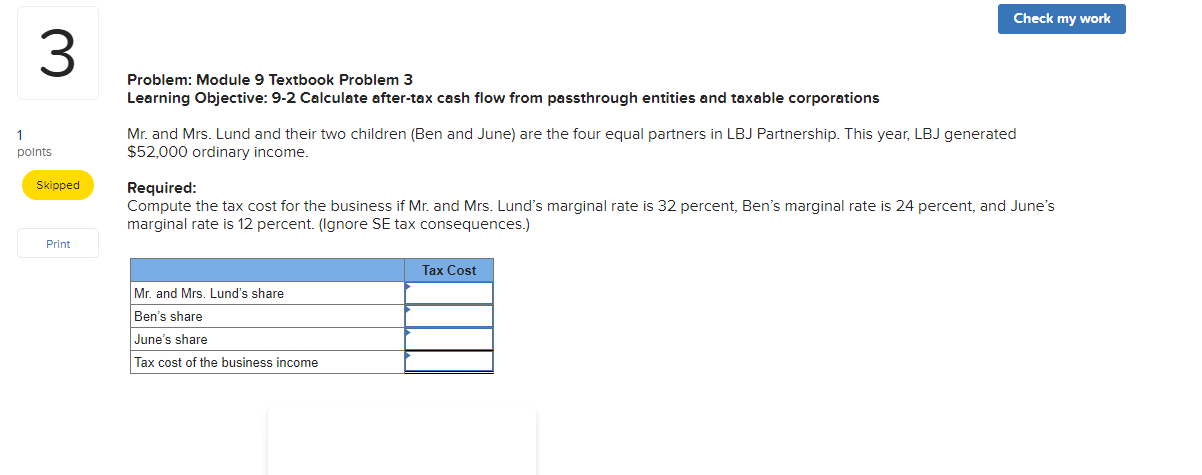

Problem: Module 9 Textbook Problem 3 Learning Objective: 9-2 Calculate after-tax cash flow from passthrough entities and taxable corporations Mr. and Mrs. Lund and their two children (Ben and June) are the four equal partners in LBJ Partnership. This year, LBJ generated $52,000 ordinary income. Required: Compute the tax cost for the business if Mr. and Mrs. Lund's marginal rate is 32 percent, Ben's marginal rate is 24 percent, and June's marginal rate is 12 percent. (Ignore SE tax consequences.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts