Question: Problem: Module 9 Textbook Problem 9 Learning Objective: 9.6 Explain why individuals once again can use corporations as tax shelters Megan operates a housecleaning business

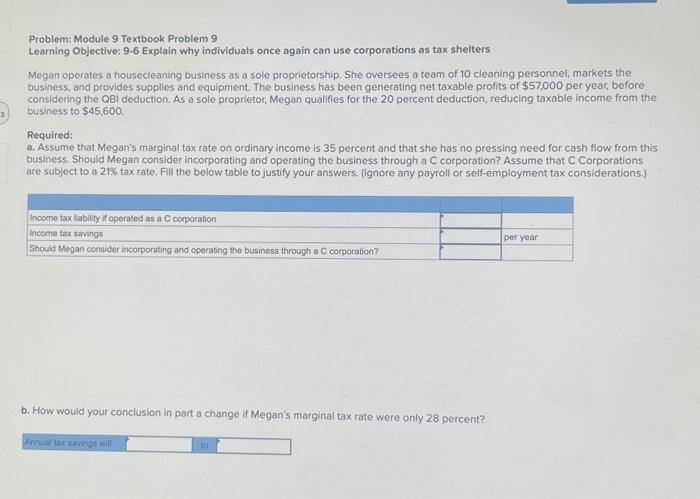

Problem: Module 9 Textbook Problem 9 Learning Objective: 9.6 Explain why individuals once again can use corporations as tax shelters Megan operates a housecleaning business as a sole proprietorship. She oversees a team of 10 cleaning personnel, markets the busines5, and provides supplies and equipment. The business has been generating net taxable profits of $57,000 per year, before considering the OBI deduction. As a sole proprietor, Megan qualifies for the 20 percent deduction, reducing taxable income from the business to $45,600. Required: a. Assume that Megan's marginal tax rate on ordinary income is 35 percent and that she has no pressing need for cash flow from this business. Should Megan consider incorporating and operating the business through a C corporation? Assume that C Corporations are subject to a 21% tax rate. Fill the below table to justify your answers. (Ignore any payroll or self-employment tax considerations,) b. How would your conclusion in part a change if Megan's marginal tax rate were only 28 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts