Question: Problem Mortgage (Setup) - You are purchasing a house that costs $500,000. You plan on making a down payment of $100,000 (i.e., your equity) and

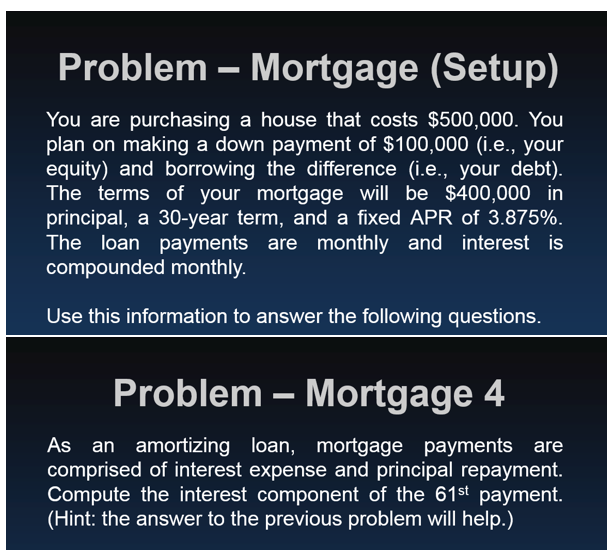

Problem Mortgage (Setup) - You are purchasing a house that costs $500,000. You plan on making a down payment of $100,000 (i.e., your equity) and borrowing the difference (i.e., your debt). The terms of your mortgage will be $400,000 in principal, a 30-year term, and a fixed APR of 3.875%. The loan payments are monthly and interest is compounded monthly. Use this information to answer the following questions. - Problem - Mortgage 4 As an amortizing loan, mortgage payments are comprised of interest expense and principal repayment. Compute the interest component of the 61st payment. (Hint: the answer to the previous problem will help.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts