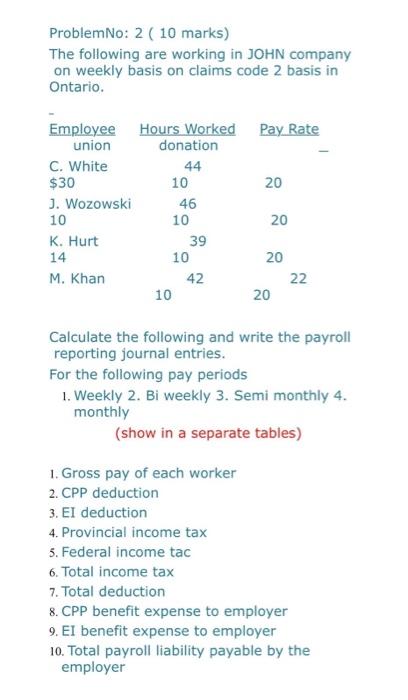

Question: Problem No: 2 ( 10 marks) The following are working in JOHN company on weekly basis on claims code 2 basis in Ontario. Pay Rate

Problem No: 2 ( 10 marks) The following are working in JOHN company on weekly basis on claims code 2 basis in Ontario. Pay Rate Hours Worked donation 44 10 20 Employee union C. White $30 J. Wozowski 10 K. Hurt 14 M. Khan 46 20 10 39 10 42 20 22 20 10 Calculate the following and write the payroll reporting journal entries. For the following pay periods 1. Weekly 2. Bi weekly 3. Semi monthly 4. monthly (show in a separate tables) 1. Gross pay of each worker 2. CPP deduction 3. El deduction 4. Provincial income tax 5. Federal income tac 6. Total income tax 7. Total deduction 8. CPP benefit expense to employer 9. El benefit expense to employer 10. Total payroll liability payable by the employer Problem No: 2 ( 10 marks) The following are working in JOHN company on weekly basis on claims code 2 basis in Ontario. Pay Rate Hours Worked donation 44 10 20 Employee union C. White $30 J. Wozowski 10 K. Hurt 14 M. Khan 46 20 10 39 10 42 20 22 20 10 Calculate the following and write the payroll reporting journal entries. For the following pay periods 1. Weekly 2. Bi weekly 3. Semi monthly 4. monthly (show in a separate tables) 1. Gross pay of each worker 2. CPP deduction 3. El deduction 4. Provincial income tax 5. Federal income tac 6. Total income tax 7. Total deduction 8. CPP benefit expense to employer 9. El benefit expense to employer 10. Total payroll liability payable by the employer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts