Question: Problem Note: For the exercises and problems in this chapter, use the following tax rates: FICAEmployer and employee, 8% of the first $100,000 of earnings

Problem

Note: For the exercises and problems in this chapter, use the following tax rates:

FICAEmployer and employee, 8% of the first $100,000 of earnings per employee per calendar year.

State unemployment4% of the first $8,000 of earnings per employee per calendar year.

Federal unemployment1% of the first $8,000 of earnings per employee per calendar year.

Federal income tax withholding10% of each employees gross earnings, unless otherwise stated.

Employees earnings using hourly and piece-rate methods

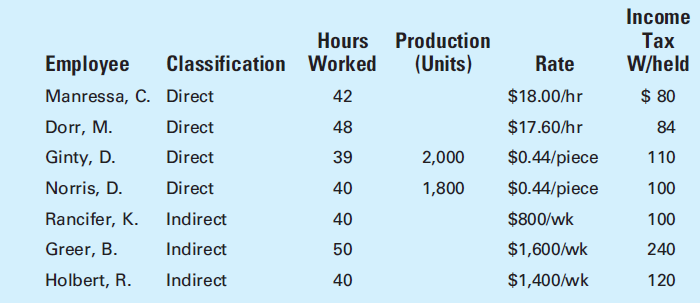

The payroll records of Linda Vista Machining Co. show the following information for the week ended April 17:

Hourly workers are paid time-and-a-half for overtime.

a. Determine the net earnings of each employee.

b. Prepare the journal entries for the following:

1. Recording the payroll.

2. Paying the payroll.

3. Distributing the payroll. (Assume that the overtime premium will be distributed to all jobs worked on during the period.)

4. Recording the employers payroll taxes. (Assume that none of the employees has achieved the maximum wage bases for FICA and unemployment taxes.)

\begin{tabular}{llcccc} Employee & Classification & HoursWorked & Production(Units) & \multicolumn{1}{c}{ Rate } & IncomeTaxW/held \\ Manressa, C. & Direct & 42 & & $18.00/hr & $80 \\ Dorr, M. & Direct & 48 & & $17.60/hr & 84 \\ Ginty, D. & Direct & 39 & 2,000 & $0.44/piece & 110 \\ Norris, D. & Direct & 40 & 1,800 & $0.44/piece & 100 \\ Rancifer, K. & Indirect & 40 & & $800/wk & 100 \\ Greer, B. & Indirect & 50 & & $1,600/wk & 240 \\ Holbert, R. & Indirect & 40 & & $1,400/wk & 120 \end{tabular} \begin{tabular}{llcccc} Employee & Classification & HoursWorked & Production(Units) & \multicolumn{1}{c}{ Rate } & IncomeTaxW/held \\ Manressa, C. & Direct & 42 & & $18.00/hr & $80 \\ Dorr, M. & Direct & 48 & & $17.60/hr & 84 \\ Ginty, D. & Direct & 39 & 2,000 & $0.44/piece & 110 \\ Norris, D. & Direct & 40 & 1,800 & $0.44/piece & 100 \\ Rancifer, K. & Indirect & 40 & & $800/wk & 100 \\ Greer, B. & Indirect & 50 & & $1,600/wk & 240 \\ Holbert, R. & Indirect & 40 & & $1,400/wk & 120 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts