Question: problem number 5 Problems 657 brum Hee where ple here that the Hep per year 1211 if she options propriate what ne the optimiste conservative

problem number 5

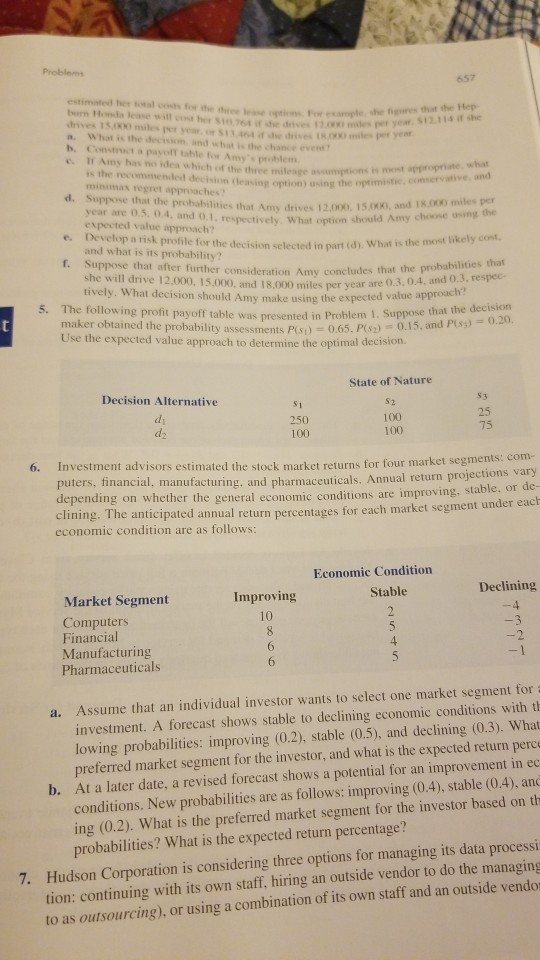

Problems 657 brum Hee where ple here that the Hep per year 1211 if she options propriate what ne the optimiste conservative and that Amy drives 12.000), 15 and 18.000 miles per respectively. What option should Amy choose the a. What is the decision, and what is the chance event? b. Construct payoff table for Amy problem 11 my hand is the recommended decision deving options in the pum minat regret approaches d. Suppose that the probabilities that Amy drives 12.000 15.00 year are 0.5 0.4 and 0.1. respectively What option should expected value approach? e. Develop a risk file for the party. What is the and what is its probability? Suppose that after further consideration Amy concludes she will drive 12.000. 15.000 and 18.000 miles per year are 0.3.0. tively. What decision should Amy make using the expected value appro 5. The following profit payoff table was presented in Problem is ) = 0.65, PC ) maker obtained the probability assessments P 0.13 Use the expected value approach to determine the optimal decision. selected in part (d). What is the most likely cost ther consideration Amy concludes that the probabilities that ad 18,000 miles per year are 0.3.0.4. and 0.3, respec- payoff table was presented in Problem 1. Suppose that the decision 065. PC) - 0.15. and PC) = 0.20 State of Nature Decision Alternative 250 100 100 100 6. Investment advisors estimated the stock market returns for four market segments. puters, financial, manufacturing, and pharmaceuticals. Annual return projections vary depending on whether the general economic conditions are improving, stable. Or ac clining. The anticipated annual return percentages for each market segment under och economic condition are as follows: Economic Condition Stable Declining Improving 10 -3 Market Segment Computers Financial Manufacturing Pharmaceuticals 6 a. Assume that an individual investor wants to select one market segment for investment. A forecast shows stable to declining economic conditions with th lowing probabilities: improving (0.2), stable (0.5), and declining (0.3). What preferred market segment for the investor, and what is the expected return pere b. At a later date, a revised forecast shows a potential for an improvement in ee conditions. New probabilities are as follows: improving (0.4), stable (0.4), and ing (0.2). What is the preferred market segment for the investor based on th probabilities? What is the expected return percentage? 7. Hudson Corporation is considering three options for managing its data processi tion: continuing with its own staff, hiring an outside vendor to do the managing to as outsourcing), or using a combination of its own staff and an outside vendoStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock