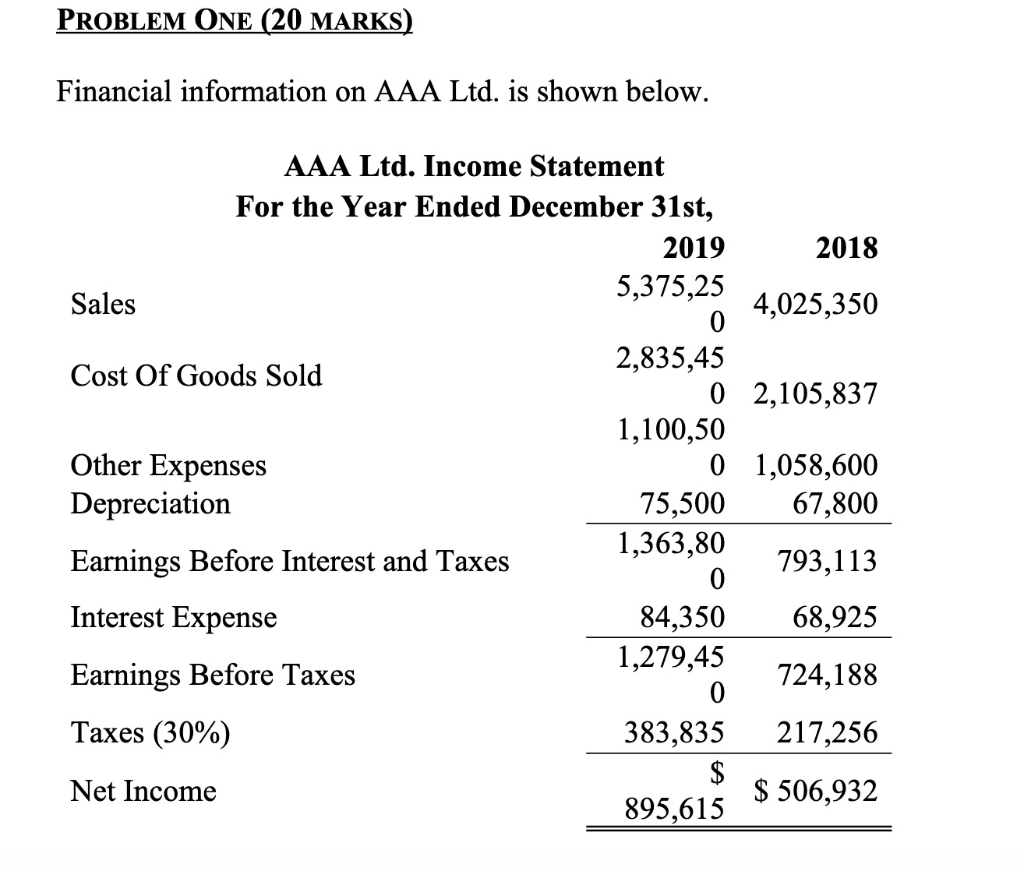

Question: PROBLEM ONE (20 MARKS) Financial information on AAA Ltd. is shown below. AAA Ltd. Income Statement For the Year Ended December 31st, 2019 2018 5,375,25

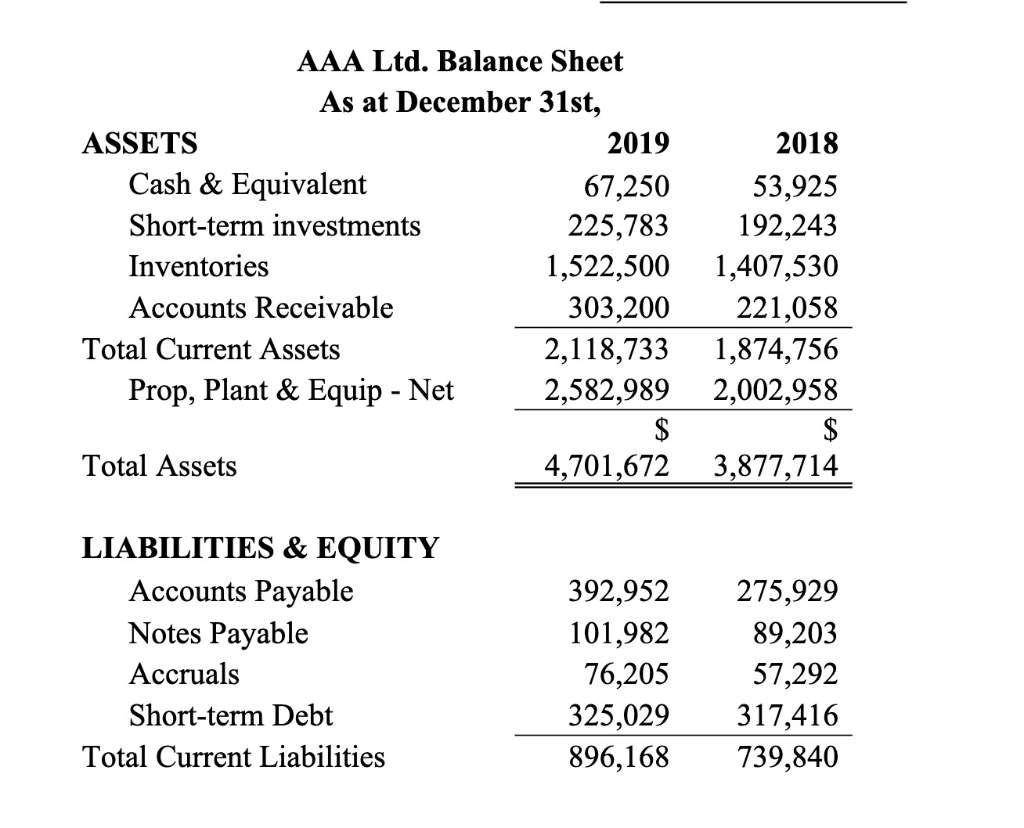

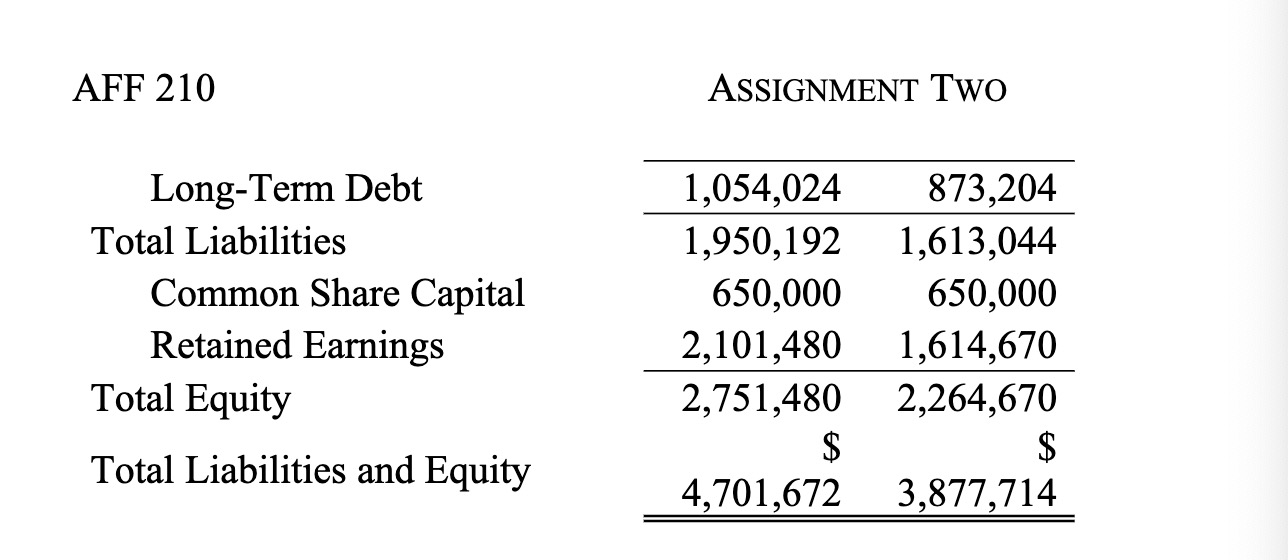

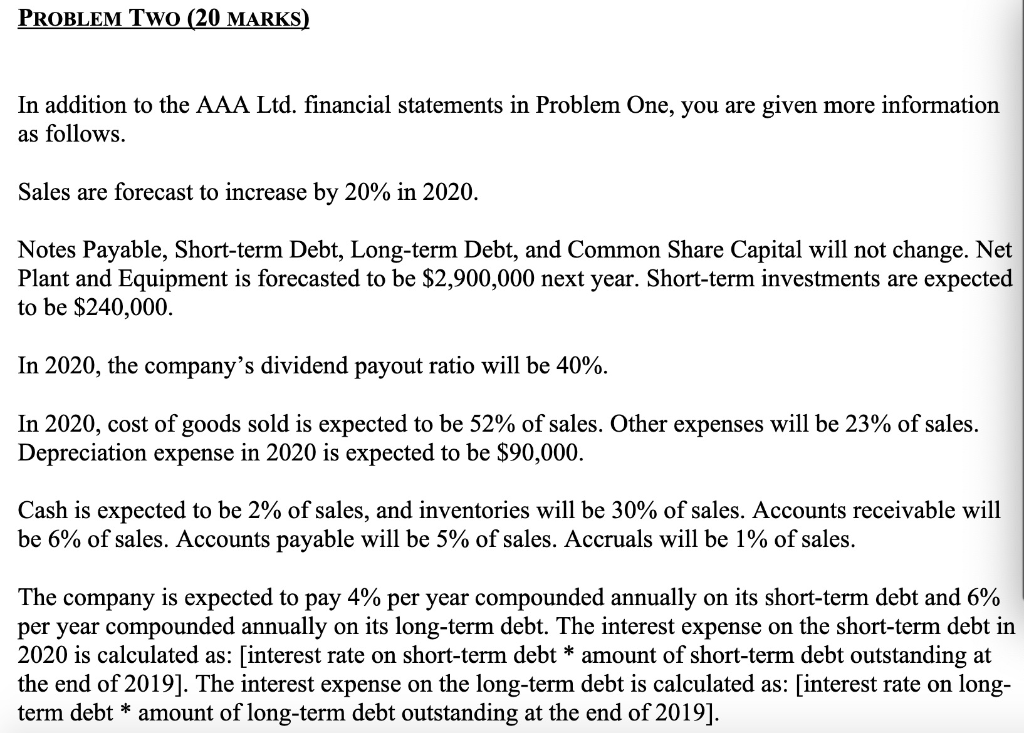

PROBLEM ONE (20 MARKS) Financial information on AAA Ltd. is shown below. AAA Ltd. Income Statement For the Year Ended December 31st, 2019 2018 5,375,25 4.025,350 Sales 0 Cost Of Goods Sold Other Expenses Depreciation Earnings Before Interest and Taxes Interest Expense Earnings Before Taxes Taxes (30%) 2,835,45 0 2,105,837 1,100,50 0 1,058,600 75,500 67,800 1,363,80 793,113 84,350 68,925 1,279,45 724,188 383,835 217,256 Net Income 895,615 $ 506,932 AAA Ltd. Balance Sheet As at December 31st, ASSETS 2019 Cash & Equivalent 67,250 Short-term investments 225,783 Inventories 1,522,500 Accounts Receivable 303,200 Total Current Assets 2,118,733 Prop, Plant & Equip - Net 2,582,989 2018 53,925 192,243 1,407,530 221,058 1,874,756 2,002,958 Total Assets 4,701,672 3,877,714 LIABILITIES & EQUITY Accounts Payable Notes Payable Accruals Short-term Debt Total Current Liabilities 392,952 275,929 101,982 89,203 76,205 57,292 325,029317,416 896,168 739,840 AFF 210 ASSIGNMENT Two Long-Term Debt Total Liabilities Common Share Capital Retained Earnings Total Equity Total Liabilities and Equity 1,054,024 1,950,192 650,000 2,101,480 2,751,480 $ 4,701,672 873,204 1,613,044 650,000 1,614,670 2,264,670 $ 3,877,714 PROBLEM Two (20 MARKS) In addition to the AAA Ltd. financial statements in Problem One, you are given more information as follows. Sales are forecast to increase by 20% in 2020. Notes Payable, Short-term Debt, Long-term Debt, and Common Share Capital will not change. Net Plant and Equipment is forecasted to be $2,900,000 next year. Short-term investments are expected to be $240,000. In 2020, the company's dividend payout ratio will be 40%. In 2020, cost of goods sold is expected to be 52% of sales. Other expenses will be 23% of sales. Depreciation expense in 2020 is expected to be $90,000. Cash is expected to be 2% of sales, and inventories will be 30% of sales. Accounts receivable will be 6% of sales. Accounts payable will be 5% of sales. Accruals will be 1% of sales. ! The company is expected to pay 4% per year compounded annually on its short-term debt and 6% per year compounded annually on its long-term debt. The interest expense on the short-term debt in 2020 is calculated as: [interest rate on short-term debt * amount of short-term debt outstanding at the end of 2019]. The interest expense on the long-term debt is calculated as: [interest rate on long- term debt * amount of long-term debt outstanding at the end of 2019]. The company's tax rate is 30%. Based on the information provided you are to: a) Complete the pro-forma income statement and balance sheet for 2020. b) Calculate the amount of Additional Funds Needed in 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts