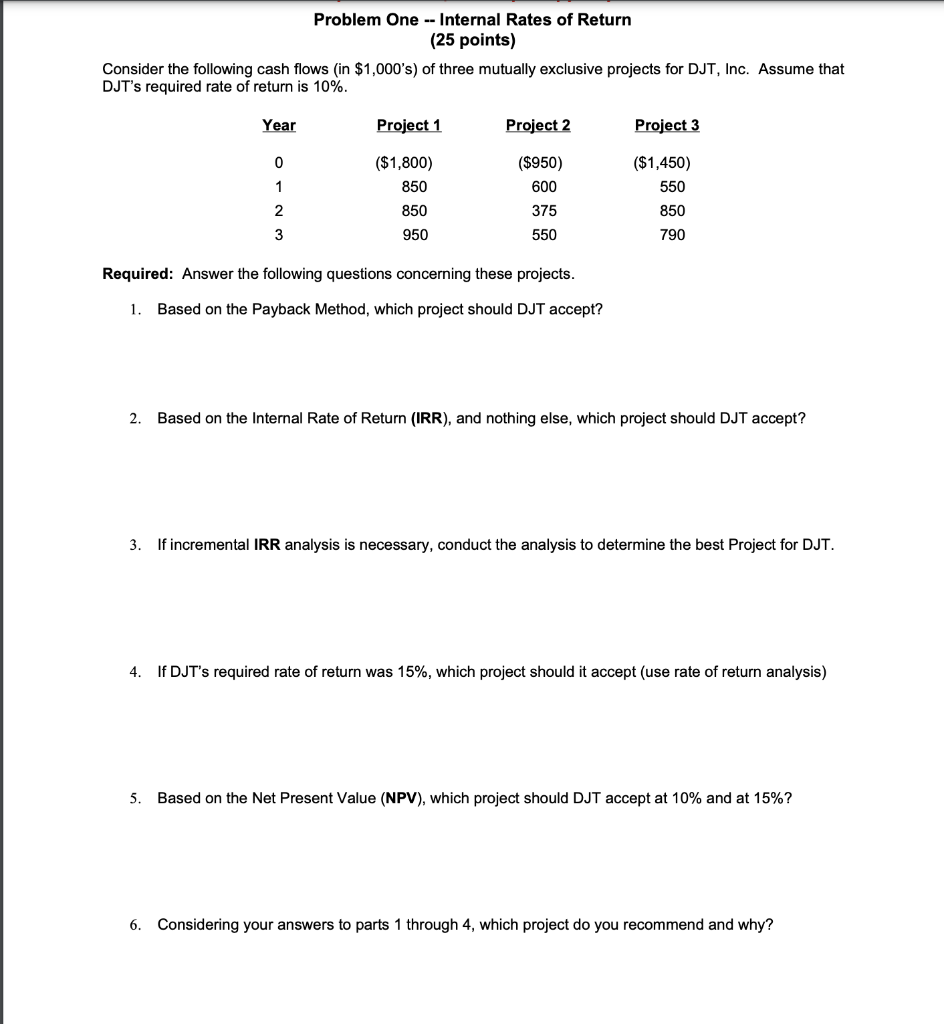

Question: Problem One Internal Rates of Return ( 25 points) Consider the following cash flows (in $1,000 's) of three mutually exclusive projects for DJT, Inc.

Problem One Internal Rates of Return ( 25 points) Consider the following cash flows (in $1,000 's) of three mutually exclusive projects for DJT, Inc. Assume that DJT's required rate of return is 10%. Required: Answer the following questions concerning these projects. 1. Based on the Payback Method, which project should DJT accept? 2. Based on the Internal Rate of Return (IRR), and nothing else, which project should DJT accept? 3. If incremental IRR analysis is necessary, conduct the analysis to determine the best Project for DJT. 4. If DJT's required rate of return was 15%, which project should it accept (use rate of return analysis) 5. Based on the Net Present Value (NPV), which project should DJT accept at 10% and at 15% ? 6. Considering your answers to parts 1 through 4, which project do you recommend and why? Problem One Internal Rates of Return ( 25 points) Consider the following cash flows (in $1,000 's) of three mutually exclusive projects for DJT, Inc. Assume that DJT's required rate of return is 10%. Required: Answer the following questions concerning these projects. 1. Based on the Payback Method, which project should DJT accept? 2. Based on the Internal Rate of Return (IRR), and nothing else, which project should DJT accept? 3. If incremental IRR analysis is necessary, conduct the analysis to determine the best Project for DJT. 4. If DJT's required rate of return was 15%, which project should it accept (use rate of return analysis) 5. Based on the Net Present Value (NPV), which project should DJT accept at 10% and at 15% ? 6. Considering your answers to parts 1 through 4, which project do you recommend and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts