Question: Problem One Use the following data to answer Questions through 14 Fattal Inc. is a pharmaceutical company which is considering the purchase of a new

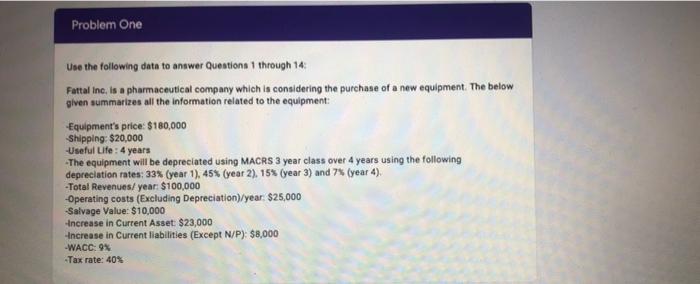

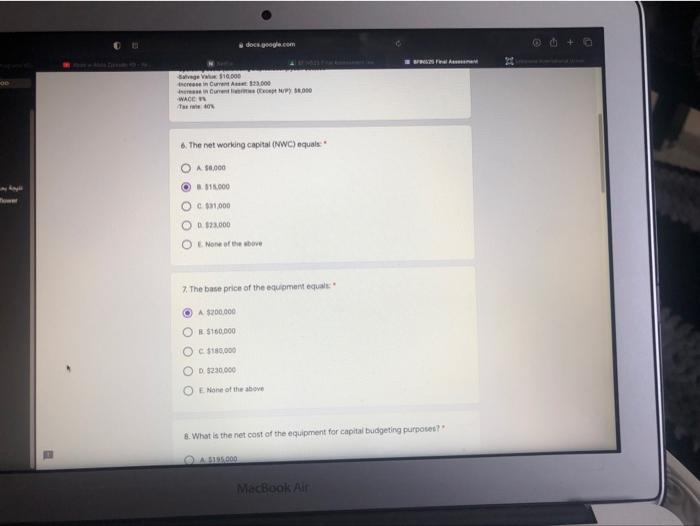

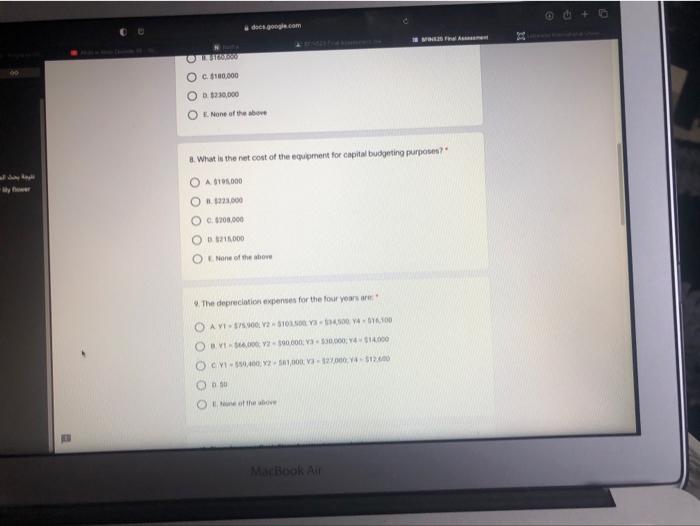

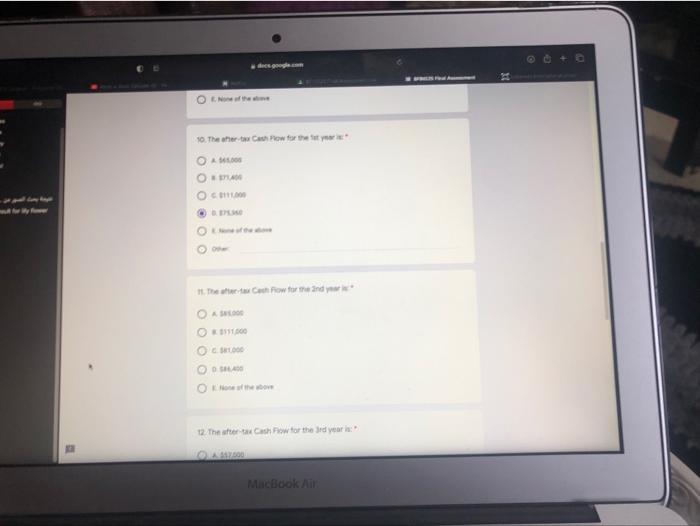

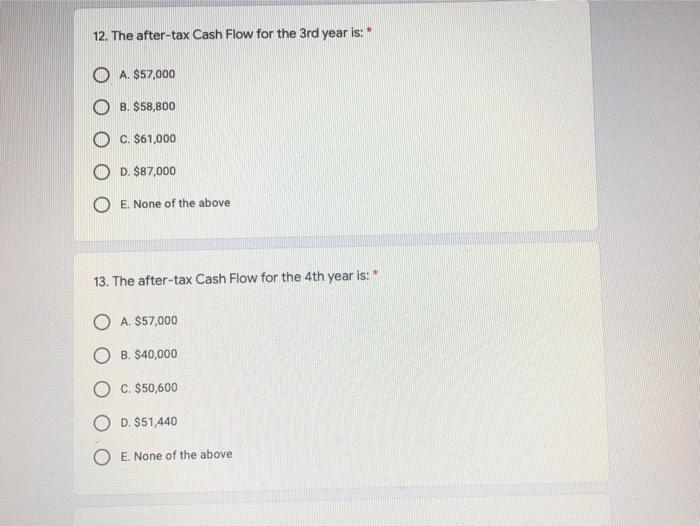

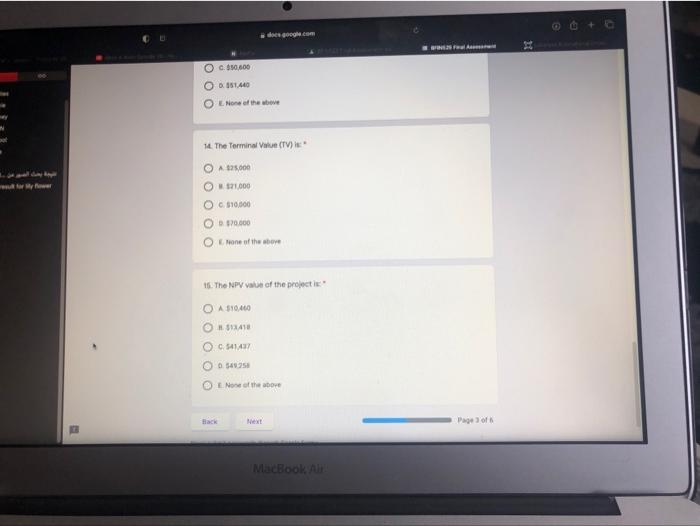

Problem One Use the following data to answer Questions through 14 Fattal Inc. is a pharmaceutical company which is considering the purchase of a new equipment. The below given summarizes all the information related to the equipment: -Equipment's price: $180,000 Shipping: $20,000 Useful Life: 4 years -The equipment will be depreciated using MACRS 3 year class over 4 years using the following depreciation rates: 33% (year 1), 45% (year 2), 15% (year 3) and 7% (year 4) -Total Revenues/ year $100,000 Operating costs (Excluding Depreciation)/year. $25,000 -Salvage Value: $10,000 Increase in Current Asset: $23,000 Increase in Current liabilities (Except N/P): $8,000 -WACC: 9% Tax rate: 40% + docs.google.com FA gewic.000 in Current Aw123.000 Current , WACE Telefon 6. The networking capital (WC) equals A 50.000 O 1.000 @ 1000 O 73.000 O None of the above 7. The base price of the equament equal A $700.000 5160.000 O $180.000 5230.000 E None of the above 8. What is the net cost of the equipment for capital budgeting purposes?" 195.000 MacBook Air doce google.com Final O. C. 100.000 12:10,000 1. None of the shore 8. What is the netcost of the equipment for capital budgeting purpo? O A 10.000 22.000 700.000 11.000 None of the above The depreciation expenses for the four years O AY $5.02.10.1400 YA 1.100 239000 30000 1000 O CY002.501,00 12000 12.00 . On tu of the MacBook Air google.com o EN 10. The her how for the OA OLD O 11. The two row to and yw 11100 DSLR Oo 2. The utterau Cash Fow for the Sed year is: MacBook Air 12. The after-tax Cash Flow for the 3rd year is: O A. $57,000 B. $58,800 O c. $61,000 O D. $87,000 O E. None of the above 13. The after-tax Cash Flow for the 4th year is: O A $57,000 O B. $40,000 O C. $50,600 D. $51,440 O E. None of the above dogo.com O c.150.000 O 0.851.440 O None of the wave 14. The Terminale (TV) A 125.000 wory O $1.000 O 10.000 $70.000 one of the above 16. The NPV value of the project A $10.460 OO $1X413 C 5414 @ Los of the above Hack Pastor MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts