Question: Problem P10-5 (similar to) , Question Help * Jerry Carter's home is currently valued, on a replacement cost basis, at $207,000. When he last checked

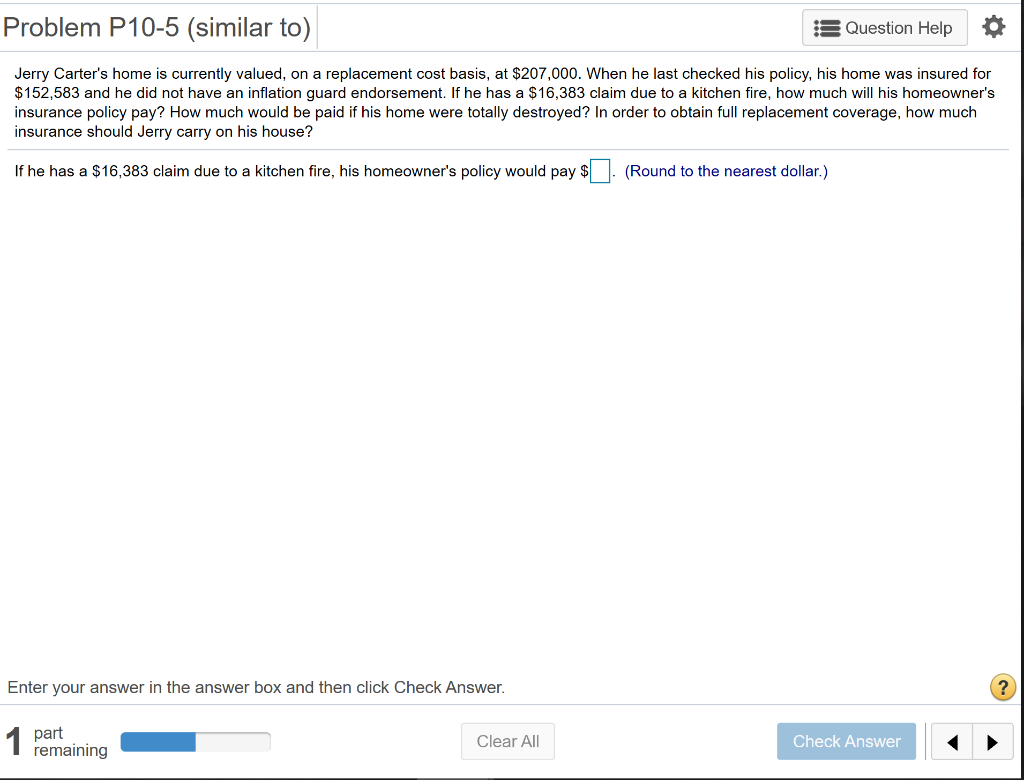

Problem P10-5 (similar to) , Question Help * Jerry Carter's home is currently valued, on a replacement cost basis, at $207,000. When he last checked his policy, his home was insured for $152,583 and he did not have an inflation guard endorsement. If he has a $16,383 claim due to a kitchen fire, how much will his homeowner's insurance policy pay? How much would be paid if his home were totally destroyed? In order to obtain full replacement coverage, how much insurance should Jerry carry on his house? If he has a $16,383 claim due to a kitchen fire, his homeowner's policy woulpay (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer part remaining Clear All Check Answer Problem P10-5 (similar to) , Question Help * Jerry Carter's home is currently valued, on a replacement cost basis, at $207,000. When he last checked his policy, his home was insured for $152,583 and he did not have an inflation guard endorsement. If he has a $16,383 claim due to a kitchen fire, how much will his homeowner's insurance policy pay? How much would be paid if his home were totally destroyed? In order to obtain full replacement coverage, how much insurance should Jerry carry on his house? If he has a $16,383 claim due to a kitchen fire, his homeowner's policy woulpay (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer part remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts