Question: Problem P4-8 (similar to) Question Help Calculate the 2017 total tax for Gordon Geist, a single taxpayer without dependents and no itemtred deductions. He has

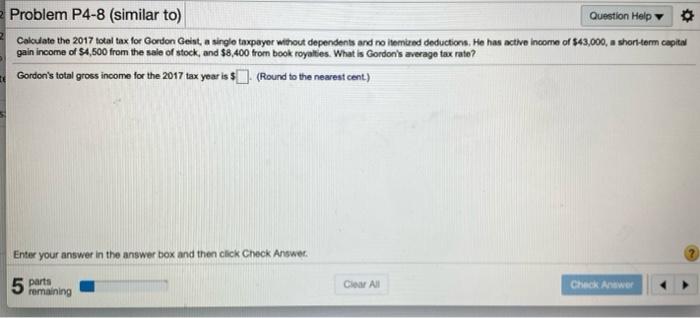

Problem P4-8 (similar to) Question Help Calculate the 2017 total tax for Gordon Geist, a single taxpayer without dependents and no itemtred deductions. He has active income of 543,000, a short-term capital gain income of $4,500 from the sale of stock, and $8,400 from book royalties. What is Gordon's average tax rato? Gordon's total gross income for the 2017 tax year is $]. (Round to the nearest cent) Enter your answer in the answer box and then click Check Answer. 5 parts remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock