Question: Problem P6-8 A. C. Security Inflation Expectation Premium Real Rate of Interest Risk Premium Risk-Free Rate Nominal Rate of Interest A 6% 3% 3% B

| Problem P6-8 | |||||

| A. | C. | ||||

| Security | Inflation Expectation Premium | Real Rate of Interest | Risk Premium | Risk-Free Rate | Nominal Rate of Interest |

| A | 6% | 3% | 3% | ||

| B | 9% | 3% | 2% | ||

| C | 8% | 3% | 2% | ||

| D | 5% | 3% | 4% | ||

| E | 11% | 3% | 1% | ||

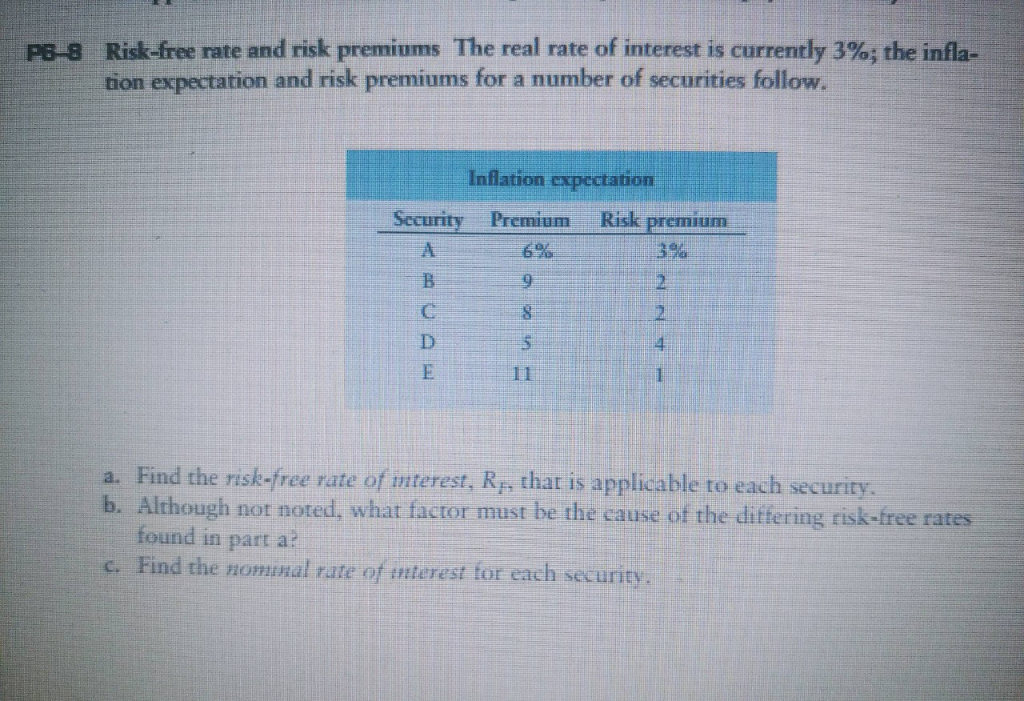

Risk-free rate and risk premiums The real rate of interest is currently 3%; the infla- tion expectation and risk premiums for a number of securities follow. PB Inflation expectation Security Premium Risk premium 1 a. Find the risk-free rate of interest, R, that is applicable to each security b. Although not noted, what factor must be the cause of the ditfering risk-free rates found in part a? c. Find the nominal rate of interest for each security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts