Question: Problem - Please answer the following questions on the Application of the theory of constraints in Job Shops. (Show all work) Process A Process B

Problem - Please answer the following questions on the Application of the theory of constraints in Job Shops. (Show all work)

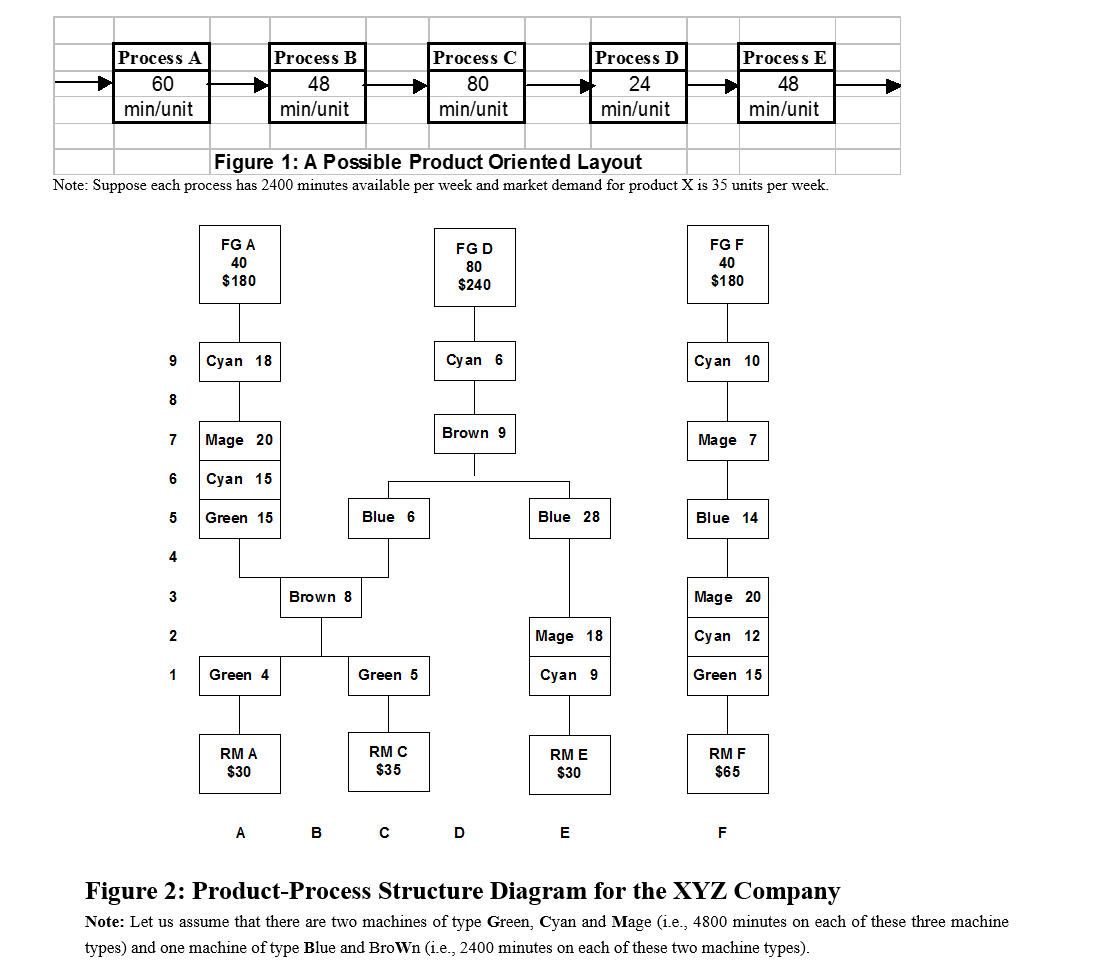

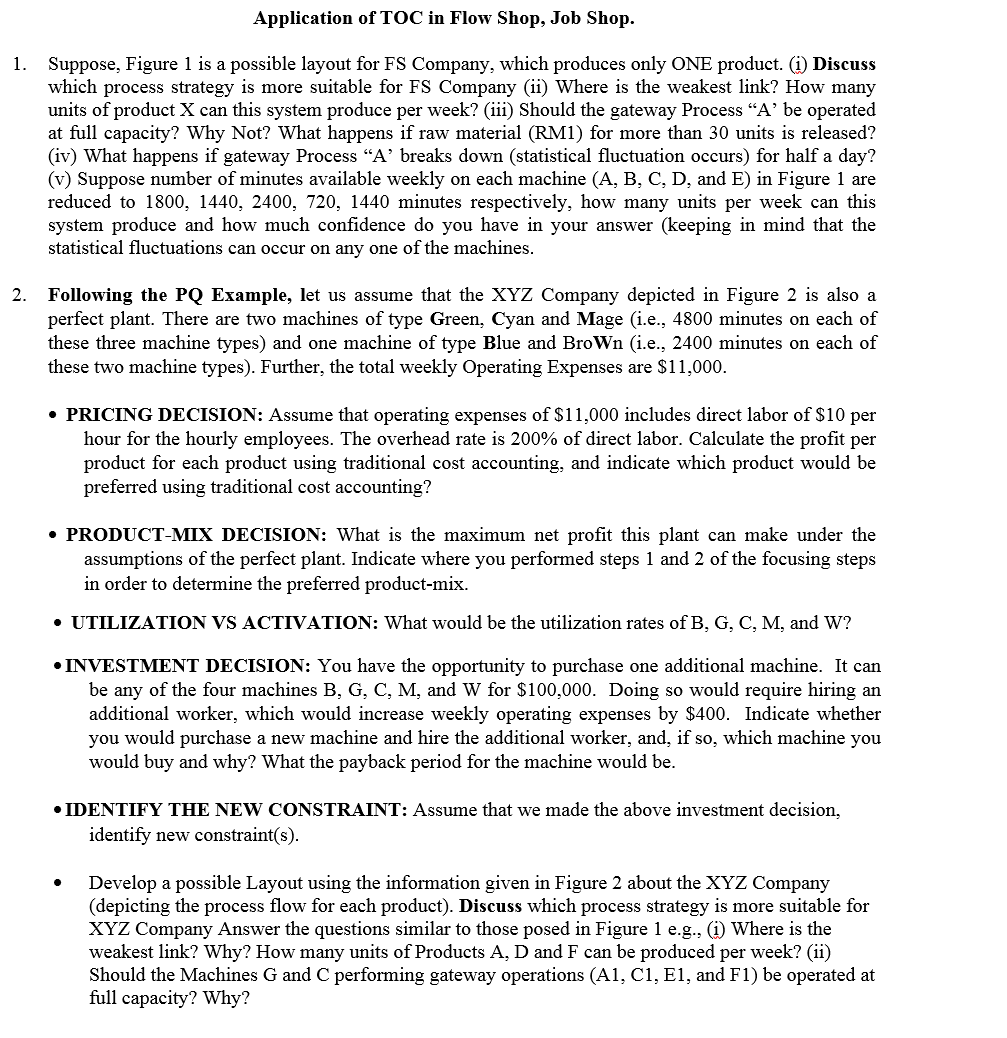

Process A Process B Process D 60 48 80 24 48 minr'unit minr'unit minlunit mim'unit minfunit Figure 1: A Possible Product Oriented Layout Note: Suppose each process has 24-00 minutes available per week and market demand for product X is 35 units per week. FG A. FG D FG F 40 an 40 $130 5240 $130 9 Cyan 13 Cyan B | Cyan 10 B 7 Mage 20 Brow" 9| Mage r B Cyan 15 5 Green 15 Blue 6 Blue 23 Blue 14 1| 3 Brown 3 Mage 20 2 Mage 13 Cyan 12 1 Green 4 Green 5 Cyan 9 Green 15 RM A RM C RM E RM F :30 $35 $30 $55 A B C D E F Figure 2: Product-Process Structure Diagram for the XYZ Company Note: Let us assume that there are two machines of type Green, Cyan and Mage (Le, 4800 minutes on each of these three machine types) and one machine of type Blue and BroWn (Le, 2400 minutes on each of these two machine types). Application of TOC in Flow Shop, Job Shop. Suppose, Figure 1 is a possible layout for F8 Company, which produces only ONE product. (i) Discuss which process strategy is more suitable for F5 Company (ii) 1Where is the weakest link? How many units of product X can this system produce per week? (iii) Should the gateway Process \"A\" be operated at full capacity? Why Not? What happens if raw material (RN11) for more than 30 units is released? (iv) What happens if gateway Process \"A' breaks down (statistical uctuation occurs) for half a day? (v) Suppose number of minutes available weekly on each machine (A, B, C, D, and E) in Figure 1 are reduced to 1800, 1440, 2400, 720, 1440 minutes respectively, how many units per week can this system produce and how much condence do you have in your answer (keeping in mind that the statistical uctuations can occur on any one of the machines. Following the PQ Example, let us assume that the XYZ Company depicted in Figure 2 is also a perfect plant. There are two machines of type Green, Cyan and Mage (i.e., 4800 minutes on each of these three machine types) and one machine of type Blue and BroWn (i.e., 2400 minutes on each of these two machine types). Further, the total weekly Operating Expenses are $11,000. . PRICING DECISION: Assume that operating expenses of $11,000 includes direct labor of $10 per hour for the hourly employees. The overhead rate is 200% of direct labor. Calculate the prot per product for each product using traditional cost accounting, and indicate which product would be preferred using traditional cost accounting? II PRODUCTMJX DECISION: What is the maximum net prot this plant can make under the assumptions of the perfect plant. Indicate where you performed steps 1 and 2 of the focusing steps in order to determine the preferred product-mix. - UTlLIZATION VS ACTIVATION: What would be the utilization rates of B, G, C, M, and W? IINVESTNIENT DECISION: You have the opportunity to purchase one additional machine. It can be any of the four machines B, G, C, M, and W for $100,000. Doing so would require hiring an additional worker, which would increase weekly operating expenses by $400. Indicate whether you would purchase a new machine and hire the additional worker, and, if so, which machine you would buy and why? What the payback period for the machine would be. - IDENTIFY THE NEW CONSTRAINT: Assume that we made the above investment decision, identify new constraint(s). - Develop a possible Layout using the information given in Figure 2 about the XYZ Company (depicting the process ow for each product). Discuss which process strategy is more suitable for XYZ Company Answer the questions similar to those posed in Figure 1 e. g., (i) Where is the weakest link? Why? How many units of Products A, D and F can be produced per week? (ii) Should the Machines G and C performing gateway operations (A1, C1, E1, and F1) be operated at full capacity? 'Why? Application of TOC in Flow Shop, Job Shop. 1. Suppose, Figure 1 is a possible layout for FS Company, which produces only ONE product. (i) Discuss which process strategy is more suitable for FS Company (ii) Where is the weakest link? How many units of product X can this system produce per week? (iii) Should the gateway Process \"A' be operated at full capacity? Why Not? What happens if raw material (RM1) for more than 30 units is released? (iv) What happens if gateway Process \"A' breaks down (statistical fluctuation occurs) for half a day? (v) Suppose number of minutes available weekly on each machine (A,B,C,D, and E) in Figure 1 are reduced to 1800, 1440, 2400, 720, 1440 minutes respectively, how many units per week can this system produce and how much confidence do you have in your answer (keeping in mind that the statistical fluctuations can occur on any one of the machines. 2. Following the PQ Example, let us assume that the XYZ Company depicted in Figure 2 is also a perfect plant. There are two machines of type Green, Cyan and Mage (i.e., 4800 minutes on each of these three machine types) and one machine of type Blue and BroWn (i.e., 2400 minutes on each of these two machine types). Further, the total weekly Operating Expenses are $11,000. PRICING DECISION: Assume that operating expenses of $11,000 includes direct labor of $10 per hour for the hourly employees. The overhead rate is 200% of direct labor. Calculate the profit per product for each product using traditional cost accounting, and indicate which product would be preferred using traditional cost accounting? PRODUCT-MIX DECISION: What is the maximum net profit this plant can make under the assumptions of the perfect plant. Indicate where you performed steps 1 and 2 of the focusing steps in order to determine the preferred product-mix. UTILIZATION VS ACTIVATION: What would be the utilization rates of B, G, C, M, and W? INVESTMENT DECISION: You have the opportunity to purchase one additional machine. It can be any of the four machines B, G, C, M, and W for $100,000. Doing so would require hiring an additional worker, which would increase weekly operating expenses by $400. Indicate whether you would purchase a new machine and hire the additional worker, and, if so, which machine you would buy and why? What the payback period for the machine would be. IDENTIFY THE NEW CONSTRAINT: Assume that we made the above investment decision, identify new constraint(s). Develop a possible Layout using the information given in Figure 2 about the XYZ Company (depicting the process flow for each product). Discuss which process strategy is more suitable for XYZ Company Answer the questions similar to those posed in Figure 1 e.g., (i) Where is the weakest link? Why? How many units of Products A, D and F can be produced per week? (ii) Should the Machines G and C performing gateway operations (A1, C1, E1, and F1) be operated at full capacity? Why? Process A 60 min/unit Process B 48 min/unit Process C 80 min/unit Process D 24 min/unit Process E 48 min/unit Figure 1: A Possible Product Oriented Layout Note: Suppose each process has 2400 minutes available per week and market demand for product X is 35 units per week. FG A 40 $180 FG F 40 $180 FG D 80 $240 C yan 18 C yan 7 M age 20 B ro w n 9 6 C yan 15 5 G re e n 1 5 9 6 C yan 10 M age 7 B lu e 14 M age 20 12 8 B lu e 6 B lu e 28 4 3 B ro w n 8 2 1 G re e n 4 G re e n 5 RM A $30 RM C $35 A B C M age 18 C yan C yan 9 G re e n 1 5 RM E $30 D E RM F $65 F Figure 2: Product-Process Structure Diagram for the XYZ Company Note: Let us assume that there are two machines of type Green, Cyan and Mage (i.e., 4800 minutes on each of these three machine types) and one machine of type Blue and BroWn (i.e., 2400 minutes on each of these two machine types)