Question: Problem: Prepare in good form a Balance Sheet for the General Fund as of the end of fiscal year, December 31, 2017. Previous information in

Problem: Prepare in good form a Balance Sheet for the General Fund as of the end of fiscal year, December 31, 2017.

Previous information in the whole problem:

Problem: Prepare in good form a Balance Sheet for the General Fund as of the end of fiscal year, December 31, 2017.

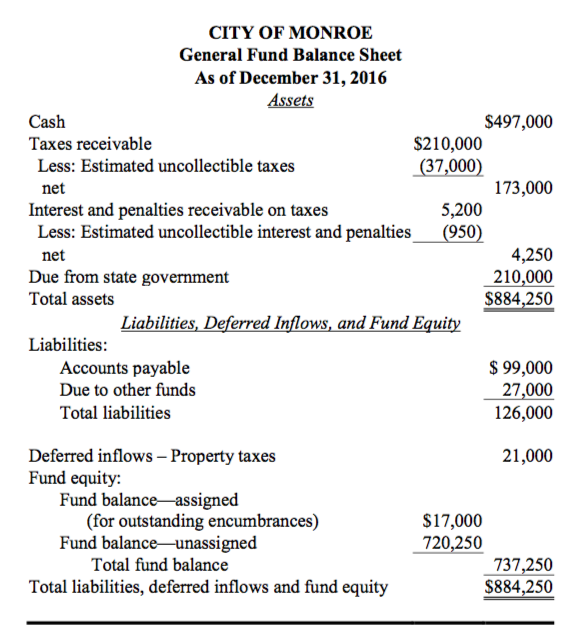

CITY OF MONROE General Fund Balance Sheet As of December 31,2016 Assets Cash Taxes receivable $497,000 $210,000 (37,000 Less: Estimated uncollectible taxes net 173,000 5,200 (950 Interest and penalties receivable on taxes Less: Estimated uncollectible interest and penalties net Due from state government Total assets 4,250 210,000 $884,250 Liabilities, Deferred Inflows, and Fund Equit Liabilities Accounts payable Due to other funds Total liabilities $99,000 27,000 126,000 Deferred inflows - Property taxes 21,000 Fund equity: Fund balance-assigned $17,000 720,250 (for outstanding encumbrances) Fund balance-unassigned Total fund balance 737,250 $884,250 Total liabilities, deferred inflows and fund equity CITY OF MONROE General Fund Balance Sheet As of December 31,2016 Assets Cash Taxes receivable $497,000 $210,000 (37,000 Less: Estimated uncollectible taxes net 173,000 5,200 (950 Interest and penalties receivable on taxes Less: Estimated uncollectible interest and penalties net Due from state government Total assets 4,250 210,000 $884,250 Liabilities, Deferred Inflows, and Fund Equit Liabilities Accounts payable Due to other funds Total liabilities $99,000 27,000 126,000 Deferred inflows - Property taxes 21,000 Fund equity: Fund balance-assigned $17,000 720,250 (for outstanding encumbrances) Fund balance-unassigned Total fund balance 737,250 $884,250 Total liabilities, deferred inflows and fund equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts