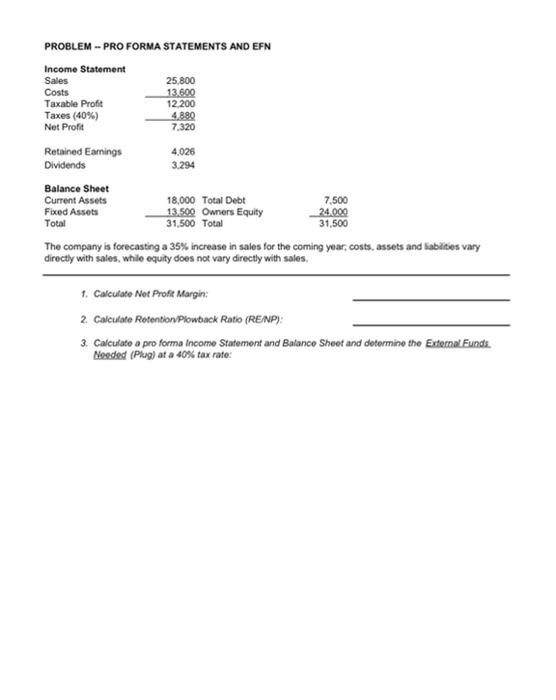

Question: PROBLEM -- PRO FORMA STATEMENTS AND EFN Income Statement Sales 25,800 Costs 13.600 Taxable Profit 12.200 Taxes (40%) 4.880 Net Profit 7.320 Retained Earings 4,026

PROBLEM -- PRO FORMA STATEMENTS AND EFN Income Statement Sales 25,800 Costs 13.600 Taxable Profit 12.200 Taxes (40%) 4.880 Net Profit 7.320 Retained Earings 4,026 Dividends 3.294 Balance Sheet Current Assets 18,000 Total Debt 7,500 Fixed Assets 13.500 Owners Equity 24.000 Total 31,500 Total 31,500 The company is forecasting a 35% increase in sales for the coming year,costs, assets and abilities vary directly with sales, while equity does not vary directly with sales. 1. Calculate Net Proft Margin: 2 Calculate Retention Plowback Ratio (RENP): 3. Calculate a proforma Income Statement and Balance Sheet and determine the External Funds Needed (Plug) at a 40% tax rate: PROBLEM -- PRO FORMA STATEMENTS AND EFN Income Statement Sales 25,800 Costs 13.600 Taxable Profit 12.200 Taxes (40%) 4.880 Net Profit 7.320 Retained Earings 4,026 Dividends 3.294 Balance Sheet Current Assets 18,000 Total Debt 7,500 Fixed Assets 13.500 Owners Equity 24.000 Total 31,500 Total 31,500 The company is forecasting a 35% increase in sales for the coming year,costs, assets and abilities vary directly with sales, while equity does not vary directly with sales. 1. Calculate Net Proft Margin: 2 Calculate Retention Plowback Ratio (RENP): 3. Calculate a proforma Income Statement and Balance Sheet and determine the External Funds Needed (Plug) at a 40% tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts