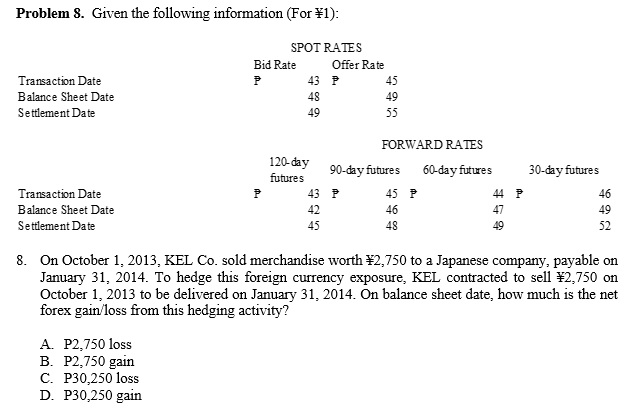

Question: Problem S. Given the following information (For 1): SPOT RATES Bid Rate Offer Rate 43 ? 45 Transaction Date Balance Sheet Date Settlement Date 30-day

Problem S. Given the following information (For 1): SPOT RATES Bid Rate Offer Rate 43 ? 45 Transaction Date Balance Sheet Date Settlement Date 30-day futures FORWARD RATES 90-day futures 60-day futures futures 43P 45 P 44 46 45 48 Transaction Date Balance Sheet Date Settlement Date On October 1, 2013, KEL Co. sold merchandise worth 2,750 to a Japanese company, payable on January 31, 2014. To hedge this foreign currency exposure, KEL contracted to sell 2,750 on October 1, 2013 to be delivered on January 31, 2014. On balance sheet date, how much is the net forex gain/loss from this hedging activity? A. P2,750 loss B. P2,750 gain C. P30,250 loss D. P30,250 gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts